- Dogecoin is above a significant EMA, suggesting a cautious near-term bullish construction.

- The rise in open curiosity highlights merchants’ renewed confidence within the DOGE futures market.

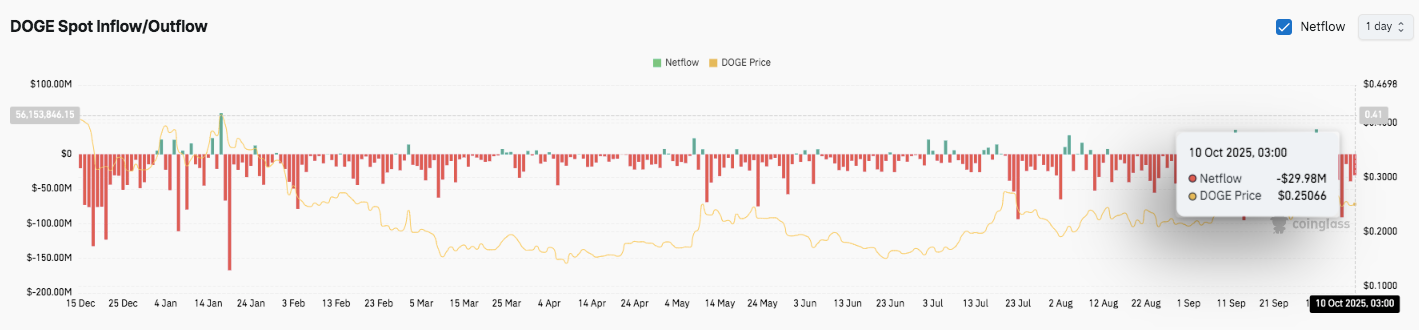

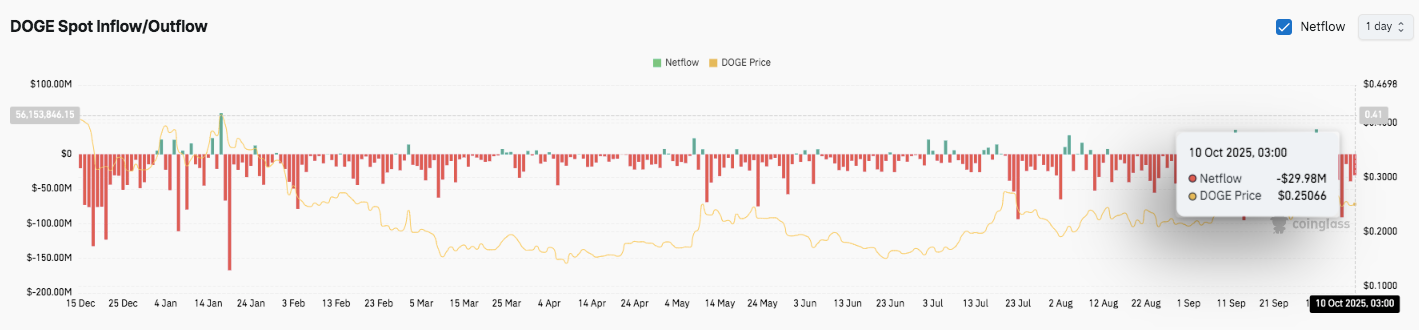

- Sustained international alternate outflows point out elevated accumulation and long-term holdings.

Dogecoin (DOGE) has rebounded from its latest swing lows round $0.2408 and is slowly displaying indicators of restoration. The token is buying and selling round $0.2522 and stays barely above its 20-day and 50-day exponential shifting averages (EMAs).

This gradual restoration comes after a number of weeks of powerful value motion, and merchants are intently waiting for potential pattern affirmation. Moreover, the Dogecoin derivatives market can be regaining momentum, suggesting that speculative participation might quickly result in extra intense value motion.

Technical construction and help outlook

DOGE’s short-term pattern stays cautiously bullish if the value stays above the $0.2450 space. This vary coincides with the 100-day EMA and represents a zone the place consumers are repeatedly defending their positions.

Importantly, a decline beneath $0.2460 might invite contemporary promoting stress and expose the value to draw back help close to $0.2408 and $0.2305. These ranges coincide with the 23.6% Fibonacci retracement and former cumulative base.

On the upside, the primary resistance cluster seems round $0.2548-$0.2610, overlapping the Fibonacci vary of 38.2%-50%. A clear breakout might push DOGE in the direction of the 61.8% and 78.6% retracement zones of $0.2737 and $0.2882. Due to this fact, a sustained transfer above $0.2600 might strengthen the bullish momentum and goal the earlier native excessive $0.30 degree.

Futures buying and selling alerts renewed confidence amongst merchants

Dogecoin’s open curiosity has risen considerably after months of subdued exercise. By October tenth, it had reached $4.4 billion, indicating a restoration in speculative positions.

Associated: Litecoin Worth Prediction: Merchants bullish on LTC as ETF optimism positive factors momentum

This follows a pointy decline after a peak of greater than $6 billion in July, when merchants took earnings after a mid-year rally. In consequence, each open curiosity and value rise concurrently, suggesting growing affect available in the market.

Such developments typically point out elevated dealer participation prematurely of main market occasions. If open curiosity continues to rise as costs stabilize, it might strengthen confidence amongst bullish merchants. Moreover, this sample might precede a bigger directional transfer within the coming weeks.

Sustained capital outflows mirror holding sentiment

Based on alternate knowledge, DOGE continues to report internet outflows reflecting the transfer to off-exchange storage. As of October tenth, the token is buying and selling at $0.25066 whereas reported outflows of roughly $29.98 million. This pattern means that traders could also be accumulating funds for medium-term holding somewhat than energetic buying and selling.

Technical outlook for Dogecoin value

Key ranges stay well-defined as Dogecoin (DOGE) trades round $0.2520 heading into mid-October.

- Upside value ranges: $0.2548, $0.2610, and $0.2737 are the rapid hurdles for consumers. A break above these factors might lengthen the rally to $0.2882 and $0.3000, the subsequent resistance zone alongside the Fibonacci extension.

- Draw back Ranges: $0.2480 and $0.2460 kind the primary main help band and are backed by the 100-day EMA. A transparent breakdown beneath this space might expose DOGE to $0.2408 and $0.2305, the place the 23.6% retracement matches the earlier cumulative base.

The 20-day and 50-day EMAs are at present converging round $0.2500, indicating short-term equilibrium between consumers and sellers. The technical construction means that DOGE is compressing inside a decent vary, indicating the potential of extra volatility on the subsequent transfer.

Will Dogecoin rise to $0.30?

Dogecoin’s future in October will depend upon whether or not the bulls can maintain the value motion above the $0.2450 to $0.2460 area. A maintain on this foundation would strengthen the bullish bias and open the best way for brand spanking new exams at $0.2610 and $0.2737. An prolonged shut above $0.2600 might present momentum to interrupt above the $0.30 goal with potential revenue taking.

Associated: Cardano Worth Prediction: Hydra Node 1.0 launch sparks new optimism

However, a break beneath $0.2450 might result in a deeper correction to $0.2305 earlier than the buildup resurfaces. The temper of the market is cautiously optimistic as open curiosity steadily exits the market and exceeds $4.4 billion, indicating long-term holding attributable to outflows. In the meantime, DOGE is at a crucial juncture, and the route of any breakout might decide the course of the whole month.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not answerable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.