- DOGE stays within the distribution as highs fall, EMA is weak and Fib breaks by means of the higher restrict

- Collapse of futures place confirms deleveraging stage and decline in danger urge for food

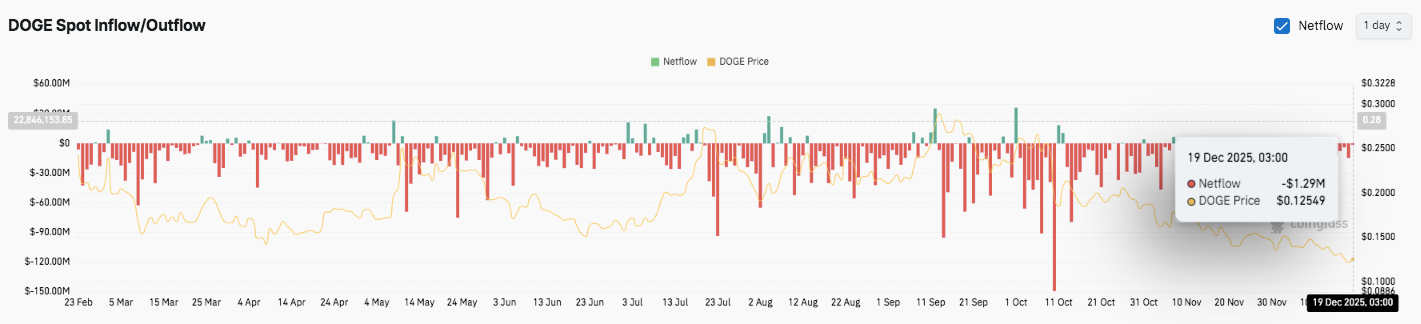

- Spot internet outflows round $0.125 recommend promoting stress is outweighing accumulation

Dogecoin continues to face continued stress on the 4-hour chart as sellers keep management over worth, derivatives, and spot exercise. Latest developments point out that the market is struggling to draw convincing shopping for. Because of this, merchants stay cautious as DOGE trades under key technical ranges. The broader construction signifies dispersal somewhat than accumulation.

Worth construction reveals persistent weak spot

DOGE maintains a transparent sequence of highs and lows on the 4-hour timeframe. Importantly, the worth fell under the 0.382 Fibonacci stage round $0.134. This transfer triggered an acceleration of promoting in direction of 0.236 Fib round $0.1286. Moreover, the worth at one level fell to almost $0.125, confirming weak demand.

DOGE is buying and selling under the 20, 50, 100, and 200 EMAs. This correction signifies that draw back momentum will proceed. Moreover, the supertrend indicator continues to flash bearish alerts, reinforcing the promoting stress.

Fast assist lies between $0.1250 and $0.1235, with consumers making an attempt short-term safety. Nevertheless, $0.120 stays a psychologically and structurally essential stage. A stable break under this zone might begin a slide in direction of $0.115.

Associated: Cardano Worth Prediction: Political Uncertainty Exacerbates Decline in Channel Strain

On the upside, resistance is concentrated between $0.1300 and $0.1327. Due to this fact, the bulls have to recuperate $0.134 for the worth to stabilize. The $0.1383 to $0.1427 zone signifies a stronger provide space. If the worth closes above that vary, the bearish construction will weaken.

Futures positioning reflecting deleveraging

Open curiosity in Dogecoin futures highlights modifications in dealer habits. Open curiosity expanded aggressively throughout the preliminary rally, suggesting leveraged hypothesis. Nevertheless, as momentum waned, the place steadily unwinded.

Notably, open curiosity has fallen from a peak of over $4 billion to round $1.27 billion. This decline signifies decrease leverage and decrease danger urge for food. Due to this fact, merchants are at the moment ready for clearer course earlier than restructuring their exposures. The deleveraging section coincides with continued worth decline.

Spot flows strengthen bearish sentiment

Spot influx and outflow information additional helps the cautious outlook. Though internet inflows fluctuate regularly, massive outflows usually coincide with falling costs. Moreover, current unfavourable internet flows have coincided with DOGE buying and selling round $0.125.

This sample suggests dispersal somewhat than accumulation. Though capital inflows typically precede a worth rebound, the response stays inconsistent. Because of this, spot exercise can not verify sustainable restoration.

Technical outlook for Dogecoin worth

Because the market searches for course following the current downturn, Dogecoin’s key ranges stay clearly outlined. Worth motion continues to respect established assist and resistance zones, maintaining DOGE in a pivotal technical vary.

High stage: Fast resistance lies between $0.1300 and $0.1327, the place the short-term EMA is concentrated. If the worth sustains above this zone, the worth might retest $0.1340. Past that, the realm between $0.1383 and $0.1427 turns into the principle provide zone. An increase into this vary would point out a weakening of bearish stress, paving the way in which for $0.1465.

Cheaper price stage: On the draw back, $0.1250 to $0.1235 stays the first demand zone. Failure to maintain this space will shift focus to $0.1200, an essential psychological and structural stage. A break under $0.1199 dangers widening losses in direction of $0.1150.

Higher restrict of resistance: The $0.1340 stage represents an essential turning level for the stabilization of the short-term development. Bulls have to reclaim this zone to problem the broader downtrend.

Will Dogecoin go up?

Dogecoin’s near-term outlook is determined by whether or not consumers can defend the $0.1250 assist space. Costs under resistance recommend that volatility could improve quickly. If consumers regain momentum and push DOGE above $0.1340, a restoration towards $0.1380 to $0.1420 is probably going.

Nevertheless, draw back dangers are growing as capital inflows stay weak and curiosity in derivatives has waned. A lack of $0.1200 would verify bearish continuation. For now, Dogecoin is buying and selling at a call level with confidence and quantity defining its subsequent transfer.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.