- Dogecoin falls beneath multi-week triangular help and turns into resistance above the 20/50/100/200-day EMA.

- Trade outflows exceeded $46 million, indicating that distributions are being made as liquidity returns to exchanges.

- The breakdown is that the goal is $0.15, and if the $0.150 demand zone fails, additional draw back is anticipated in direction of $0.13.

Dogecoin value is buying and selling round $0.165 right this moment as sellers pressure a decisive breakdown from the multi-week triangle sample. This transfer will put short-term strain on consumers as spot outflows speed up and the EMA cluster heads in direction of the ceiling.

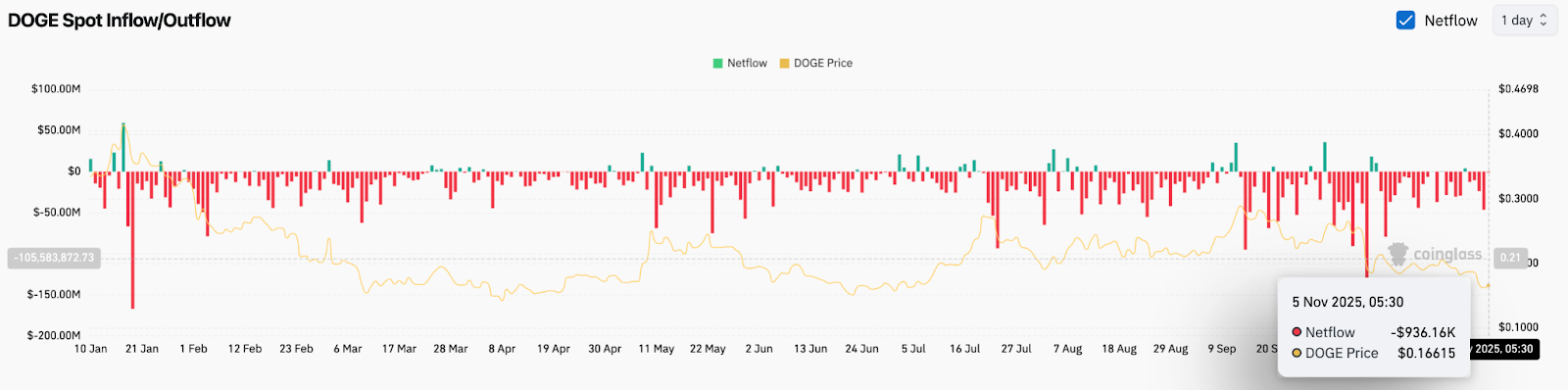

Spot outflows improve as consumers exit

Based on Coinglass, Dogecoin recorded almost $46 million in outflows yesterday, making it one of many largest single-session flows in current weeks. The identical development continues right this moment. As of early Wednesday, spot flows confirmed an extra $936,000 in web outflows, indicating that sellers had been nonetheless transferring DOGE to exchanges moderately than holding it.

When spot outflows predominate over a number of classes, it often displays dispersion moderately than accumulation. Market contributors aren’t taking positions for upside, and liquidity flows out of the ecosystem moderately than into it.

A trendline break is a sign of short-term weak spot

DOGE failed to interrupt out of the downtrend line that has capped the rally since September. This rejection pushed the token beneath the symmetrical triangle help, a stage it had beforehand held for almost three weeks.

As soon as that ground is gone, the chart will appear to be this:

- DOGE buying and selling beneath 20, 50, 100 and 200 day EMAs

- EMAs stack downwards, forming a resistance ceiling

- Parabolic SAR dot reverses above value, confirming bearish development

The primary main resistance was seen on the 20-day EMA close to $0.189. Above that, the 50-day EMA of $0.207 and 200-day EMA of $0.221 pose bigger reversal limitations.

To carry momentum again to impartial, consumers have to reclaim this EMA cluster. Till such a transfer happens, all pullbacks stay rescue pullbacks inside bearish constructions.

Intraday momentum signifies an try at stabilization

On the shorter timeframe, we see that DOGE is attempting to defend the $0.160 to $0.157 zone.

On the 30 minute chart:

- Supertrend stays crimson, suggesting draw back strain

- RSI recovers above 50, indicating stabilization from oversold circumstances

- Worth is testing the decrease facet of the supertrend band

Intraday merchants try to pressure a modest restoration, however a pullback stays unsure till DOGE closes above $0.171. This stage marks the supertrend reversal zone. A rejection right here may set off an additional decline in direction of $0.150.

The bulls’ technique is straightforward. A robust shut above $0.189 signifies that consumers can regain management and override the breakdown. A break above $0.207 opens the door to $0.240, and finally a development reversal in direction of the higher development line close to $0.260. The construction stays bearish beneath $0.189.

outlook. Will Dogecoin go up?

The subsequent transfer will rely on how DOGE reacts at $0.157 to $0.150, the demand ledge that has traditionally served as a springboard.

- Bullish case: DOGE rebounded from $0.157 and ended above $0.189 on elevated quantity. This reverses the supertrend and marks the primary signal of a development reversal.

- Bearish case: If the value closes beneath $0.150 for the day, a clear breakdown will probably be confirmed and the following liquidity zone will seem round $0.140.

Momentum adjustments as the value regains $0.189 and breaks out of the EMA cluster. A lack of $0.150 turns right into a full correction from $0.130 to $0.110..

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.