- Ki Younger Ju gently urges after Bybit’s reserves fell following the $1.5 billion hack.

- BYBIT has secured 446,870 ETH by means of loans, whale deposits and purchases.

- CEO Ben Zhou is releasing an upcoming spare proof report to verify full asset assist.

Cryptoquant CEO Ki Younger Ju urged the crypto neighborhood to cease spreading FUD concerning the Buybit alternate after a pointy decline in reserves following the unlucky hack.

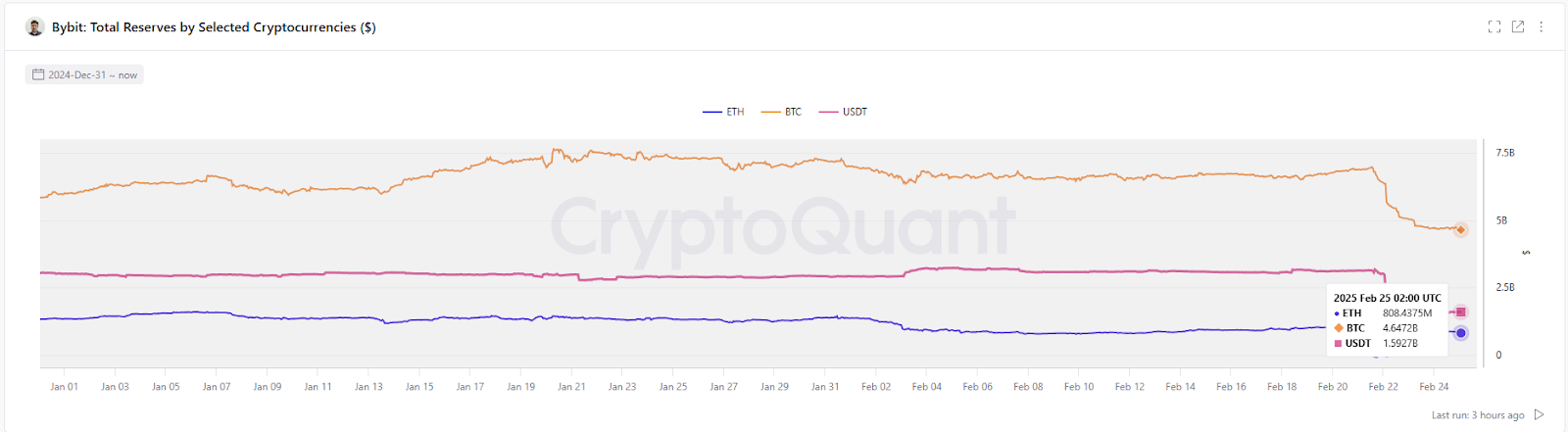

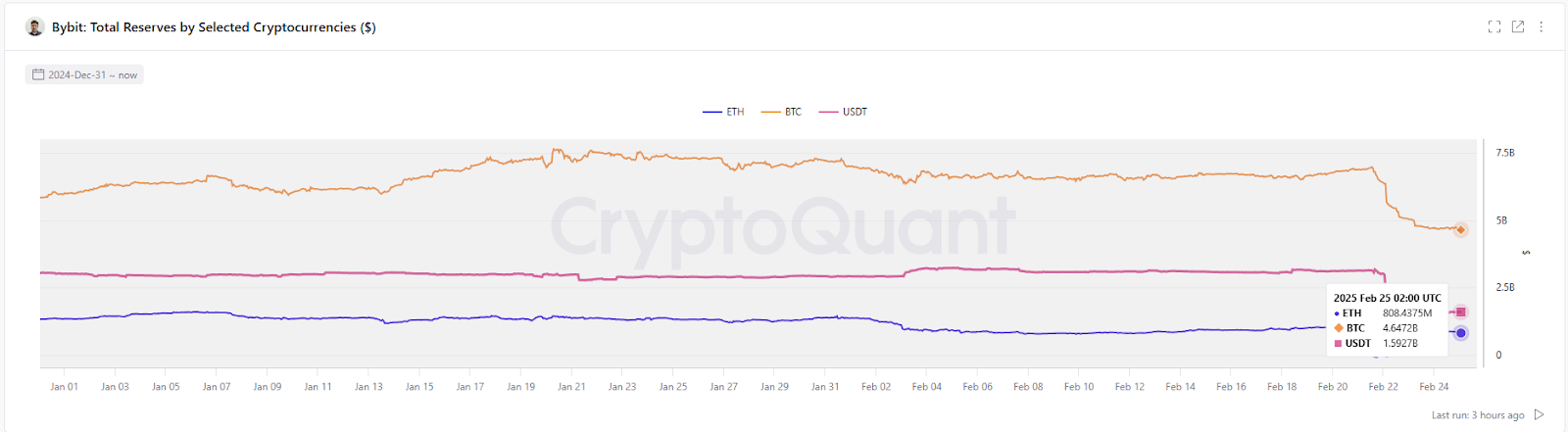

The cryptographic chart monitoring Bybit’s BTC, ETH and USDT reserves by means of December 31, 2024 reveals a sudden decline in holdings on February twenty fourth. Nevertheless, he emphasised that Bybit was “alright” and that there was no have to panic.

Ethereum reserves present indicators of restoration

Bibit’s Bitcoin reserve remained comparatively secure, however fell from over $7.5 billion to beneath $5 billion on February twenty second. The USDT reserves are additionally secure, displaying vital DIP on the identical day, indicating withdrawals and funding actions.

Equally, Bybit’s ETH steadiness fell sharply on February 21 when hackers stole $1.4 billion value of Ethereum from the alternate.

Regardless of preliminary panic, Bybit’s Ethereum reserves initially fell to round 600,000 ETH earlier than rebounding to ETH above 800,000 as of the newest information.

Exchanges secured 446,870 ETH and Bibit ETH holdings have skyrocketed to bridge the hole by means of loans, whale deposits and purchases by means of purchases.

Associated: Bybit is seeing a stunning $4 billion inflow after a large hack to assist flooding companions

Exchanges, businesses, and whales contribute to restoration

LookonChain information reveals that BYBit obtained 157,660 ETH (roughly $437.8 million) from one tackle. One other 109,033 ETH ($304.1 million) got here from an entity that bought the ETH from each centralized and decentralized exchanges.

In the meantime, contributions to whales and institutional restoration embody greater than $127 million in loans, crypto alternate bitgets supply 40,000 ETH ($106 million) and MEXC 12,653 Gives STETH ($33.9 million).

CEO Ben Zhou has beforehand introduced that customers will probably be reform-reserves (POR) studies utilizing Merkle Tree validation to verify their holdings instantly to verify the assist of Bybit’s full property. Assured.

Associated: Bibit closes ETH hole after a billion greenback hack comes, back-proof

Trade stability and future prospects

Efforts to replenish Bibit reserves recommend that the alternate is working in the direction of a stabilizing operational and full restoration. Replenishment of ETH Reserve, coupled with reserving proof information, can restore person belief and contribute to the market restoration.

Regardless of BYBIT totally operational, the broader crypto market has seen a pointy decline after the hack. Bitcoin is at present buying and selling at $91,680, down 4.3% over the previous day. Ethereum and XRP commerce at $2,491 and $2.26 respectively, each falling 8.4% over the identical interval.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version is just not responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.