- If the value is buying and selling under STH’s realized value, it often signifies that current consumers are taking a loss and a earlier help stage has become resistance.

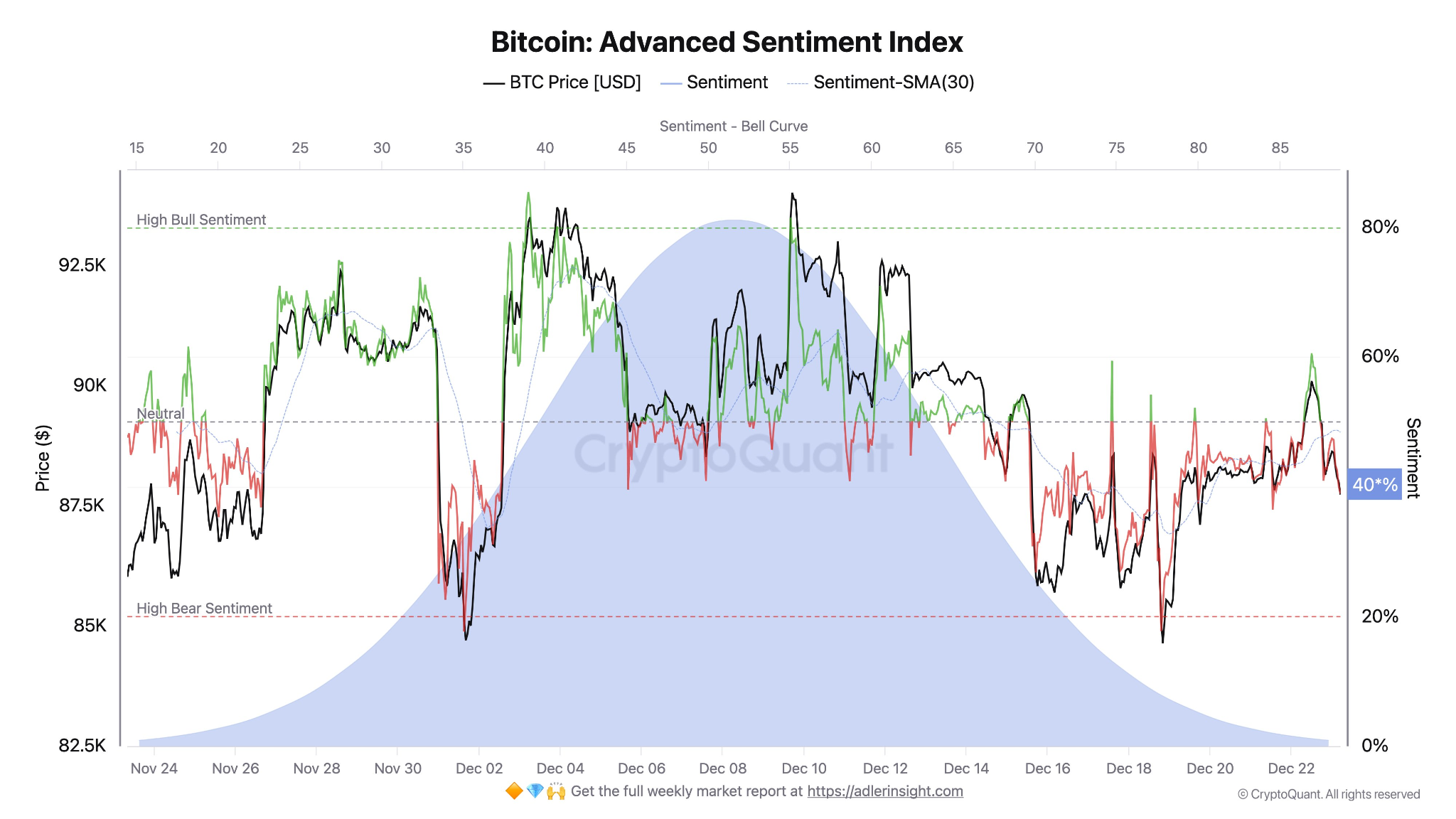

- Adler factors out that the drop in Bitcoin’s Superior Sentiment Index to round 40 means we’re firmly within the circulation zone and any try to lift the value will fail until new demand is available in.

- The analyst additionally cited a complete realized value of $56,300, which he views as an vital long-term help line.

CryptoQuant analyst Axel Adler Jr. shared his view on the everyday short-term decline in Bitcoin brought on by short-term holders (STH) being submerged and the sentiment turning decisively risk-off.

When the value is under the realized value of STH, it often means:

- Fashionable consumers are at a loss

- Worth will increase are prone to be bought off, so these merchants could break even

- Former help stage turns into resistance

This creates a state of affairs the place folks promote as costs rise, reasonably than permitting the rally to construct on itself.

Adler factors out that it is price noting that Bitcoin’s Superior Sentiment Index has fallen to round 40. Which means that until new demand enters, Bitcoin’s Superior Sentiment Index is firmly in circulation territory and any try to maneuver increased will fail.

At round $87,400, Bitcoin is under all significant short-term value metrics, which explains the weak point in its construction.

Traditionally, bull markets solely restart after STH offers up and sells or the value returns to the extent it was at when it was purchased. Adler’s view that the value must stabilize above $90,000 is according to earlier bull cycles.

The analyst additionally talked about a complete realized value of $56,300, which he believes is a crucial long-term help stage. This value is the common value paid for the coin by all Bitcoin holders. In previous cycles, above this common value has sustained the general bull market, however under this common value, most holders, not simply current consumers, will undergo losses.

In the intervening time, the value remains to be effectively above this stage, suggesting that it is a regular pullback in a bigger uptrend and never the top of a bull market.

Current developments help Adler’s view

A number of current market modifications help Adler’s view that traders have gotten extra cautious. For instance, the Financial institution of Japan’s rate of interest hike and uncertainty surrounding world rates of interest are negatively impacting dangerous investments like cryptocurrencies. Moreover, digital currencies have lately develop into extra delicate to change fee and yield fluctuations.

Spot Bitcoin ETF inflows have slowed since their peak, making it tough for the market to soak up promoting with out robust shopping for from giant establishments.

The whole quantity of open futures contracts additionally fell. This reveals merchants are taking much less danger and is according to Adler’s perception that the market is cautious however not in a full-blown panic.

Associated: Bitcoin enters a quiet accumulation part. Analysts predict 2026 lows

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.