- DogeCoin Value traded in the present day at $0.232 and holds help from over $0.22 to $0.219 after falling beneath $0.25.

- $1746 million in internet spills reveals cautious sentiment, and the buildup is just too weak to set off sustained gatherings.

- By-product knowledge present a protracted bias, however reveals an increase in liquidation, conserving Doge momentum beneath $0.25-0.30.

Dogecoin Value has traded almost $0.232 after sliding 3.8% over the past 24 hours. Sellers stay beneath resistance degree of $0.25, with zones between $0.22 and $0.219 rising as rapid help clusters. Merchants weigh technical compression in opposition to weak inflows to find out their subsequent transfer.

Dogecoin Value faces resistance after current pullback

The each day chart reveals Dogecoin integration inside ascending channels, however in a current session, the token misplaced momentum after an unsuccessful try at almost $0.30 within the first half of September. Costs now retreated in direction of the midrange, testing the 20-day EMA at $0.238 as ceiling.

Emma clusters at round $0.226 and $0.219 for 50 and 100 days, making this zone necessary within the brief time period. Above $0.219, the bullish channel construction is preserved, however the failure exposes $0.20 and preserves deeper liquidity close to $0.18. The benefit is that by accumulating $0.25, patrons can rethink $0.28 and $0.30, with the channel restrict near $0.32.

Associated: PI Coin Value Prediction: PI is struggling to get better after breakdown

The momentum indicator signifies the cooling energy. The RSI has immersed from the acquired territory and is now approaching impartial ranges, however the MACD line is flat. This means that Dogecoin’s pricing measures might enter the combination part earlier than the subsequent essential breakout.

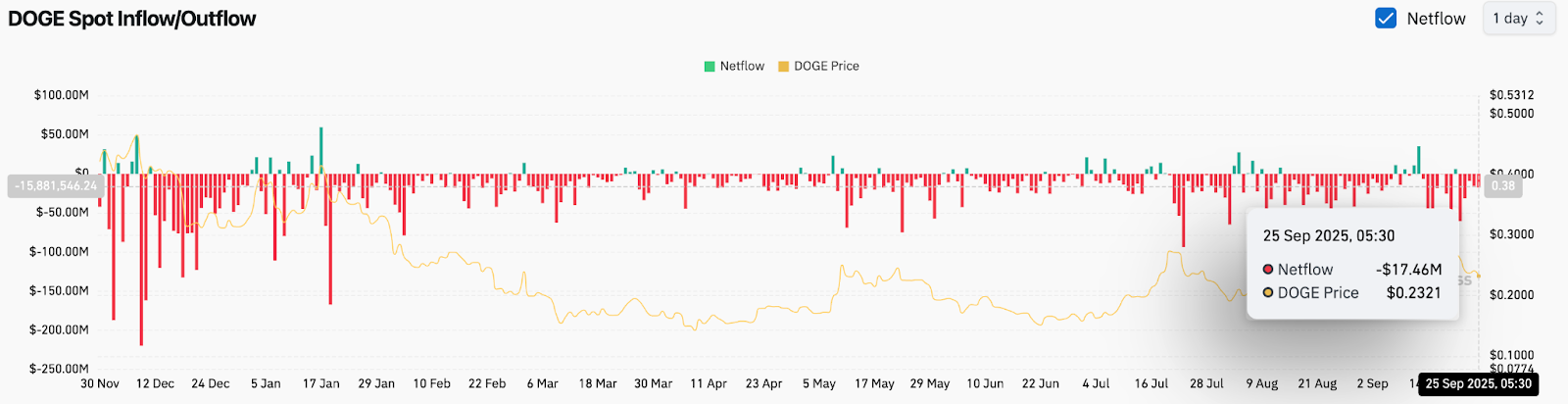

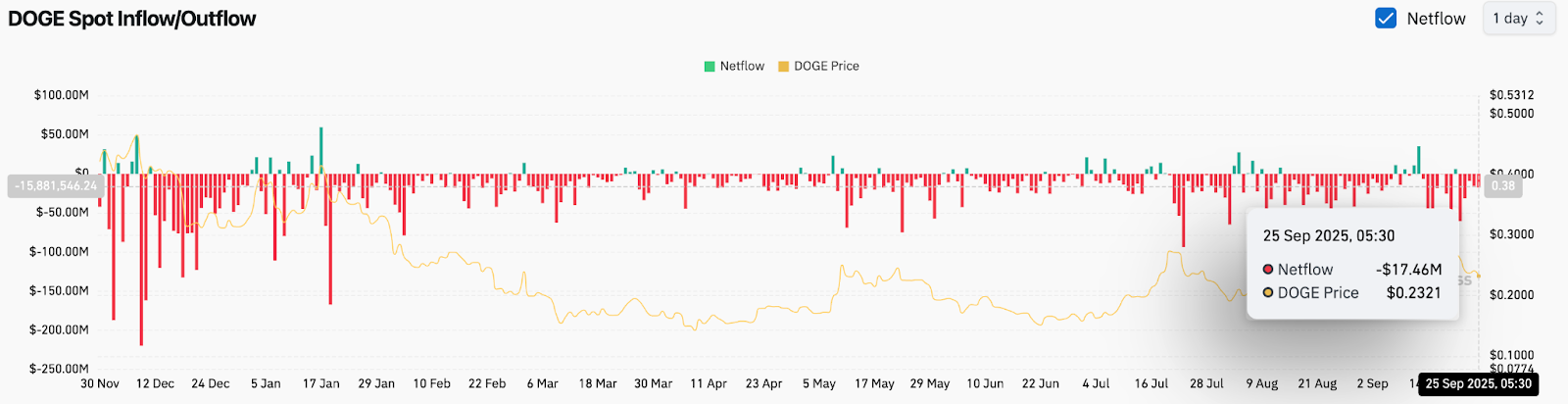

On-chain circulation emphasizes cautious feelings

Change circulation knowledge reveals a development of persistent outflow, however inconsistent dimension. On September twenty fifth, internet outflow reached $17.46 million, reflecting gentle build-up, however not sufficient to point out a robust conviction. Total, the previous two months have been dominated by crimson internet circulation bars, indicating that merchants have a tendency to cut back publicity throughout gatherings fairly than actively accumulate.

This lack of sustained inflow is a vital concern. Whereas Dogecoin’s worth volatility typically depends on a fast burst of retail exercise, present circulation profiles recommend a extra measured market. With out a robust inflow, the rally try will stall over $0.25 and stall in opposition to overhead provide.

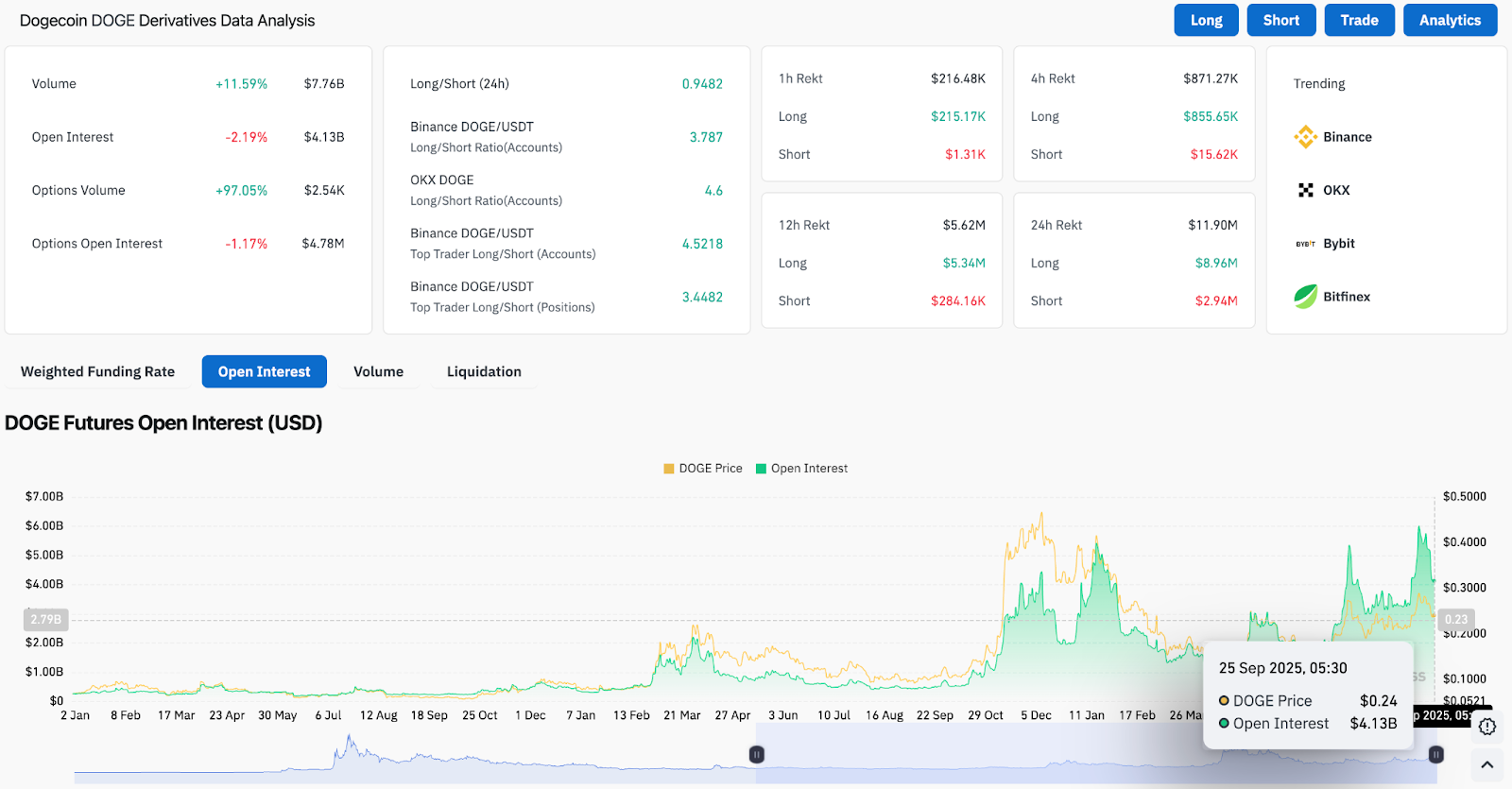

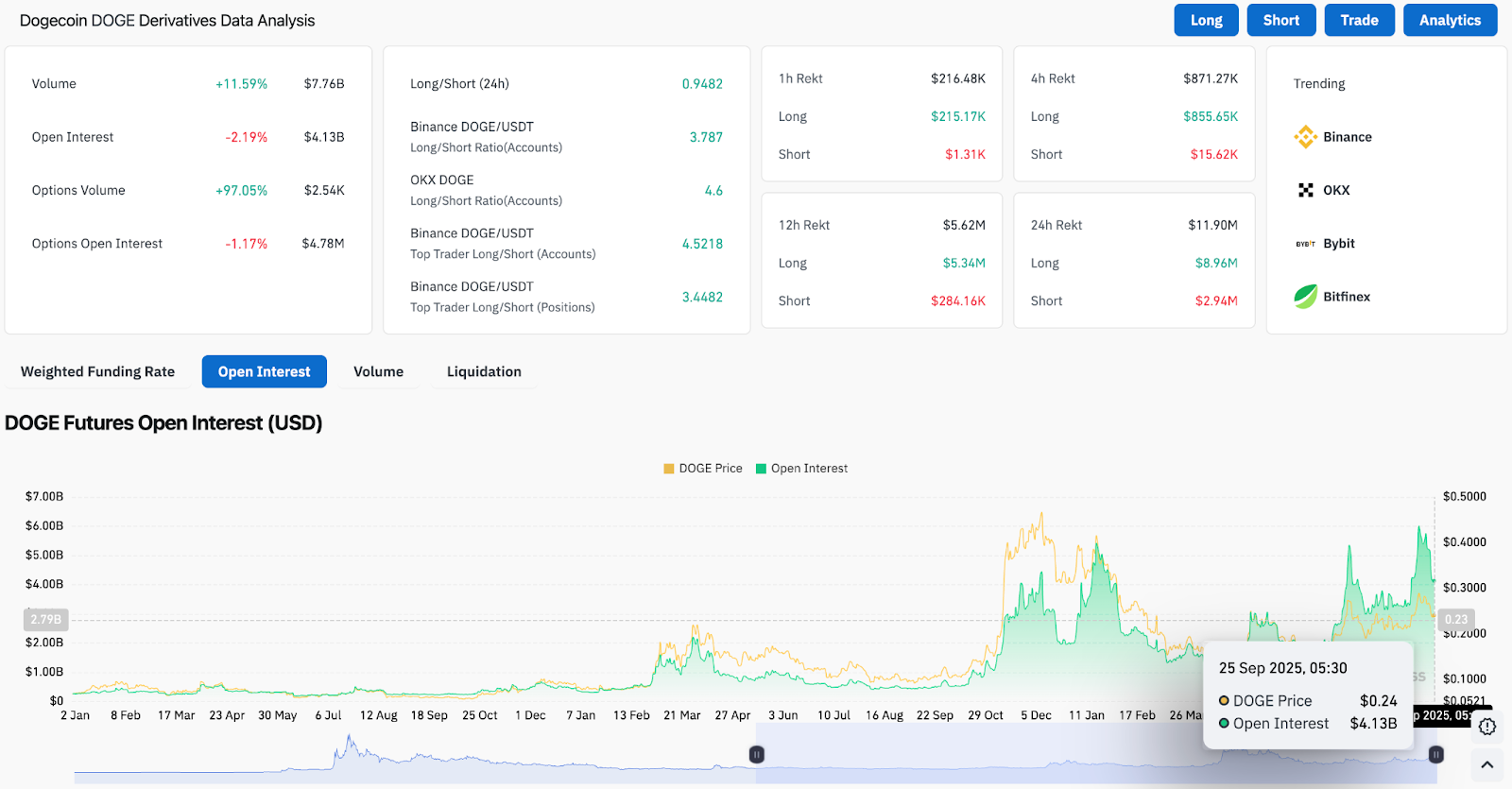

The derivatives market reveals a wide range of positionings

Dogecoin spinoff knowledge attracts cautious photos. Open Curiosity was $4.13 billion, down 2.2% over the previous day, and each day volumes rose 11.6% to $7.76 billion. This divergence indicators lively buying and selling, however with fewer unissued contracts, it’s a signal that merchants will finish their publicity after a current swing.

Associated: Ethereum (ETH) Value Forecast: ETH slips underneath key help

The lengthy/brief ratio of the primary exchanges signifies a leaning in direction of the lengthy, each with Binance and OKX above 3.5, reflecting that many merchants nonetheless count on to proceed upward. Elective exercise has additionally skyrocketed, with 97% quantity leaping to a $2,540 contract. Nevertheless, open curiosity on choices stays modest at $4.78 million, highlighting that this surge could also be speculative fairly than structured.

It absorbed many of the current losses, wiping out $11.9 million over the previous 24 hours, in accordance with liquidation knowledge. This means optimistic merchants can be caught off guard by pullbacks, decreasing leveraged urge for food within the brief time period.

DogeCoin Value Technical Outlook

The DogeCoin worth forecast for September 26 highlights the battle between help and resistance and the $0.25 resistance.

- Upside degree: If momentum is strengthened, $0.25, $0.28 and $0.30 stay rapid targets.

- Deficiency degree: $0.22, $0.20 and $0.18 are the primary defence factors, whereas $0.16 is taken into account to be a bigger cycle decrease.

- Development Construction: The broader channel stays above $0.219, however the danger of breakdowns rises sharply than this degree.

Outlook: Will Dogecoin go up?

DogeCoin’s short-term trajectory is determined by whether or not the customer is ready to shield the $0.22 help cluster, however the circulation begins to check optimistic. Present chain and spinoff knowledge recommend warning, with a restricted conviction with restricted scope of sharp rally.

Associated: XRP Value Forecast: Can SEC ETF approvals trigger rebounds above $3?

So long as Dogecoin costs exceed $0.219, the broader bullish channel will stay in impact, permitting patrons to strive one other transfer in direction of $0.28-0.30. Nevertheless, if this zone is just not maintained, a $0.20 deal with can be printed, weakening the bullish mid-cycle thesis. For now, integration is a fundamental case, with merchants ready for a stronger inflow earlier than committing to directional bets.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version is just not chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.