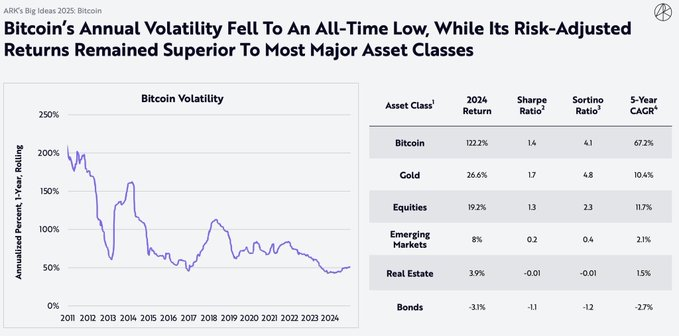

- Bitcoin’s volatility is low on report, presently below 50%, indicating a rise in market maturity.

- Bitcoin led returns at 122.2% in 2024, surpassing gold, shares and bonds.

- Ark Make investments will improve Bitcoin Holding by $221.5 million amid growing adoption by establishments.

In line with Ark Make investments’s newly launched Huge Concepts 2025 report, Bitcoin’s volatility has dropped to the bottom stage on report.

The findings help the expansion of Bitcoin’s market progress. It is a paper supported by substantial purchases of BTC.

Ark Make investments: How low is Bitcoin volatility now?

The findings present a yearly decline in rolling volatility since 2011, with metrics beneath 50%, marking the bottom stage because the monitoring started in 2011.

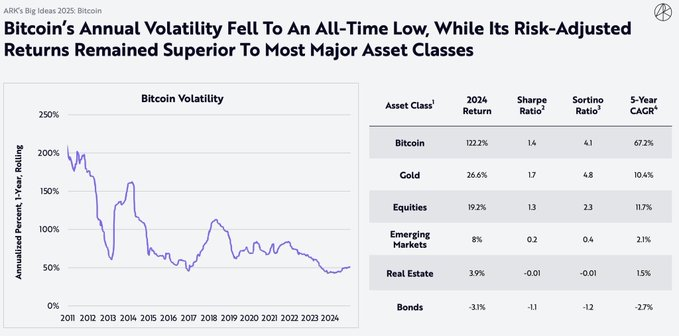

And regardless of the decline in volatility, Bitcoin provided a return of 122.2% in 2024, surpassing gold, shares and bonds. The report positions Bitcoin as one of the best efficiency asset in absolute and risk-adjusted phrases, informing us that its long-term metrics will enhance buyers’ confidence.

What does the Sharpe/Sortino ratio say about Bitcoin threat?

In 2024, Bitcoin registered a Sharp ratio of 1.4 (measured return per unit of threat) and a sortino ratio of 4.1 (measured return on draw back threat).

Gold achieved the next Sharp ratio of 1.7, however its annual income was restricted to 26.6%. The inventory recorded a return of 19.2% at a 1.3 Sharp ratio.

Rising markets and actual property returned 8% and three.9% respectively, whereas bonds recorded unfavourable returns of -3.1%. Over the course of 5 years, Bitcoin’s mixed annual progress fee (CAGR) reached 67.2%, with gold at 10.4% nicely forward of the shares reaching 11.7%. The info displays the magnitude and effectivity of Bitcoin’s glorious returns on threat.

Associated: Ark Make investments might be including considerably to Coinbase place throughout the market sale on Friday

Is Ark Make investments shopping for extra Bitcoin based mostly on stories?

Along with the motion, Ark Make investments elevated its direct publicity to property. On March 13, 2025, ARK acquired 997 BTC, price roughly $80 million via Coinbase. Arkham Intelligence’s blockchain information reveals that inside a four-hour window, the corporate acquired two transactions: 498 BTC and 499 BTC.

This was adopted by Ark Make investments bought a further $130 million price of Bitcoin on April 3, and later purchased one other $11.3 million in BTC, sustaining its accumulation. These transactions replicate an elevated institutional adoption via direct holdings and ETF publicity, as they enhance market stability.

What’s the present market scenario for Bitcoin?

This bullish reporting and buying exercise happens as Bitcoin experiences a short-term pullback. On the time of reporting, Bitcoin had fallen 2.21% to $83,547.45 over the previous 24 hours. Market capitalization fell to $1.65 trillion, and each day buying and selling quantity fell 6.65% to $275.2 billion. Worth Motion confirmed an intraday peak of over $85,500 on April fifteenth, adopted by a decline of beneath $83,000 in property previous to a partial restoration.

Associated: Analyst: Bitcoin volatility happens quicker than later

Bitcoin presently has 19.85 million out of a most of 21 million. The totally diluted valuation (FDV) is $1.75 trillion, with a market-to-market cap ratio of 1.61%, indicating average liquidity.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version isn’t responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.