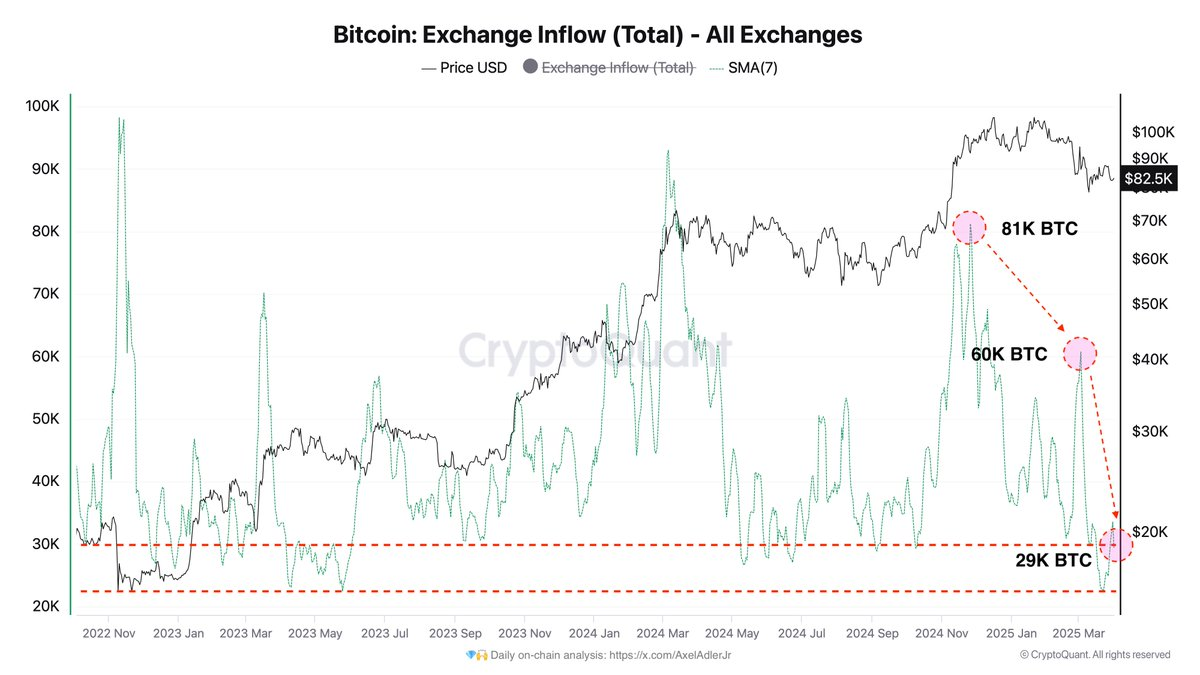

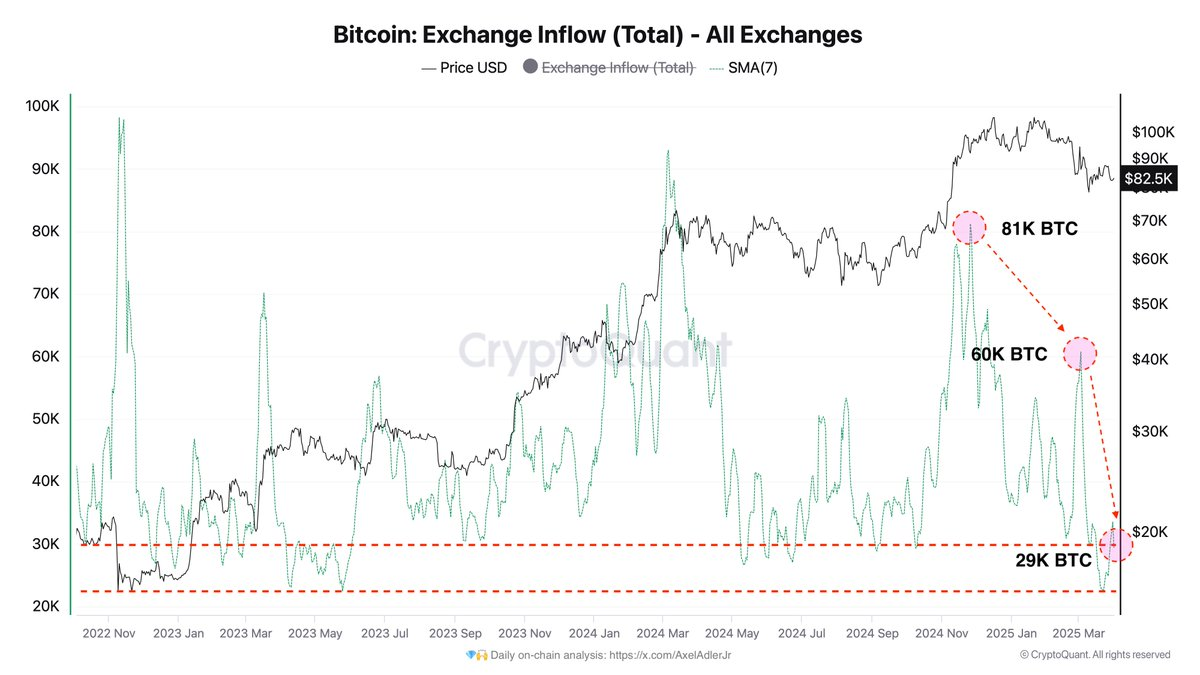

- Analyst Axel Adler: BTC alternate inflows have dropped sharply (81K->29K/day)

- A decrease influx suggests a decrease gross sales strain, a possible “sluggish provide”

- The BTC commerce is ~83.4k and wishes to interrupt the 84.8K ema resistance. $76.1K is vital assist

Bitcoin (BTC) stays within the consolidation section after hitting an all-time excessive of practically $109,000 a couple of months in the past. Regardless of current worth changes, some chain market indicators recommend that structural provide shortages could also be creating and probably creating circumstances for an additional bullish worth switch within the coming days or even weeks.

Main crypto market analysts level out decreasing the inflow of Bitcoin into exchanges as a key issue. Additionally they spotlight key assist ranges that would quickly exceed $90,000 in key digital belongings.

Is Bitcoin gross sales strain falling?

Encrypted writer Axel Adler has reported common Bitcoin gross sales strain throughout high exchanges, which has been considerably decreased by a current vital decline. He famous that every day inflow has dropped sharply from a peak of 81,000 btc to only 29,000 btc over the measurement interval.

This sudden drop within the quantity of Bitcoin shifting to the alternate signifies that fewer buyers are transferring BTC to a platform that may simply promote. This pattern might cut back general speedy gross sales strain available on the market.

Adler explains that this market situation might fall right into a “zone of uneven demand.” His view suggests that almost all aspiring sellers have left largely close to current worth highs, however it seems that present patrons will comfortably maintain or accumulate inside their present consolidated vary.

Nonetheless, Adler additionally mentioned that the April and Might time frames might stay within the consolidation interval earlier than Bitcoin experiences the following main worth impulse.

Adler shared a chart exhibiting that vital alternate inflows traditionally coincided with a pointy worth drop in Bitcoin in earlier cycles. Conversely, decreasing influxes typically recommend intervals of worth stabilization or the prevalence stage of a possible restoration section.

As of late March 2025, Bitcoin costs fluctuated primarily inside the $80,000-85,000 vary. The seven-day shifting common (SMA) of alternate inflows continues to maneuver downwards, supporting the concept that speedy gross sales strain is at the moment declining.

Associated: Bitcoin and Ethereum ETFs show contrasting traits in capital flows

What are the primary assist ranges for Bitcoin?

Analyst Ali Martinez beforehand mentioned it was beneath the $80,000 worth degree, however Bitcoin is dealing with an “air hole.” In his technical view, because of this there’s minimal established assist as much as the $70,000 space.

He additionally highlighted the vital degree of assist for BTC primarily based on the particular pricing band indicators proven on the chart. These embrace ranges near $76,180, $58,080, $43,740 and $39,980.

What’s Bitcoin’s present worth motion?

On the time of writing (early April 1st), BTC is buying and selling practically $83,410. This represents a rise of round 2% over the previous 24 hours, following a bounce from its current low of practically $81,300 shortly after the announcement of the acquisition of Technique Inc.

What’s Bitcoin’s present worth motion?

On the time of writing (early April 1st), BTC is buying and selling practically $83,410. This represents a rise of round 2% over the previous 24 hours, following a bounce from its current low of practically $81,300 shortly after the announcement of the acquisition of Technique Inc.

Associated: Bitcoin $100K FOMO Return: Santimento warns that it may very well be a bull entice

Nonetheless, costs have up to now did not regain the 20-day index shifting common (EMA) and are actually near $84,824. This shifting common now serves as an instantaneous overhead resistance. If Bitcoin is unable to destroy this degree of resistance quickly, new downward strain may very well be confronted in direction of the foremost assist ranges beforehand recognized.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version just isn’t answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.