- Legal professional Invoice Morgan stated the choose’s resolution on the Daubert grievance targeted on knowledgeable proof relating to secondary market buying and selling of XRP.

- Whether or not XRP will likely be relisted on exchanges is determined by whether or not XRP is inherently categorised as a safety.

- Ripple might search consent from the SEC to explicitly exclude secondary advertising in its remaining judgment.

Legal professional Invoice Morgan stated in a current tweet that Decide Analisa Torres took a transparent place on sure points to be resolved in figuring out the Dobert movement. The choice revolved round whether or not to permit knowledgeable proof of secondary market buying and selling of XRP moderately than XRP itself.

Following on from his final tweet, Morgan stated he expects a choose to handle the necessary query of whether or not XRP qualifies as a safety. thread Could twenty ninth.

Within the thread, he highlighted the continued debate about whether or not or how the “secondary market sale” of XRP can be handled within the Ripple case. This facet is necessary as a result of whether or not or not XRP will likely be relisted on exchanges will largely depend upon whether or not the elemental query of whether or not XRP is inherently categorised as a safety is correctly addressed. . Addressing this necessary concern is vital to giving confidence that XRP might be relisted on exchanges.

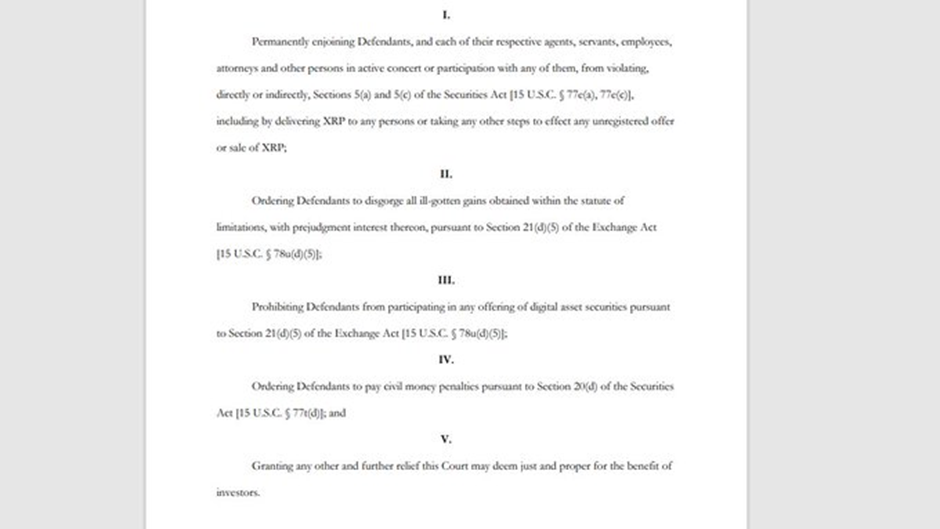

Regardless of language within the SEC lawsuit suggesting that XRP itself is taken into account a safety, the request the SEC filed with the court docket was not meant to present the asset such standing. factors out Morgan.

In keeping with Morgan, the difficulty of secondary gross sales within the Ripple affair could possibly be addressed in a number of situations. First, Ripple might search consent from the SEC to explicitly exclude secondary advertising in its remaining judgment, following the profitable strategy taken by KIK Interactive.

Second, attorneys say the choose might contemplate issues raised by numerous events, together with XRP holders represented by Deaton, relating to secondary gross sales. Given the precedent within the LBRY case, the place secondary gross sales had been addressed to some extent, an analogous strategy could also be doable within the Ripple case.

Moreover, if Ripple loses the case, the choose could possibly be pressured to say secondary gross sales throughout the “penalty” stage of drafting the disgorgement order. As evidenced within the SEC v. Wang lawsuit, Ripple might argue that solely direct purchasers from Ripple must be reimbursed for his or her investments. In any other case, giant secondary gross sales will happen, diluting the disgorgement quantity of particular person consumers.

Finally, Morgan stated, such rulings would implicitly handle the difficulty of secondary gross sales and guarantee a good distribution of withdrawn funds.

Comments are closed.