- Ripple CTO David Schwartz emphasizes understanding the tax implications of AMM transactions.

- Customers share tweets displaying examples of AMM excessive yields of as much as 24% on XRP withdrawals.

- David Schwartz leads a dialog on Twitter to focus on AMM's tax challenges.

Ripple co-founder David Schwartz emphasizes the significance of understanding the tax implications of AMM transactions. The CTO continued that deposits and withdrawals of property from these swimming pools set off taxable occasions as a result of customers successfully convert cryptocurrencies into liquidity supplier (LP) tokens upon deposit and again to cryptocurrencies upon withdrawal. He defined that it was doable.

The idea of “foundation” is essential in navigating the tax setting of AMM transactions. The worth of property deposited into the AMM pool upon entry serves as the idea for the LP tokens and guides the calculation of capital features or losses upon redemption or sale.

The CTO requested buyers to think about a hypothetical state of affairs through which an investor deposits combined property into an AMM pool after which redeems a portion of the LP tokens. Features or losses realized are decided by modifications in asset worth and established standards on the time of deposit.

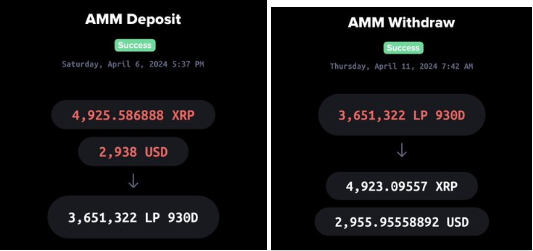

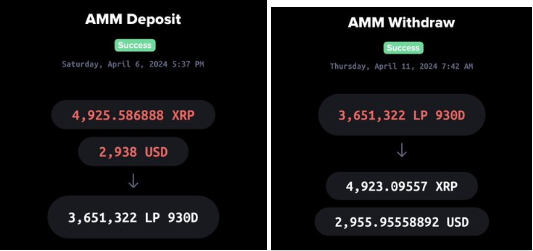

David Schwartz was responding to an ongoing dialog on Twitter praising the XRP AMM yield. Within the tweet, Hartner particulars an AMM deposit he made for 4926 XRP and 2938 USD. And he made a withdrawal after 4.6 days and obtained 4,923 XRP and he obtained 2,956 USD. By his calculations, his complete annual return in 4.6 days was 24%.

Customers like Neil Hartner share Spectacular returns may be achieved by means of AMM swimming pools, with some customers boasting annual returns of over 20%. These swimming pools enable individuals to deposit their crypto holdings and earn yield by leveraging the liquidity offered to facilitate decentralized buying and selling.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be chargeable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.