This text offers an summary of the present know-how panorama, connects it to the broader cryptocurrency context, and offers an summary of the important thing ranges which will decide the following substantive strikes.

abstract

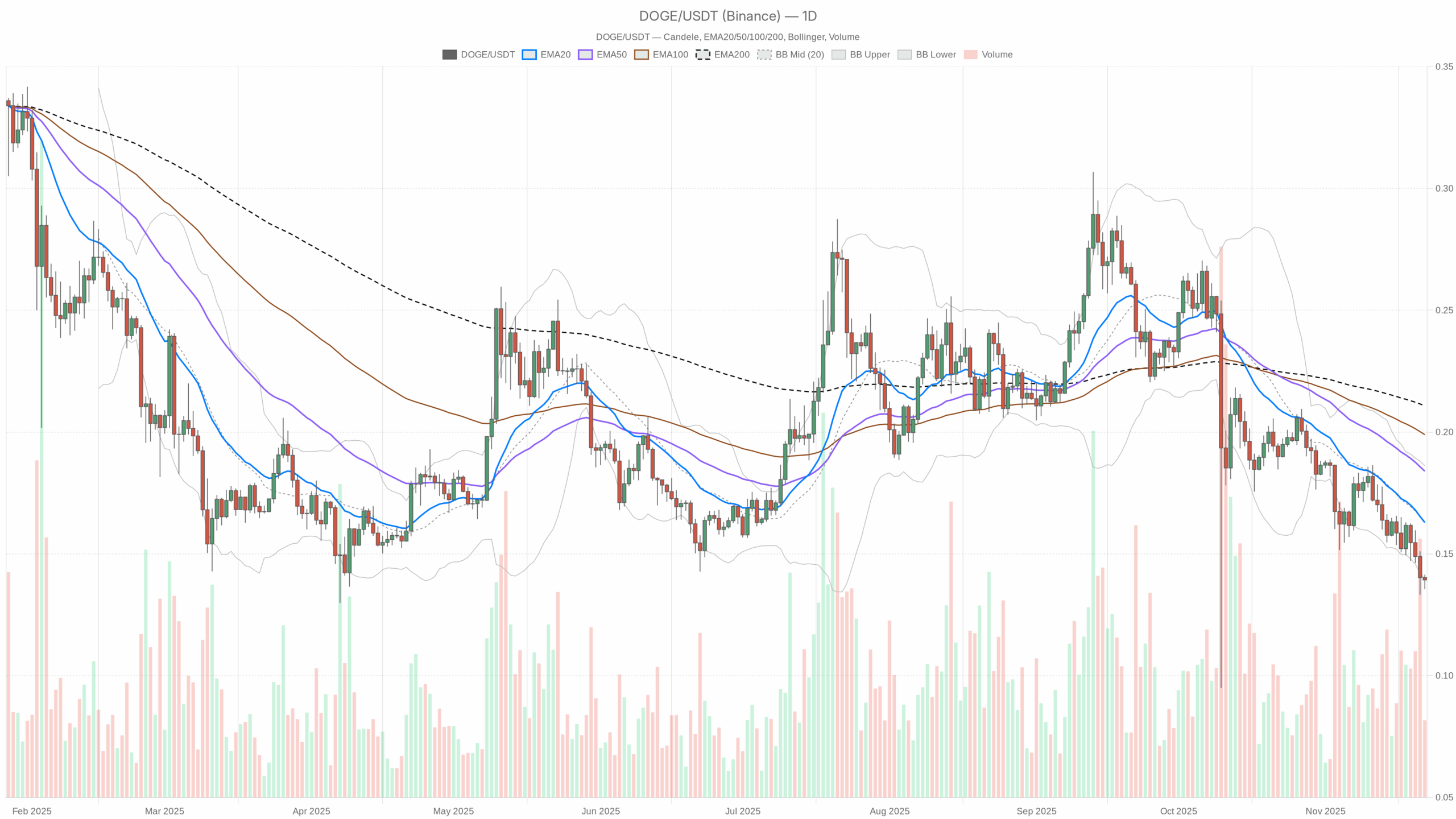

The every day development is clearly tilted to the draw back, and the worth is stagnant round it. 0.14under all main transferring averages. Momentum on increased time frames is weak, as seen with the RSI under 50 and the MACD flat. bearish market strain Greater than lively give up. Nevertheless, intraday alerts have subsided, indicating a impartial stance with costs above the short-term common. Volatility is compressed as slim Bollinger Bands and a really low ATR sign the upcoming part. Decreased volatility. In the meantime, the general market is barely within the crimson over the previous 24 hours, with sentiment dominated by: excessive worry. This mix of things suggests a market the place sellers nonetheless have the higher hand, however the place sharp directional actions are more likely to reemerge provided that there’s a clear set off.

Market scenario and course

The broader crypto setting offers essential context for this pair. Its market capitalization is just below $3 trillion; 0.14% Over the previous day. Moreover, Bitcoin instructions are roughly 56.8% This highlights a regime the place capital is drawn to benchmark property fairly than speculative altcoins.

That being mentioned, feelings are arguably essentially the most spectacular knowledge level. worry and greed index 11firmly within the excessive worry zone. In such an setting, individuals usually prioritize capital preservation fairly than chasing short-term rebounds in riskier shares. Consequently, whereas we see cleaner follow-through on draw back setups in altpairs, rebound rebounds are usually shallow until macro situations all of the sudden enhance.

Technical Perspective: Learn the general setup

On the every day chart, the pair is buying and selling at 0.14, considerably under the 20-day exponential transferring common of 0.16, the 50-day exponential transferring common of 0.18, and the 200-day exponential transferring common of 0.21. This clear correction of the EMA above the present value Established bearish development constructionsellers persistently cap their makes an attempt to extend costs. Till costs can recuperate no less than the shortest of those averages, the trail of least resistance is to the draw back, or at finest keep sideways.

The every day RSI is round 31.8. This degree is near typical oversold territory, however not deep there but. It suggests the next There’s downward momentum, nevertheless it has not run out.. The bears are nonetheless in charge of the tape, however the scenario is approaching a zone the place additional promoting might begin to regularly lose momentum, opening the door to a rescue rally fairly than an inexorable decline.

Trying on the MACD, the road and sign are each round -0.01 and the histogram is flat close to zero. Subsequently, the indicator refers to Momentum stagnation in a bearish context. Though the downtrend is maintained, the dearth of growth of the detrimental histogram means that essentially the most aggressive part of the sell-off has already cooled down for now.

Bollinger bands add one other essential layer. The center band coincides with 0.16, whereas the decrease band is principally concentrated round 0.14, the place the worth is presently positioned. The higher band is round 0.19. This means that costs are nearing the decrease sure and highlights the underlying. downward biasNevertheless, the band isn’t dramatically wider.

Mixed with an ATR of simply 0.01, this photograph seems to be like this: Compressed volatility inside a downtrend. For the reason that actions are small in absolute phrases, merchants mustn’t anticipate massive actions until a breakout from this volatility pocket happens.

The every day pivot framework is firmly centered round the primary level at 0.14, with close by help and resistance additionally clustered on the similar worth. This uncommon overlap displays how narrowly concerned the market is, reinforcing the thought of rising markets. Stability space after earlier weak point. If it strikes decisively away from this zone, it could be handled as a brand new directional sign.

Intraday outlook and DOGE cryptocurrency momentum

Once you zoom in on the hourly chart, the burden of the image seems to be diminished. The value as soon as once more stays at 0.14, however the 20 and 50 interval EMA at the moment are close to the highest of the worth, whereas the 200 interval EMA is lagging barely increased at 0.15. In the meantime, the RSI for this time-frame is near 49; impartial vary regime Not a development day.

In the course of the day, the MACD is actually flat, the Bollinger Bands are collapsing across the present value, and the ATR is close to zero. Consequently, short-term merchants are confronted with the next setting: Minimal realized volatilitybreakout methods usually tend to produce false begins until quantity and momentum return. The 15 minute chart displays this message. The EMA is clustered round 0.14, the RSI is simply above 50, and the MACD is flat once more, highlighting that short-term flows are neither strongly bullish nor bearish.

This intraday neutrality is in distinction to the every day downtrend. This means that fast promoting strain has eased, however consumers usually are not but satisfied. For lively merchants, this usually means ready for a transparent change, both a decisive break above the intraday transferring common as a consequence of elevated momentum, or a re-breakout of the decrease finish of the current vary.

DOGE key ranges and market reactions

With the worth fastened at 0.14, this space acts as each a de facto help and a short-term pivot. If it sustains above this zone, the present value motion will stay intact. Nevertheless, if the pair loses this degree as a consequence of elevated volatility, Bearish continuation state of affairs He’s reaffirming his presence and there’s a chance that there might be room for one more participant to enter the decrease ranks.

On the upside, the world across the 0.16 20-day EMA is the primary significant resistance to look at. If the every day shut is above its transferring common, that may be the primary signal, particularly if the RSI is climbing towards the mid-40s or increased. The downward momentum continues to chill down.. Additional resistance is more likely to emerge close to the mid-Bollinger Bands and 50-day EMA, and intermediate-term individuals could contemplate decreasing publicity after the rebound.

DOGE future state of affairs and funding outlook

General, the primary state of affairs for DOGE consists of a value under all main EMAs, a low however not but depleted RSI, a compressed volatility construction, and stays bearish on the every day time-frame. Within the quick time period, the impartial stance in the course of the day means that the following large transfer is but to be determined.

Conservative merchants could want to attend for a transparent break under 0.14 because the ATR rises, confirming a brand new draw back, or ready for a restoration above 0.16-0.18 to sign a extra significant correction.

Extra lively individuals could search tactical trades inside the present vary, however ought to be conscious that the broader development nonetheless favors sellers. In a scenario of maximum worry and Bitcoin’s robust dominance, threat administration and place sizing stay essential. Any technique should be constructed on the concept this asset will nonetheless be purposeful over the long run. Late-stage downtrend that has not fully reversedEven when the short-term charts look benign at first look.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making any funding choices.