- Dogecoin climbs above key Fibonacci assist as merchants look ahead to definitive breakout

- Elevated open curiosity alerts elevated speculativeness and potential short-term volatility

- Continued forex outflows spotlight profit-taking and weakening bullish momentum

Dogecoin value exercise stays cautious because the market continues to settle down after a pointy pullback from a excessive of $0.27. The asset has been hovering across the $0.19 zone for a number of periods, indicating delicate bearish strain.

This era of consolidation displays indecision amongst merchants following current volatility. Nevertheless, the underlying knowledge reveals elevated speculative participation, suggesting Dogecoin’s subsequent transfer could possibly be extra important than it appears.

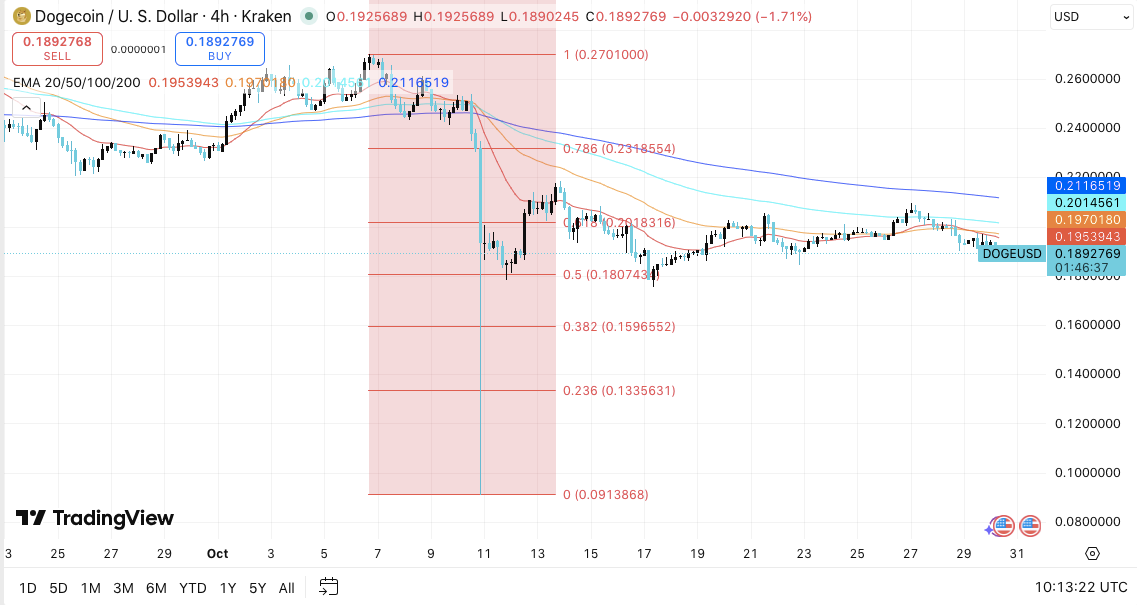

Consolidation inside main Fibonacci ranges

The Dogecoin chart outlines a broad Fibonacci retracement sample from $0.27 to $0.091. The 0.5 retracement stage close to $0.1807 stays a strong assist space, with consumers persevering with to defend their positions. A decisive transfer beneath this level might set off a decline in direction of $0.159 and $0.133, equivalent to the 0.382 and 0.236 Fibonacci ranges, respectively.

On the upside, Dogecoin faces quick resistance close to the 20-day EMA at $0.195, however the 200-day EMA close to $0.211 poses a serious barrier. Moreover, the 0.618 Fibonacci stage at $0.218 stays an vital pivot for a potential development reversal. A break above $0.23 might reestablish bullish momentum and pave the best way for a retest of the $0.27 excessive.

Rising open curiosity displays market hypothesis

Along with chart construction, derivatives market exercise exhibits a rise in contributors. Open curiosity jumped to $1.79 billion from lower than $1 billion at first of September.

This sharp rise signifies that merchants are actively taking positions in hopes of a directional breakout. The mixture of rising value ranges and rising open curiosity suggests elevated leverage out there.

Associated: Bitcoin value prediction: Analysts warn of additional decline as BlackRock sells $2 billion in BTC

Nevertheless, this setting is usually completed prematurely of short-term volatility. If funding charges stay optimistic, there’s a excessive chance that they’ll proceed to rise. Conversely, a lower in open curiosity might point out revenue taking and result in a short lived decline. Due to this fact, merchants might have to be cautious of sudden modifications in derivatives exercise as a possible sign of market route.

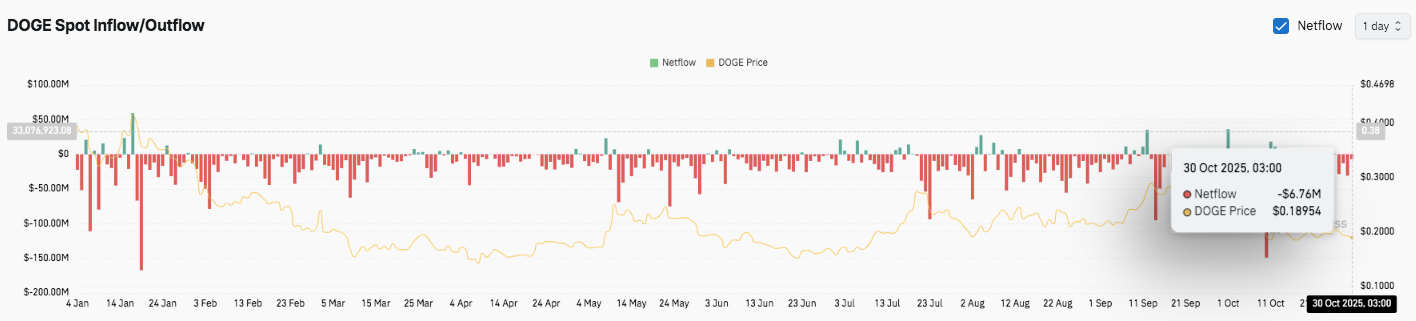

Sustained outflows are an indication of revenue taking

Dogecoin spot market knowledge additional exhibits continued outflows, totaling $6.76 million as of October 30, 2025. This development highlights profit-taking conduct and restricted accumulation amongst traders. Moreover, constant outflows cut back liquidity assist and sometimes precede a slowing of value restoration.

Due to this fact, a return to bullish sentiment would require sustained capital inflows to exchange the present promoting sample. Till then, Dogecoin is anticipated to stay inside consolidation with a short-term transfer outlined by modifications within the derivatives market and the energy of the $0.18 assist zone.

Associated: Zcash Value Prediction: Zcash rally widens as open curiosity reaches yearly excessive

Technical outlook for Dogecoin value

Dogecoin’s value construction stays effectively outlined as it’s consolidating round $0.19 following a powerful rebound from the $0.27 swing excessive. The important thing Fibonacci ranges between $0.133 and $0.23 proceed to map out vital zones for merchants.

- Prime stage: $0.195 (20-day EMA) and $0.211 (200-day EMA) are quick hurdles, whereas $0.218 (Fib 0.618) and $0.23 (Fib 0.786) kind main breakout zones. A decisive transfer above these ranges might push DOGE towards the $0.27 highs and sign a full restoration from the current correction.

- Lower cost stage: Help stays at $0.1807 (Fib 0.5), adopted by $0.159 (Fib 0.382) and $0.133 (Fib 0.236). Shedding the $0.18 deal with might retest the $0.16 and $0.13 zones, doubtlessly opening up room for a deeper retracement.

The broader construction means that DOGE is compressing between medium-term assist at $0.18 and resistance at $0.21, forming a symmetrical consolidation forward of a bigger directional transfer.

Will Dogecoin rebound?

Dogecoin’s subsequent transfer will largely depend upon whether or not consumers can keep on with the $0.18 flooring as capital outflows proceed. The energy of the derivatives market, with open curiosity surging above $1.79 billion, suggests elevated speculative demand. Nevertheless, persistent promoting strain within the spot market continues to dampen the upside momentum.

Elevated capital inflows together with secure funding charges might give DOGE sufficient energy to retest $0.21 and regain $0.23. Nevertheless, failure to maintain above $0.18 might set off a breakdown in direction of $0.16 and delay any significant restoration.

Associated: Cardano value prediction: ADA threat breakdown as $25 million outflow collides with Laios milestone

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t chargeable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.