Ethereum is experiencing its longest interval of inflation, with greater than 350,000 ETH (value about $1.1 billion) added to produce for the reason that Dencun improve in March, in keeping with Ultrasound.cash information. Ethereum's present inflation fee is 0.35%.

This enhance brings the full provide to 120.4 million ETH, with slightly below 95,000 ETH remaining, similar to the extent on the time of the Ethereum merger in September 2022.

Since EIP-4844, also referred to as Denkun or Protodunk Sharding, practically two years of ETH provide cuts have been reversed in simply seven months.

How Dencun modified Ethereum’s provide dynamics

The Dencun replace launched necessary adjustments that cut back Ethereum's base price burn fee.

Allocating particular block house to the Layer 2 community to course of bundled transactions referred to as BLOBs lowered competitors for mainnet block house. As well as, the proto-dunk sharding mechanism has made information availability extra environment friendly, leading to considerably decrease base prices.

These occasions severely impacted the blockchain community's transaction charges, leading to Ethereum issuing extra ETH than it consumes in most blocks.

For context, Ethereum has minted 78,676 ETH whereas spending 45,022 ETH up to now 30 days. This elevated internet provide by over 30,000 ETH, highlighting the inflationary affect of the decrease base price setting.

Influence of staking

Elevated inflationary strain on Ethereum can be related to a rise within the ETH staking ratio. Coinbase analyst David Hung stated that whereas the Dencun improve had a major affect on the Ethereum ecosystem, adjustments within the inflation fee, akin to a rise within the ETH staking ratio, which is accelerating all token issuance, They famous that it seems to be associated to a broader vary of things.

Ethereum's transition to proof-of-stake (PoS) has strengthened the community's safety and elevated participation, which in flip has led to extra ETH being minted. Validators who lock their ETH to guard the community will earn rewards in newly minted tokens.

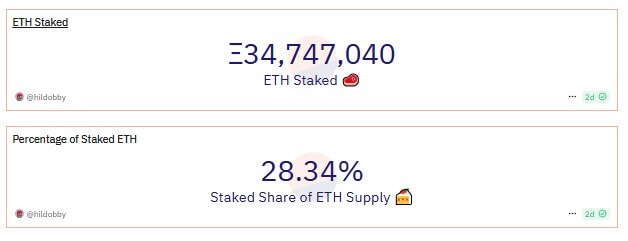

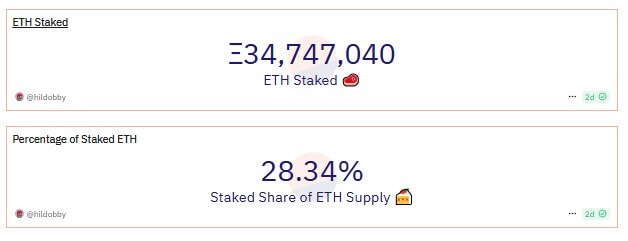

In accordance with information from Dune Analytics, roughly 34.7 million ETH is at the moment staked, representing roughly 28% of the full provide. This staked ETH helps safe the community and generate rewards, additional rising the provision of Ethereum.

Moreover, the rising development of restaking, particularly utilizing protocols like EigenLayer, amplifies this affect. When customers reinvest their staking rewards, much more ETH is generated, additional exacerbating the results of inflation.

talked about on this article

(Tag Translation) Ethereum