- With the entry of monetary establishments, the market capitalization of cryptocurrencies will attain $4.3 trillion in 2025.

- Digital Asset Treasuries raised $29 billion to construct out its cryptocurrency holdings.

- Safety threats and centralization dangers will decide market outcomes in 2026.

The Block and GK8 report outlines the digital asset panorama into 2026. After a yr of institutional entry and product launches, the main focus is now on integration and real-world functions. The crypto sector faces an vital check of its potential to transition from a unstable frontier to mainstream monetary infrastructure.

The worldwide cryptocurrency market capitalization will attain $4.3 trillion in 2025, however value efficiency will differ by asset. Bitcoin and Ethereum have hit new highs regardless of combined year-to-date returns. The market is now getting into a part the place sustainable development is extra vital than speculative rebound.

Regulatory readability encourages institutional participation

Modifications in U.S. coverage have modified the working setting for digital property. The appointment of Paul Atkins as SEC Chairman and the passage of the GENIUS Act moved regulation from an enforcement-focused measure to an enabling framework. The implementation of the Crypto Asset Market Framework in Europe progressed all year long, creating uniform requirements throughout member states.

These regulatory developments have freed up the move of institutional capital and accelerated product approvals. Alternate-traded funds have expanded past primary spot merchandise to staking ETFs. The Solana Staking ETF attracted roughly $1 billion in property below administration shortly after its launch. The SEC has launched basic itemizing guidelines to expedite the approval course of for brand spanking new ETF functions.

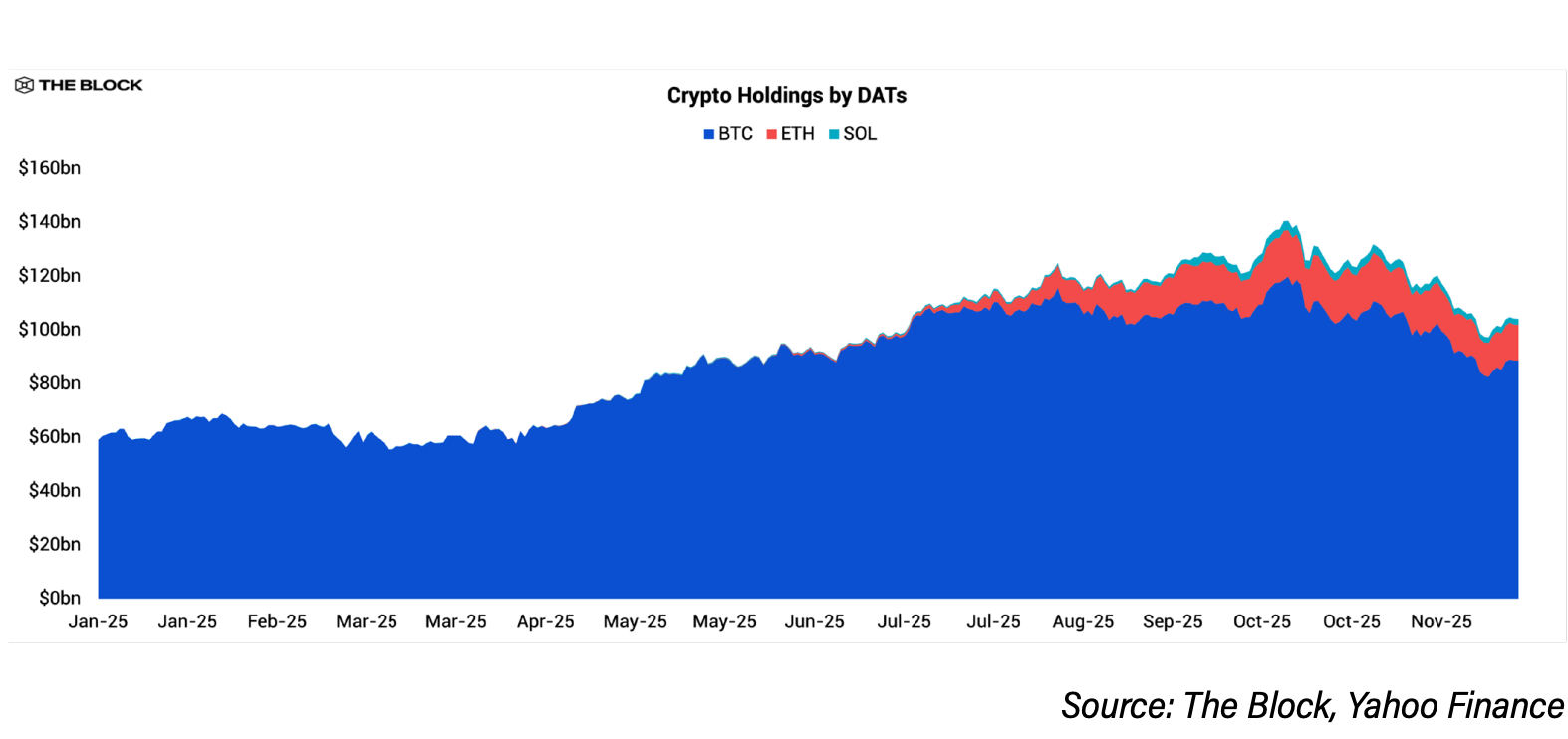

Digital property authorities bonds grew to become a serious pressure within the crypto market in 2025. Publicly traded firms raised $29 billion to extend their holdings of cryptocurrencies on their stability sheets. Greater than 100 public DATs are at present in operation, collectively holding a good portion of main digital property. These holdings are strategic positions, not short-term trades.

Tokenization of real-world property grew from $5.6 billion to $16.7 billion in 2025. BlackRock’s BUIDL Fund has supported the expansion of tokenized U.S. Treasuries and introduced conventional fastened revenue merchandise on-chain at scale.

Stablecoins and derivatives are reshaping crypto buying and selling

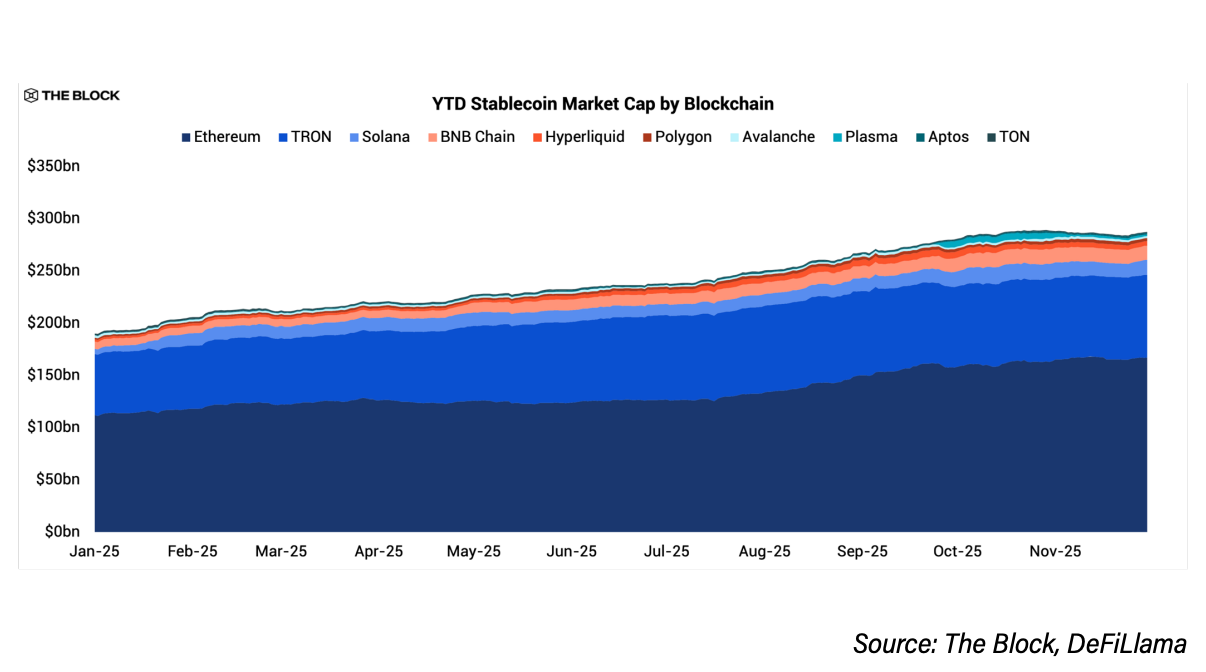

As these property achieved clear product-market match, the circulating provide of stablecoins reached roughly $300 billion. Main cost networks reminiscent of Visa, PayPal, and Stripe are integrating stablecoins into their infrastructure. A brand new blockchain community designed particularly for stablecoin transactions has raised funding to construct a system centered on funds.

Prediction markets have matured as a class and have raised giant funding rounds. Platforms like Polymarket and Kalshi are anticipated to see excessive exercise in the course of the 2026 election cycle.

The Layer 2 community on Ethereum is consolidated round just a few winners. Base captured 46.6% of the full Layer 2 worth locked at $5.6 billion, whereas Arbitrum retained 31%. Gross sales partnerships and consumer acquisition methods now decide success greater than technical structure.

The report identifies safety as a key operational problem for 2026. AI-powered social engineering assaults, deepfake scams, and focused keyhunting campaigns have gotten extra subtle. DATs and tokenized property improve the assault floor for malicious actors. Focus of property in institutional custody creates centralization vulnerabilities that should be fastidiously managed.

Associated: Brazil approves reside orchestra mission to show Bitcoin value into music

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t chargeable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.