Bitcoin regained the $66,000 degree on the night time of Could fifteenth and Could sixteenth, recovering among the losses incurred over the previous week. This surge had a significant influence on the derivatives market, with a big influence on each open curiosity and buying and selling quantity.

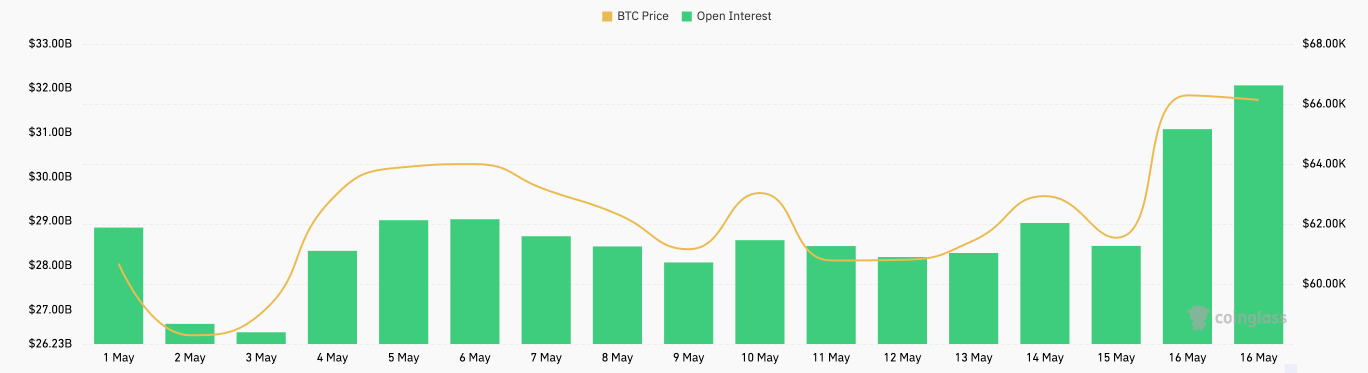

Futures open curiosity, which measures the whole quantity of excellent futures contracts, elevated considerably. Futures open curiosity on Could fifteenth was $28.45 billion, however by Could sixteenth it had jumped to $31.18 billion. This corresponds to a big enhance of roughly 9.6%. This enhance means that investor curiosity in Bitcoin futures is growing resulting from expectations of additional value actions. An increase in OI is important because it signifies the influx of latest funds into the market, indicating dealer expectations and potential value path.

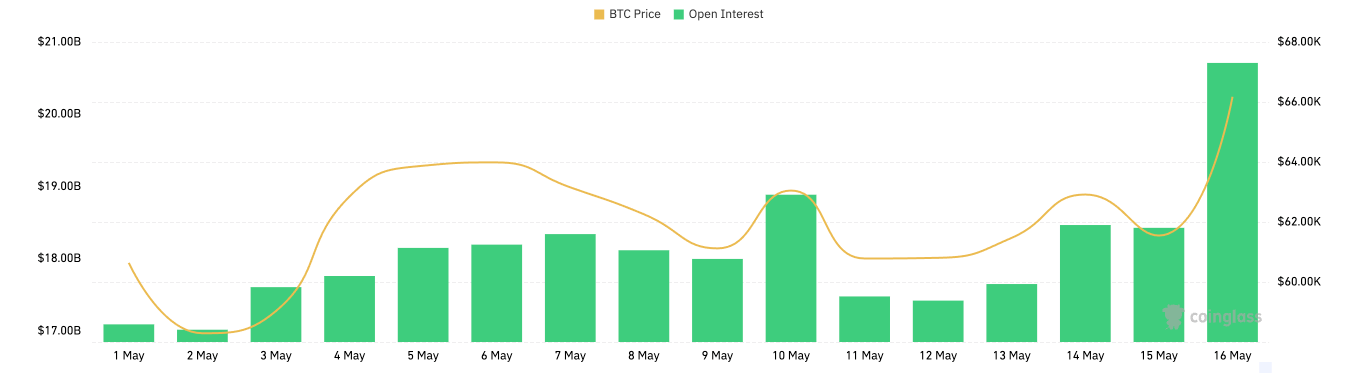

Open curiosity within the choices market additionally elevated considerably. Choices open curiosity on Could fifteenth was $18.43 billion, growing to $20.71 billion by Could sixteenth. This enhance of roughly 12.4% highlights the elevated exercise and curiosity in choice contracts as merchants put together for a spike in costs.

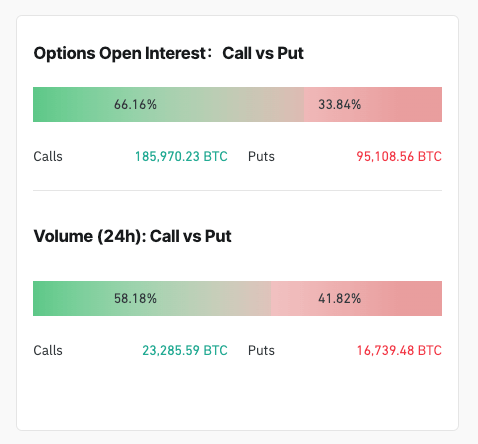

The distribution of choices open curiosity on Could sixteenth was 66.16% in calls and 33.84% in places, indicating bullish sentiment amongst merchants anticipating additional will increase in Bitcoin value. A more in-depth have a look at choices quantity additional helps the overwhelmingly bullish sentiment. As of Could 16, name choice quantity accounted for 58.18% in comparison with 41.82% for places, indicating that merchants are primarily betting on value will increase.

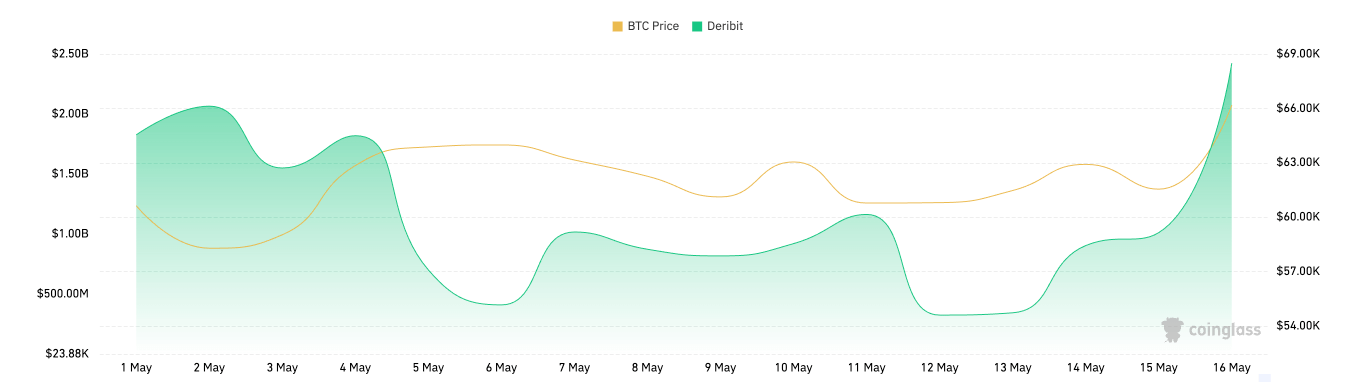

Deribit's day by day choices buying and selling quantity elevated dramatically, leaping from $1.01 billion on Could fifteenth to $2.42 billion on Could sixteenth.

The amount and distribution between shorts and longs supplies additional perception into the state of the market. As of Could sixteenth, whole liquidation amounted to $150.52 million, with lengthy liquidation amounting to $40.76 million and quick liquidation amounting to $109.76 million. The big enhance in brief liquidations signifies that many merchants have been caught off guard by the rising value, resulting in compelled liquidations of their quick positions. This liquidation asymmetry reinforces the bullish development noticed throughout this era as shorts have been locked out of the market.

Analyzing adjustments in OI and quantity is essential for understanding how derivatives markets react to cost adjustments. As soon as a distinct segment marketplace for a couple of refined buyers, Bitcoin derivatives have grown right into a cornerstone of the market. Tens of billions of open contracts throughout merchandise point out that derivatives are essential and essential sufficient to influence the broader crypto market.

CoinGlass information exhibits that bullish sentiment is rising amongst merchants, with a notable choice for name choices and huge quantities of short-term liquidations. This transfer means that merchants are bracing for additional value will increase for Bitcoin. If this bullish sentiment persists and is supported by continued optimistic value traits, open curiosity and buying and selling volumes might additional enhance, pushing Bitcoin value larger.

The submit Open Curiosity and Quantity Surges in Derivatives as Bitcoin Breaks Above $66,000 appeared first on currencyjournals.