- DogeCoin Value trades immediately at $0.232 and has defended help of $0.23 in upward channel since June.

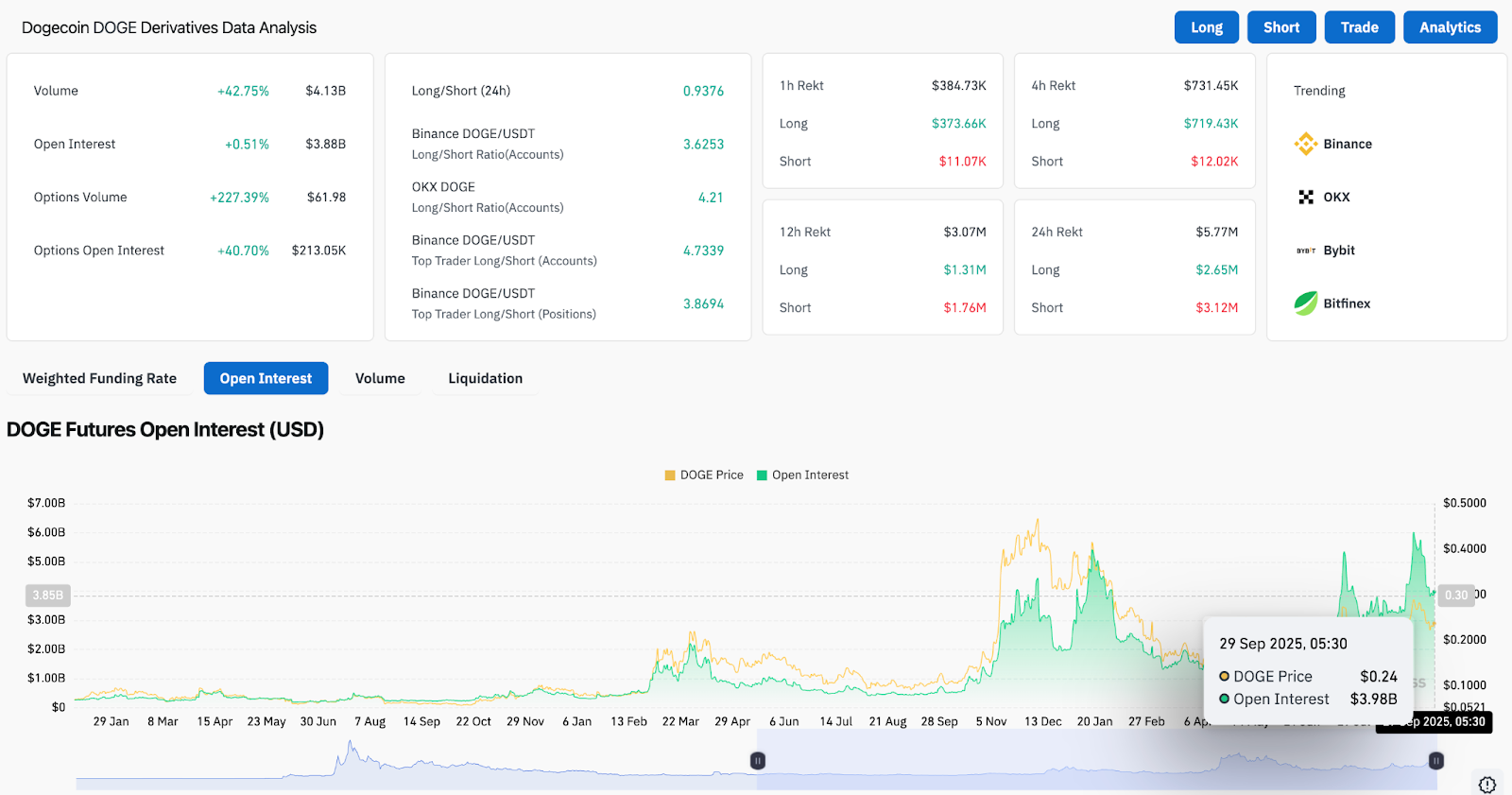

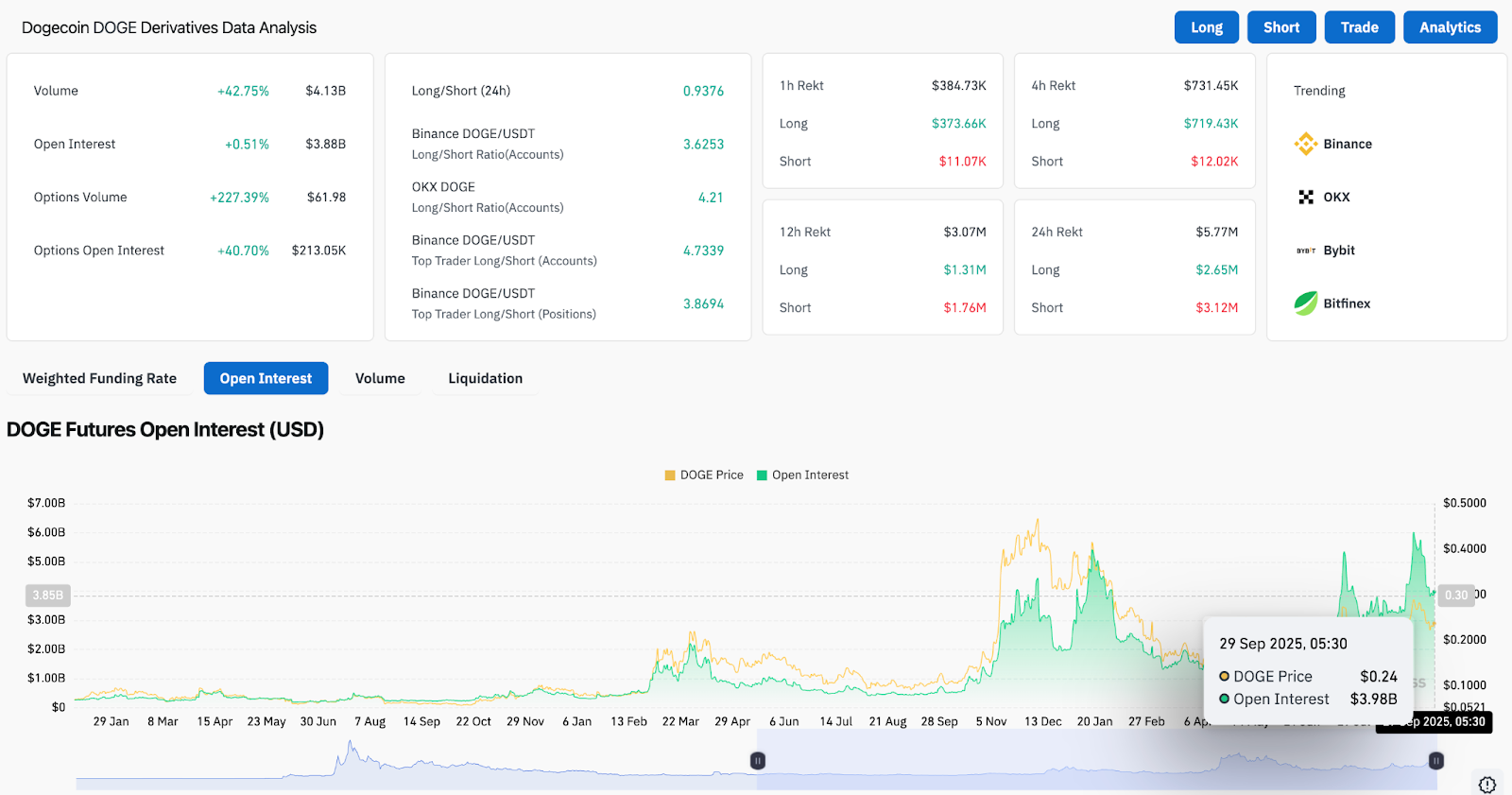

- Futures opens curiosity of $3.88 billion, with choices quantity of 227%, exhibiting robust hypothesis regardless of the weak spot.

- Morgan Stanley plans to allow dogcoin buying and selling by 2026, including an institutional tailwind to the Doge adoption narrative.

Dogecoin Value is buying and selling at $0.232 immediately, defending trendline help in ascending order after sliding out of the resistance zone between $0.26-$0.28. Sellers have examined the $0.23 ground, however patrons nonetheless shield the rising channel construction. At the moment, the market focus is shifting to Morgan Stanley’s plans to start DogeCoin buying and selling by early 2026.

DogeCoin Value retains rising channel help

Every day charts present Doge is built-in inside the upward channel since June. At the moment, costs are pinned to a help base of $0.23 and a resistance cluster of $0.26-$0.28. The 20-day EMA at $0.237 and the 50-day EMA at $0.226 are compressed close to the spot, reflecting a impartial steadiness.

Associated: Solana Value Forecast: Sol Costs combine inside the Rising Channel

The 200-day EMA is low at $0.220, making this an vital line of defense. The breakdown right here may reveal demand zones between $0.20 and $0.18. The benefit is that recalling $0.26 will resume the trail to $0.28 and $0.30, when channel resistance and previous provide converge.

Parabolic SAR dots outperform costs and sign short-term bearish bias, however the wider trendline construction shouldn’t be damaged.

Spinoff information reveals robust hypothesis

DogeCoin Futures Open Interes was $3.88 billion, a rise of 0.5% on the day, however buying and selling quantity rose by greater than 42% to $4.1 billion. Non-compulsory actions additionally surged, with day by day quantity leaping by 227% and open curiosity rising by 40%.

Particularly, in binance, the place prime merchants have positioned over 3.6 accounts for a very long time, the lengthy/brief ratio is skewed in favor of lengthy. This reveals a powerful speculative urge for food regardless of the weak spot of the spot. Nonetheless, liquidation information highlights danger. With $5.7 million liquidated during the last 24 hours and $3.1 million hitting longs, suggesting merchants are being over-levered.

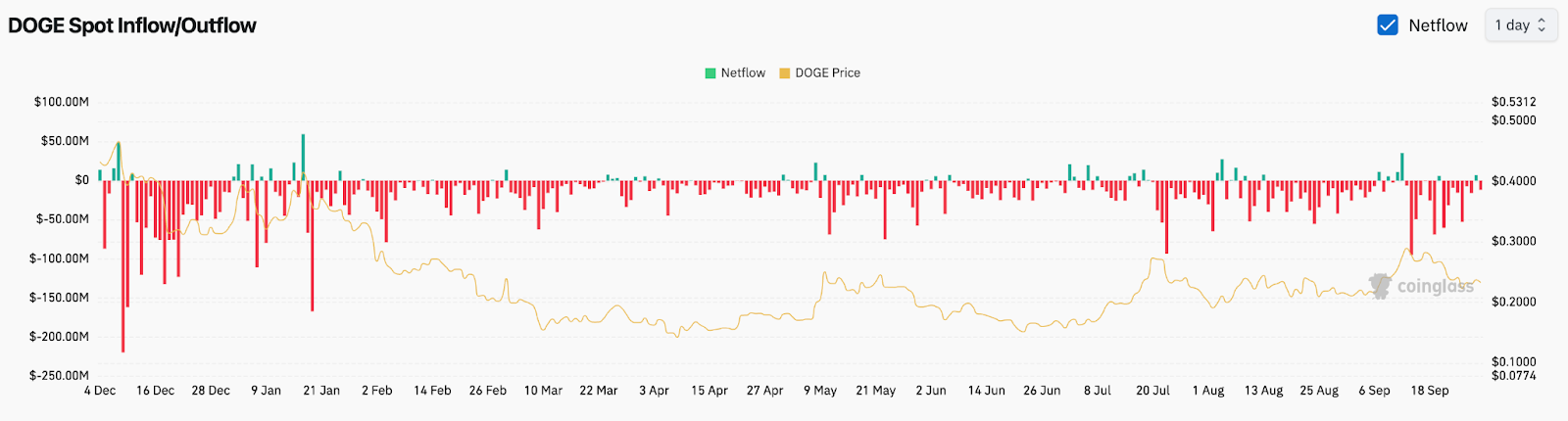

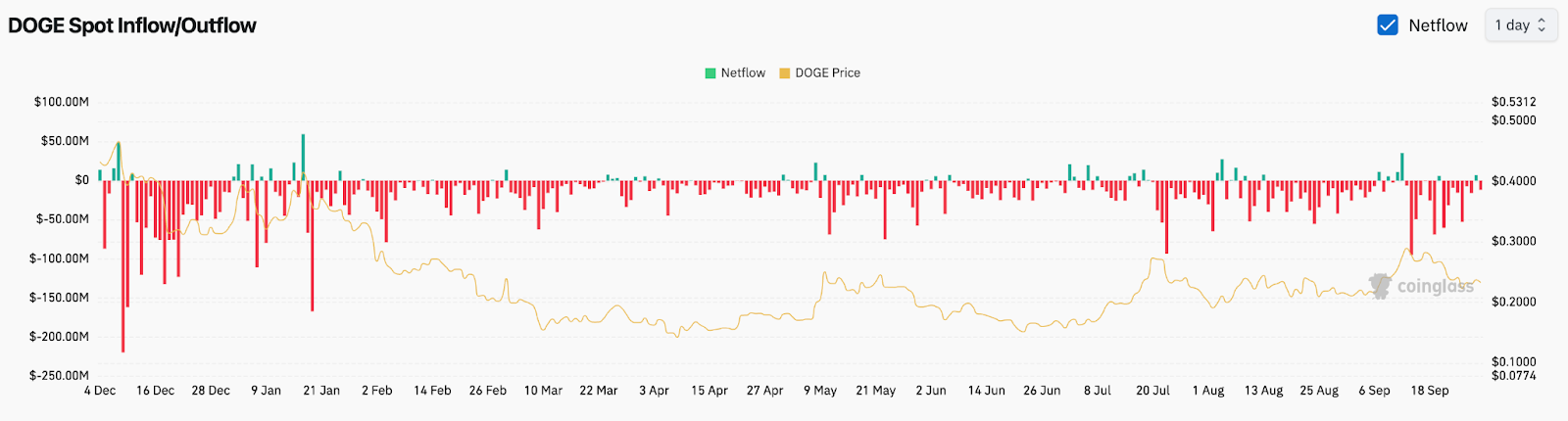

On-chain move highlights cautious accumulation

Spot move reveals combined feelings. Coinglass information reveals a sustained web spill from the alternate to September, an indication of long-term accumulation, regardless of the latest inflow including volatility. The online spill has been eased, which means patrons are positioned however not aggressive.

If the move turns optimistic and aligns with the exercise of the by-product, Doge could achieve momentum. Nonetheless, if inflows surge throughout worth put on, it suggests profitability and places strain on $0.22 in help.

Morgan Stanley’s buying and selling plan boosts the story

The important thing catalyst surfaced with studies that Morgan Stanley, who manages $1.3 trillion in property, plans to allow Dogecoin and Bitcoin buying and selling by early 2026.

Associated: Bitcoin Value Prediction: BTC holds 111K {dollars} as dealer’s eye $115K liquidation set off

Institutional entry may increase the liquidity pool and produce new participation from conventional buyers. For dogcoin, which has traditionally thrived in retail hypothesis, bridging to institutional markets can have a big affect on long-term adoption and analysis.

DogeCoin Value Technical Outlook

Quick-term DogeCoin worth forecasts stay strictly certain by that channel.

- Upside stage: As resistance of $0.26, $0.28, and $0.30.

- Deficiency stage: $0.23 for rapid help adopted by $0.22 and $0.20.

- Development Line Base: The upward channel trendline from June is at the moment in keeping with $0.22 and stays a key construction.

Outlook: Will Dogecoin go up?

Dogecoin’s shut outlook will depend on whether or not the customer is ready to defend $0.23 and flip $0.26. The derivatives market has proven bullish hypothesis, suggesting a cautious however regular accumulation within the chain. Morgan Stanley’s announcement provides a long-term bullish tail that might doubtlessly place Doge for a wider adoption.

If DogeCoin Value is above $0.23 immediately, analysts are hoping to get again $0.26 and attempt to retest $0.28. Nonetheless, a break under $0.22 weakens the bullish construction and shifts the main target to $0.20. For now, the steadiness between know-how and information catalysts has built-in Deuge and is gaining momentum on purchaser convictions on the present stage.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version shouldn’t be accountable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.