- Dogecoin (DOGE) stays locked beneath $0.20 regardless of the launch of Grayscale’s GDOG ETF.

- The US Federal Reserve will finish quantitative tightening (QT), a key catalyst for liquidity, on December 1st.

- Technical fractals recommend {that a} “third wave” will accumulate earlier than a parabolic breakout.

Regardless of a mixture of bullish catalysts that will usually set off a bull market, Dogecoin (DOGE) stays structurally trapped. The main meme coin continues to be buying and selling round $0.15 and has failed to interrupt by way of resistance regardless of Wall Avenue opening trades by way of the newly listed Grayscale Dogecoin Belief ETF (NYSE: GDOG).

Associated: Grayscale’s DOGE and XRP ETFs to debut on NYSE and shock market

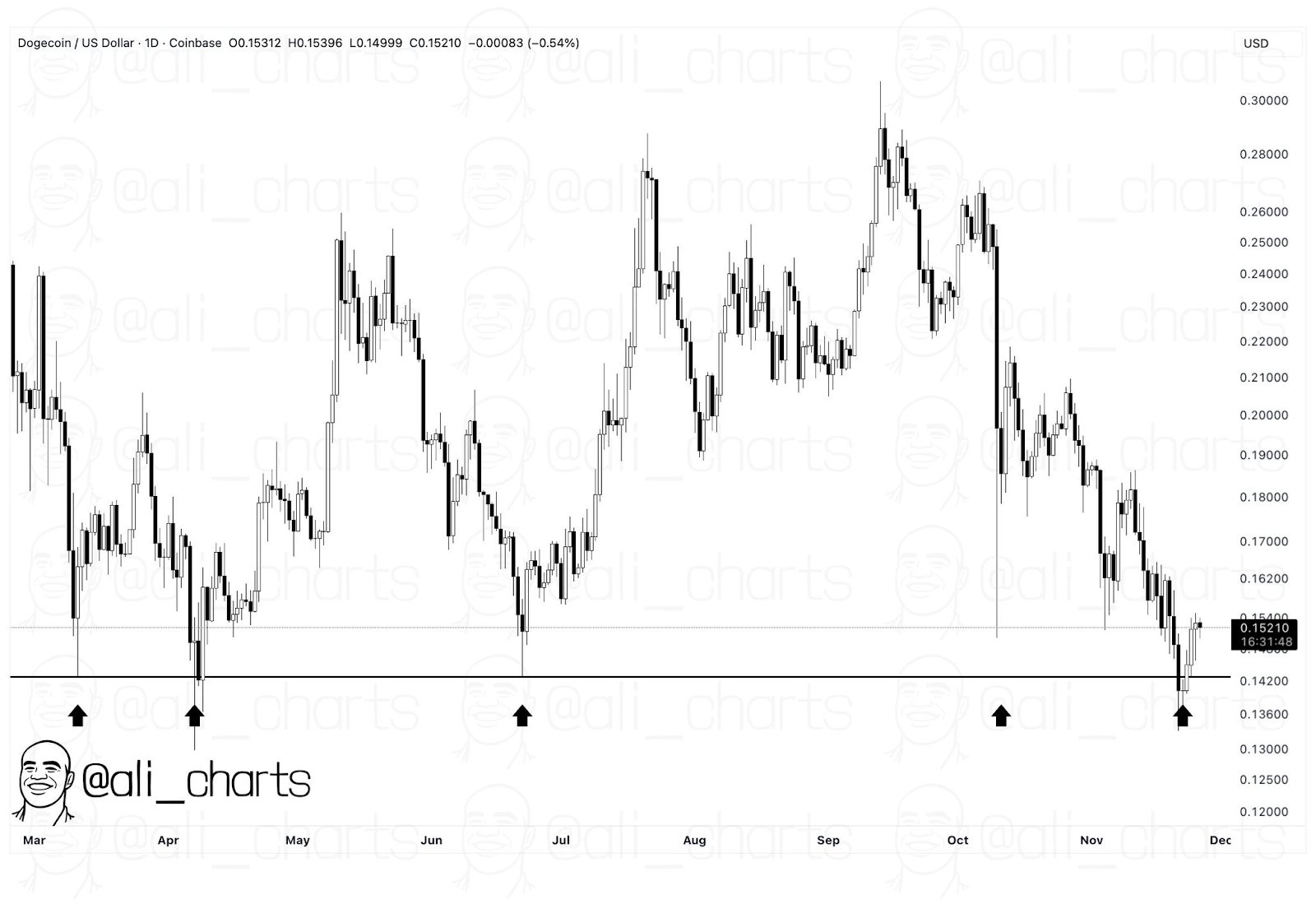

Crypto analyst Ali Martinez famous that the DOGE/USD pair has retested the help degree round $0.144 5 instances for the reason that starting of the 12 months. The massive-cap memecoin has a totally diluted valuation of roughly $22.8 billion and traded at roughly $0.15 on Friday, November 28, in the course of the European early session.

What’s going to occur to the value of Dogecoin sooner or later?

Dogecoin worth is caught in third wave dreadlocks, in response to crypto analyst @EtherNasyonaL alias X. Cryptocurrency analysts base their bullish theorization on the previous two main bull cycles, 2017 and 2021.

Associated: Dogecoin Worth Prediction: Doge Worth Weak point Coincides with Weak point in Futures Buying and selling

As such, cryptocurrency analysts anticipate DOGE worth to breakout in direction of all-time highs (ATH) within the close to future. Nevertheless, the medium-term bullish outlook for DOGE depends closely on help from a multi-year ascending logarithmic trendline. If DOGE worth falls beneath $0.14 within the coming weeks, a full-blown bear market will likely be inevitable.

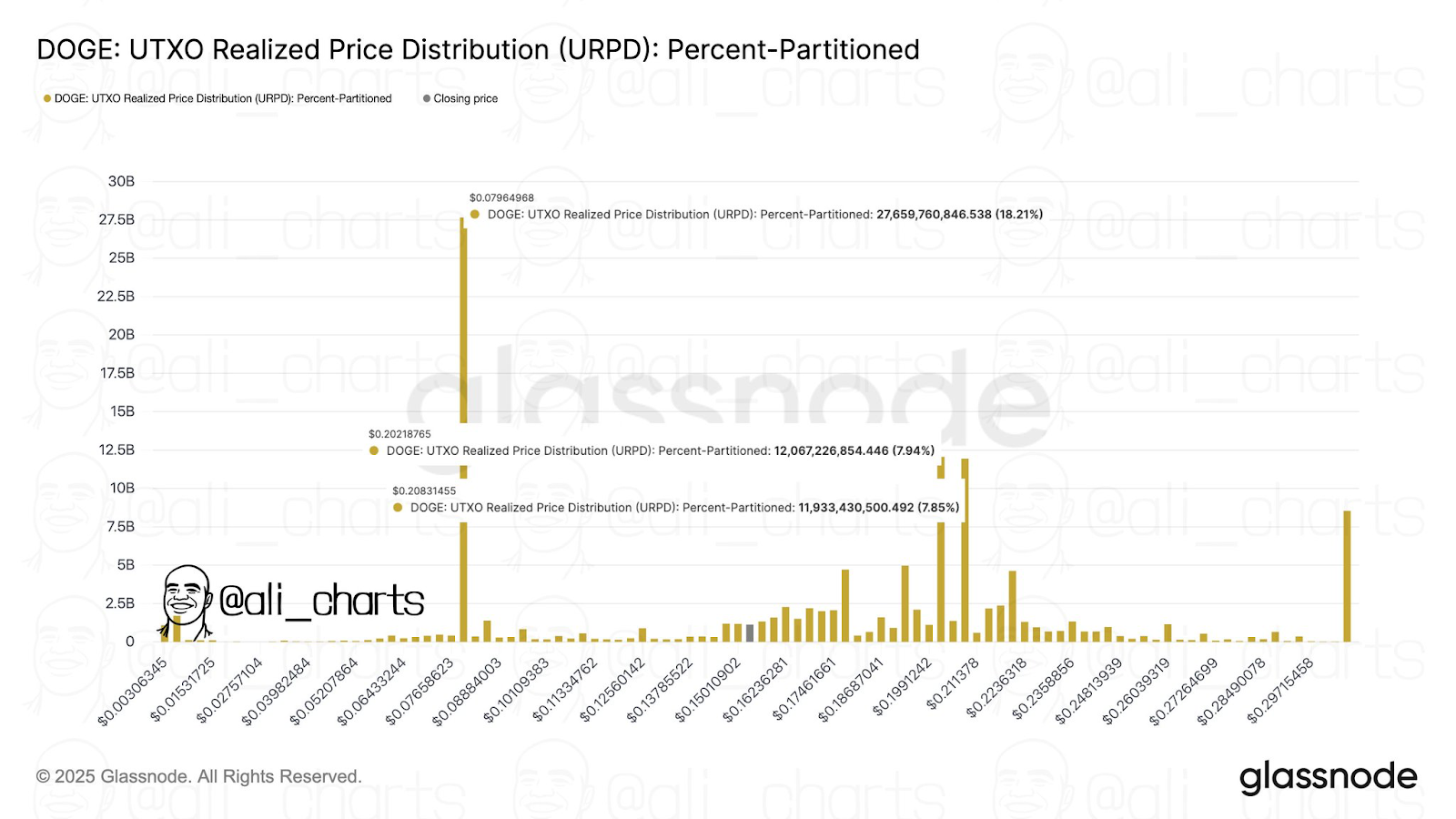

However, cryptocurrency analyst Martinez identified that if the help degree round $0.14 fails to carry, DOGE worth is more likely to fall in direction of the help degree round $0.08. Conversely, cryptocurrency analysts have set a goal of $0.2 primarily based on the UTXO realized worth distribution.

Key components that will have an effect on DOGE within the medium time period

Spot ETF Hype and Money Stream

The medium-term outlook for Dogecoin costs will likely be closely influenced by the efficiency of the lately listed spot Doge Change Traded Fund (ETF). Furthermore, Bitcoin (BTC) worth rose to an all-time excessive in 2024 even earlier than the halving occasion, pushed by the spectacular efficiency of dozens of spot BTC ETFs.

Over the previous week, a number of U.S. fund managers have listed their spot DOGE ETFs. On the time of writing, the Grayscale Dogecoin Belief ETF had complete property below administration of $3.5 million.

Crypto capital rotation amid expectation of Fed quantitative easing

The medium-term outlook for Dogecoin costs will likely be closely influenced by the Federal Reserve’s financial coverage selections. Beginning subsequent week, December 1st, the Federal Reserve will start its long-awaited quantitative easing (QE).

The final time the Fed carried out WE was throughout and earlier than Crypto Summer time 2017. As the worldwide cash provide continues to surge, Dogecoin’s worth will profit drastically from the anticipated capital rotation from Bitcoin and different massive altcoins within the quick time period.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.