- DOGE merges round $0.25, balancing patrons and sellers throughout main EMAs.

- The rise in futures open curiosity and capital inflows suggests new accumulation tendencies.

- The demand for company Treasury strengthens the belief of Dogecoin’s long-term establishments.

Dogecoin (DOGE) exhibits indicators that actions will resume in each the spot and derivatives markets as merchants contemplate short-term instructions. The meme-inspired cryptocurrency is presently buying and selling close to $0.25, however after a robust rise firstly of the month, it has been solidifying inside a slender vary.

Technical indicators counsel worth stability above the primary shifting common, whereas latest capital inflows and financing actions present a stronger accumulation development in each retailers and institutional buyers.

Integration defines the present setup

On the 4-hour chart, dogecoin is hovering between $0.245 and $0.254. This zone matches the exponential shifting common (EMA) for the 20, 50, and 100 durations, indicating the stability between patrons and sellers.

The $0.263 stage marked by the 0.5 Fibonacci retracement serves as a notable first resistance. Whether it is confirmed that it has damaged out of this space, DOGE might rise in direction of $0.274, or $0.288 within the brief time period. Nevertheless, if you cannot keep it above $0.245, you might probably trigger an adjustment slide in direction of $0.22.

Associated: XRP Value Forecast: Institutional approval and S&P’s crypto index enhance confidence

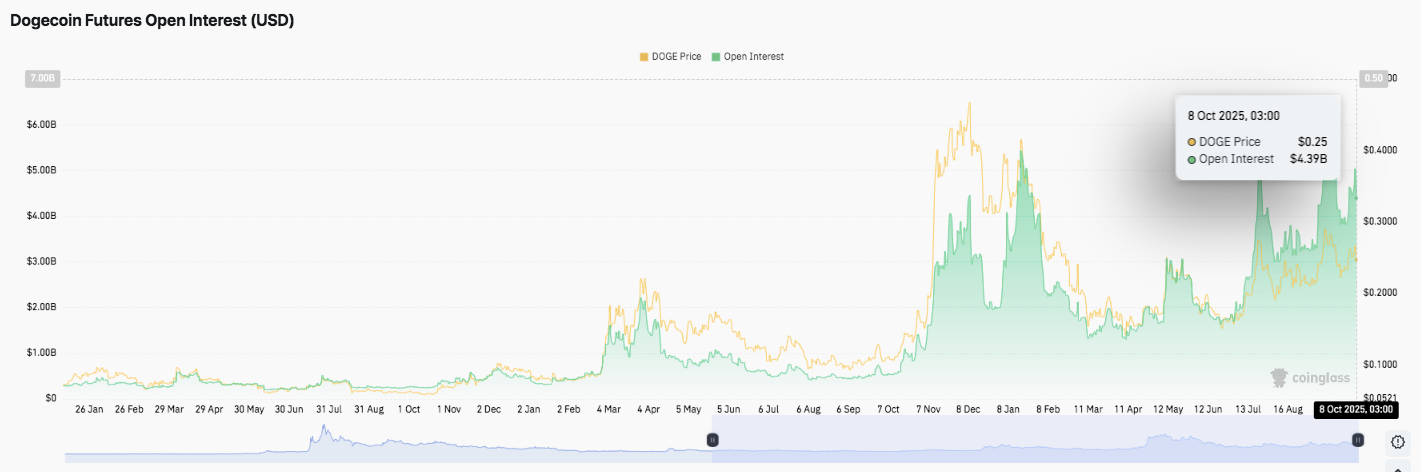

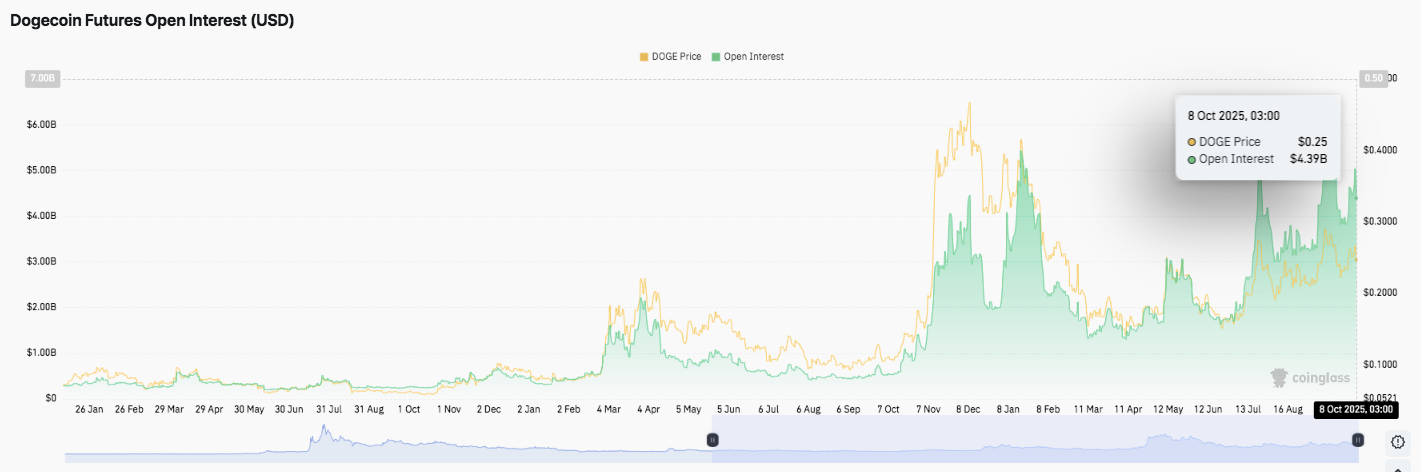

Open curiosity sign suggests updating leverage publicity

Open curiosity in Dogecoin futures had skyrocketed to $4.39 billion as of October eighth, indicating that leveraged positions have accrued. This enhance comes on account of months of sluggish buying and selling exercise in early 2025.

Importantly, open curiosity is increasing with regular worth will increase, suggesting accumulation reasonably than speculative liquidation. Traditionally, this sample typically happens forward of main worth fluctuations, as merchants take positions forward of potential volatility.

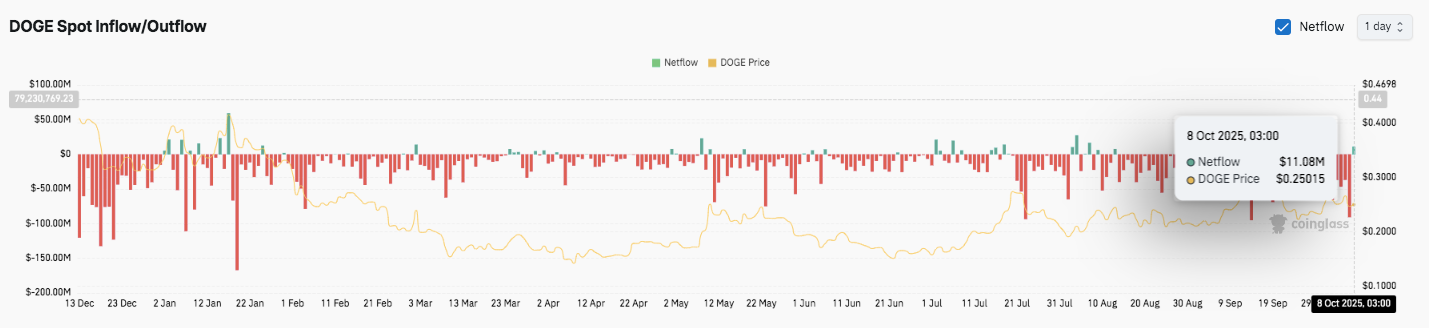

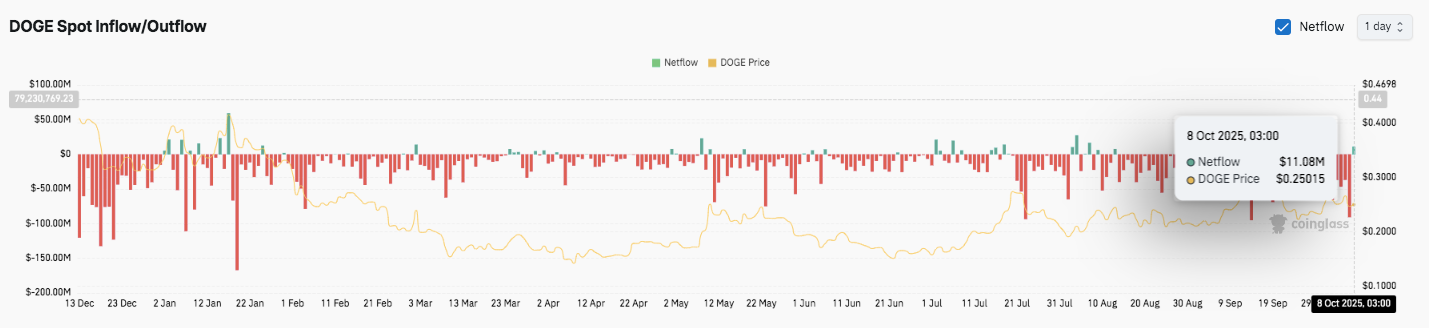

Inflow refers to accumulation

Along with derivatives actions, on-chain knowledge exhibits Dogecoin recorded a web influx of $11.08 million on October eighth. The return of constructive inflow signifies notable modifications after months of secure outflow.

Steady inflows above $10 million usually point out a restoration in market confidence and accumulation by giant holders. Conversely, a reversed stream to a major outflow might imply a revenue seize or a weakening of demand.

Company demand strengthens long-term belief

Enterprise pursuits proceed to offer fundamental help. NYSE-listed CleanCore Options just lately revealed that it presently owns DOGE of 710 million (worth of roughly $188 million).

The corporate goals to broaden its belongings to 1 billion tokens by means of a structured acquisition technique backed by Bitstamp and Robinhood. This accumulation confirms the rising institutional confidence in Dogecoin’s long-term position as a financial-grade digital asset.

Associated: Cardano Value Forecast: Open curiosity reaches $1.57 billion, ADA consolidated

Technical outlook for dogecoin costs

Dogecoin’s worth construction continues to be firmly wrapped in direction of mid-October, with clear definitions of key help and resistance ranges. The token is buying and selling close to $0.25 and has been secure following the latest rise earlier this month.

- Higher stage: The resistance line in the intervening time is at $0.263, which coincides with a 0.5 Fibonacci retracement. A essential breakout past this stage might set off a transfer to $0.274 and $0.288 with the following Fibonacci extension. If bullish quantity continues, a stronger continuation might even retry the psychological threshold of $0.30.

- Decrease stage: Help is round $0.246 on the 200EMA, adopted by a requirement zone of $0.240, between $0.220 and $0.225. If it falls beneath $0.238, DOGE may very well be retraced much more considerably in direction of $0.21.

- Resistance restrict: The $0.263-$0.274 cluster stays an vital resistance zone for reversing medium-term momentum. If the closing worth continues above this space, it may very well be verified of bullish continuation in direction of $0.28 or extra.

The technical setting exhibits that Dogecoin kinds a compression vary inside overlapping EMAs, suggesting the potential for elevated volatility in future classes. Earlier knowledge exhibits related worth drops typically precede sturdy directional actions round 200 EMA.

Will Dogecoin rise even additional?

Dogecoin’s subsequent transfer will rely upon whether or not patrons can keep management over $0.246 and break by means of the resistance band between $0.263-$0.274. Elevated open curiosity, improved on-chain inflows, and elevated monetary accumulation all counsel new buyers’ belief.

If momentum grows, DOGE might take a look at the $0.28 zone and broaden to $0.30. Nevertheless, if the present help fails, a short-term adjustment to $0.22 might happen.

Associated: Ethereum Value Forecast: Jack Mah’s ETH Preparation Report boosts market sentiment

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not accountable for any losses that come up on account of your use of the content material, services or products described. We encourage our readers to take nice care earlier than taking any motion associated to us.