On this article, we study the place the market at the moment stands, what forces are driving this motion, and what subsequent decisive steps the meme large might take towards USDT.

abstract

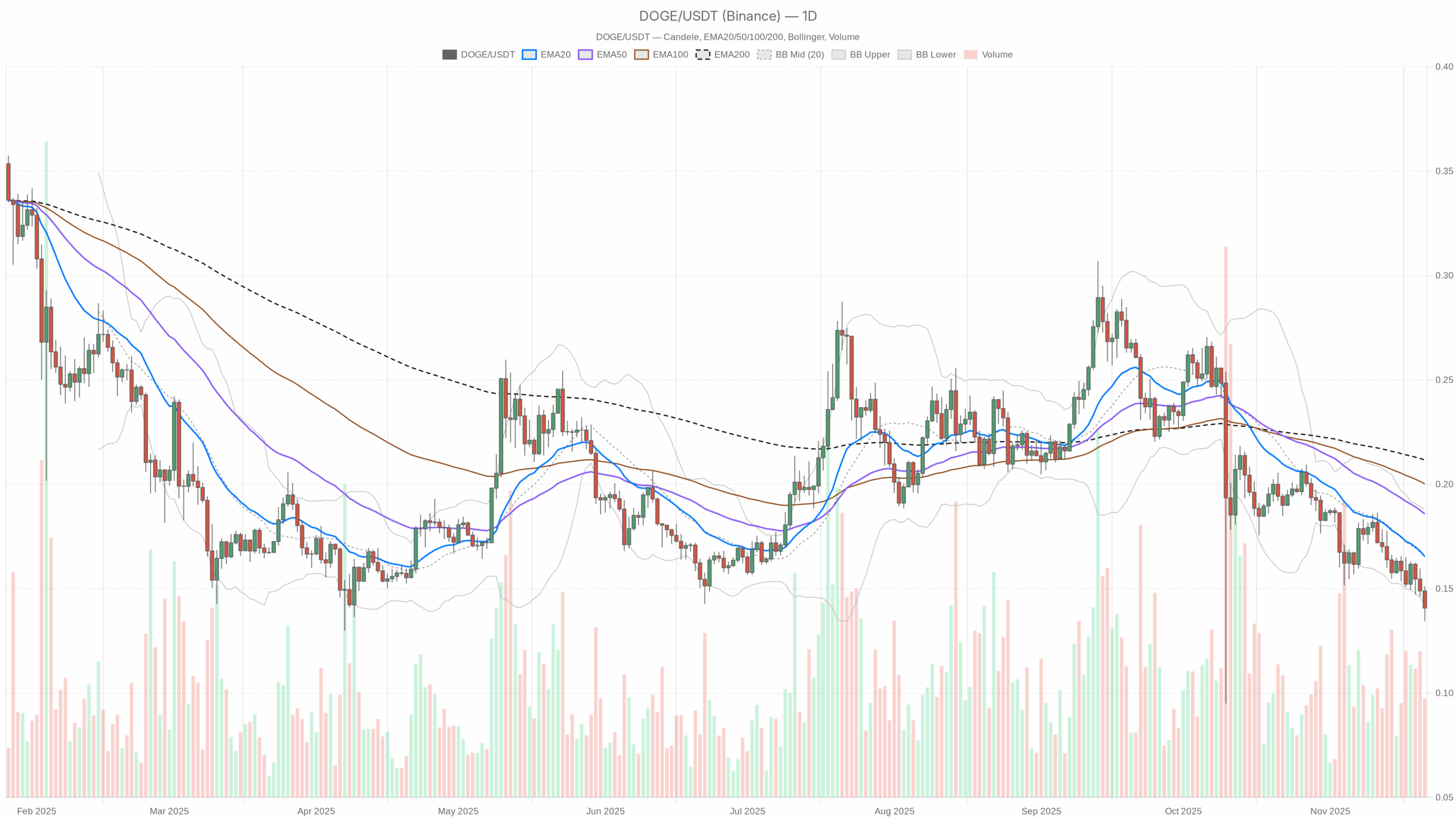

Day by day setup is obvious bear market regimethe worth is 0.14, properly under the 20-day, 50-day, and 200-day EMA. With the every day RSI within the low 30s, close to oversold territory, the momentum indicator is trending unfavorable, reflecting sustained promoting stress quite than a panic capitulation.

MACD is barely unfavorable however flat; Momentum exhaustion quite than aggressive development acceleration. Volatility is average and the decrease sure of the Bollinger Bands is near the spot worth, suggesting restricted room earlier than a possible pullback or brief squeeze.

In the meantime, the broader market simply misplaced 8% in whole market capitalization in 24 hours, leaving traders in “excessive worry” in keeping with the Concern & Greed Index. Total, this backdrop is alarming, nevertheless it additionally opens the door to a pointy countertrend rally if sentiment stabilizes.

Dogecoin DOGE: Market background and path

The broader crypto surroundings is clearly a risk-off. The market capitalization is about 2.95 trillion {dollars}, nevertheless it has fallen about 8% previously day. Speedy danger repricing Total.

Bitcoin’s dominance is near 56.4%, indicating that capital is concentrated in market leaders whereas altcoins are lagging behind. Moreover, when BTC accounts for greater than half of the market, liquidity tends to empty away from speculative belongings like this meme token.

The macroeconomic scenario is reinforcing this sense of warning. The Concern and Greed Index is 14, firmly within the “excessive worry” realm.

That mentioned, such situations typically coincide with situations corresponding to: The tip of the downward worth motionthe place compelled sellers are already in motion, making it troublesome to maintain marginal new gross sales. In distinction, aggressive new lengthy exposures sometimes look ahead to indicators of stabilization or clear technical triggers, which aren’t but absolutely captured on the every day chart.

Technical Perspective: Learn the general setup

On the every day time-frame, the token closes at 0.14, whereas the 20-day, 50-day, and 200-day EMAs cluster between 0.17 and 0.21. This huge hole under all three shifting averages reveals: Dominant draw back management and strong bearish development construction. So long as worth stays under the 20-day EMA at round 0.17, the pullback is extra prone to be a response inside a downtrend quite than the start of a sustained reversal.

The every day RSI of round 32 helps this view. Whereas not but in extraordinarily oversold territory, it’s shut sufficient to point that sellers are in management for a while. Nevertheless, the RSI just isn’t a lot under 30; Weak spot honed, not a wash of give up.. This nuance is essential. Extreme downtrends can final for a very long time, however in addition they are likely to trigger frequent short-term rebounds.

The MACD on the every day chart reveals an nearly flat histogram with each the road and the sign round -0.01. This configuration provides weight to the next concepts: The downward momentum is weakening. Though the development stays unfavorable, the bears are now not accelerating the transfer, which frequently precedes both a sideways consolidation or a reduction rally in direction of the short-term common.

Bollinger Bands reinforce this story. The center band is positioned at 0.17, the higher band is round 0.19, and the decrease band is round 0.14, nearly precisely the place the worth is buying and selling. Being pressed towards the underside band suggests the next circumstances: There’s localized downward stress, and there’s restricted room for additions earlier than trying a return to the imply.. An ATR of round 0.01 on the every day body signifies that volatility is subdued however not negligible. A 1-cent transfer on a 14-cent asset represents a significant transfer for merchants, nevertheless it’s not a full-blown volatility spike.

Intraday outlook and Dogecoin DOGE momentum

On shorter time frames, this example largely confirms day-to-day weak point. On the hourly chart, the worth is once more at 0.14, and the 20, 50, and 200 interval EMAs vary roughly from 0.15 to 0.16. However, the hourly RSI is close to 30, in keeping with the every day oversold slope, indicating that intraday flows are biased in direction of promoting. Because of this, intraday merchants usually are not actively betting on a pullback but.

The MACD on each the hourly and 15-minute charts is actually flat close to zero. Lack of sturdy directional confidence through the day. Which means whereas the general development is down, ultra-short individuals are in wait-and-see mode, able to react to breaks quite than impulsively pushing costs increased. The 15-minute RSI is slightly below 30 and the worth is as soon as once more nailed to the decrease finish of the Bollinger Bands, typically previous brief reduction pops. Nevertheless, these pops are liable to being bought if we do not get well the close by EMA round 0.15.

Key ranges and market reactions for Dogecoin (DOGE)

Day by day pivot ranges make it easier to refine your roadmap. The central pivot is positioned at 0.14, which is actually the place the market is buying and selling, making this a delicate level. Equilibrium zone within the present battle between bulls and bears. A sustained transfer under this space will draw consideration to the primary help round 0.13, the place bullish patrons might attempt to intervene.

On the upside, the primary resistance band seems round 0.15, coinciding with the preliminary pivot resistance and never far under the 20-day EMA round 0.17. If the worth manages to shut above 0.15 after which ventures into the realm between 0.17 and 0.19, it will likely be the primary actual check of potentialities. Makes an attempt at development stabilization or early bullish reversal. Failure to regain this zone leaves the trail of least resistance directed downwards.

Future eventualities and funding outlook

Total, Dogecoin DOGE faces a market dominated by worry, a heavy Bitcoin presence, and a decidedly unfavorable technical construction.

For conservative individuals, the present setting requires persistence. Ready for a sustained restoration with an in depth above the 20-day EMA and an RSI above 40 would supply stronger proof. Development affirmation in new bullish section. Till then, rallies are prone to encounter promoting stress close to resistance bands.

Extra lively merchants could search for a short-term rebound from the 0.13-6 space, utilizing the oversold studying and the proximity to the decrease Bollinger Bands as a information. Nevertheless, we additionally have to respect the broad bearish regime and tightly handle danger in case new volatility causes asset costs to fall. In any case, upcoming classes across the 0.14 pivot and close by 0.15 resistance might decide whether or not this downtrend matures right into a deeper slide or develops right into a foundation-building section for the subsequent chapter of this meme asset.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making any funding selections.