- Dogecoin worth is buying and selling at $0.189 right now after stabilizing from an earlier drop.

- Elon Musk’s meme replies have revived the social dialog, however technical limitations stay.

- Resistance between $0.21 and $0.23 is a crucial check for a breakout state of affairs.

After a pointy correction earlier this week, Dogecoin worth stays close to $0.189 right now. Memecoin is displaying indicators of stabilization above the $0.18-$0.19 vary and merchants are conserving an in depth eye on a doable pullback. Regardless of the renewed consideration from Elon Musk, the chart exhibits DOGE going through layered resistance close to $0.20 and $0.23, the zone that can decide whether or not the restoration positive factors momentum.

Dogecoin worth consolidates in a descending triangle

DOGE worth stays inside the descending triangle on the 4-hour chart, with repeated lows and highs persevering with to restrict upward momentum. The 20-day EMA is close to $0.197, which overlaps with short-term resistance, whereas the 50-day EMA is at $0.209 and the 100-day EMA is at $0.221, forming a decent provide zone. Above that, the 200-day EMA at $0.2306 would be the final hurdle earlier than a sustained breakout.

The Parabolic SAR indicator continues to show a dot above the present worth, reinforcing a cautious short-term view. Momentum indicators are pointing to consolidation, with the value compressed between the assist at $0.189 and the resistance at $0.204. A breakout above this zone may set off a push in the direction of $0.221, whereas an in depth beneath $0.185 would pave the way in which for a return to $0.172.

Musk’s tweet sparks social revival

Elon Musk’s current change on X was his first Dogecoin-related publish in years, and it shortly reignited curiosity within the retail business. Musk responded to a meme evaluating Bitcoin’s power base to Dogecoin’s power base with a “100” emoji. This easy gesture sparked contemporary hypothesis about his continued token assist.

The publish shortly garnered greater than 130,000 views, after which the Dogecoin hashtag briefly trended. Traditionally, Musk’s tweets have typically acted as short-term sentiment catalysts, briefly pushing costs larger. However analysts say that whereas this might result in an inflow of speculative capital, the dearth of robust follow-through shopping for suggests merchants stay cautious.

This new consideration might present a psychological enhance, however finally technical elements will finally resolve whether or not or not to take action. dogecoin worth You possibly can regain misplaced floor.

Derivatives knowledge exhibits a blended place

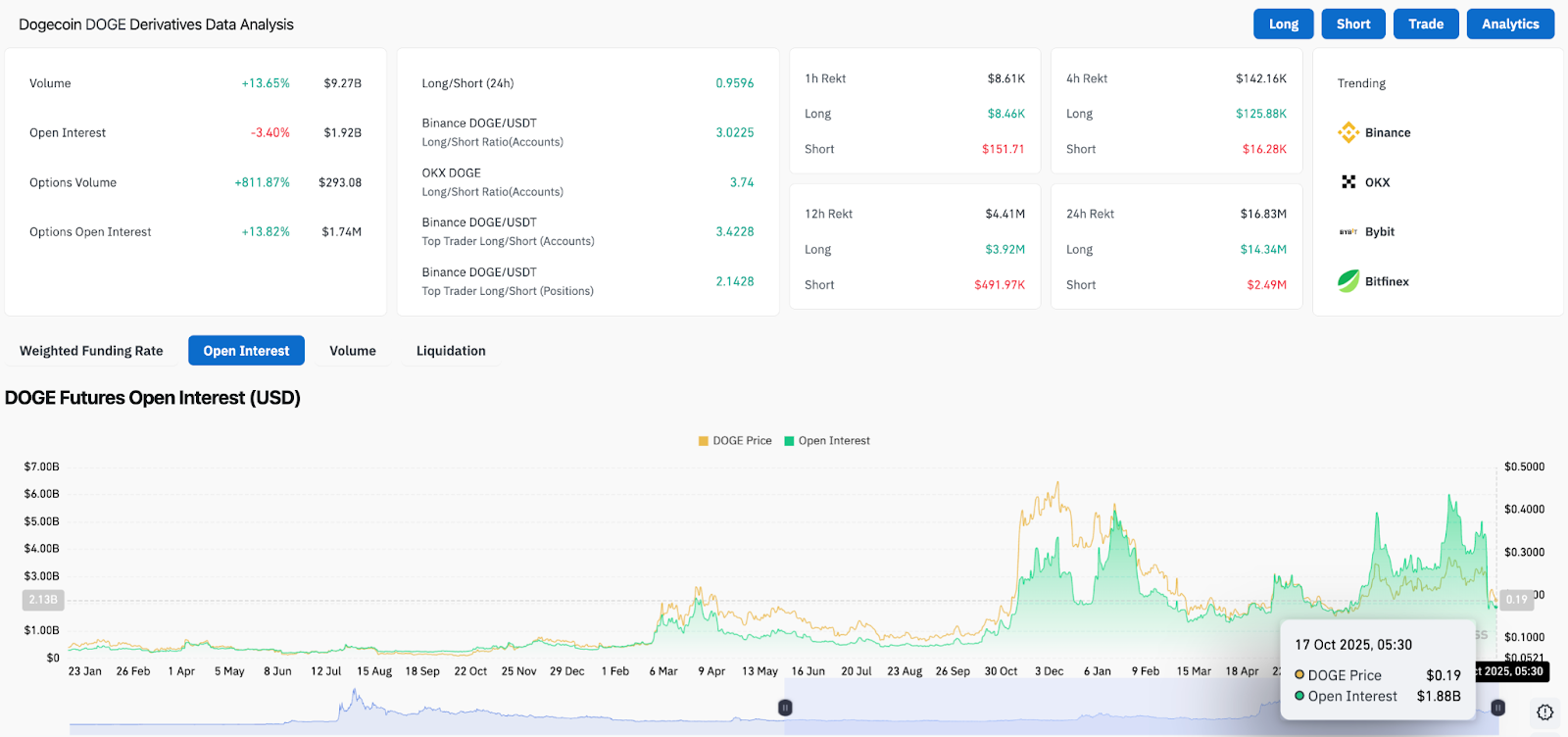

Derivatives market exercise highlights a cautious however bettering pattern. Complete DOGE futures buying and selling quantity rose 13.6% to $9.27 billion, whereas open curiosity fell 3.4% to $1.92 billion, in accordance with Coinglass knowledge. This divergence signifies that short-term positions had been closed after the current decline, regardless of elevated buying and selling exercise.

The choices market tells a special story. Choices quantity surged greater than 800% and open curiosity rose almost 14%. That is an early signal that merchants are hedging in opposition to a volatility occasion. The lengthy/quick ratio on Binance and OKX stays above 3.0, indicating that high merchants are leaning lengthy regardless of the slowing spot restoration.

Funding charges stay impartial, suggesting that leverage is just not but extreme. If inflows proceed and open curiosity stabilizes above $2 billion, momentum may shift to the bulls. For now, the info displays optimism tempered by uncertainty and is according to Dogecoin worth predictions that can stay range-bound till confirmed.

Technical outlook for Dogecoin worth

The important thing resistance ranges to look at are $0.197, $0.204, and $0.221. A day by day shut above $0.221 invalidates the draw back construction, paving the way in which for $0.23 and $0.25. On the draw back, quick assist lies at $0.189, adopted by $0.172 and $0.160, which signify the Fibonacci retracement zone from the final impulse.

If the value recovers above the 20-day EMA, it might invite new shopping for, but when the value can’t preserve $0.18, there’s a threat that the decline might be extended. Merchants proceed to give attention to the convergence of the EMA and trendline resistance as the important thing technical axis for subsequent week.

Outlook: Will Dogecoin go up?

Dogecoin’s near-term outlook will depend on whether or not new social sentiment interprets into actual shopping for strain. Dogecoin worth is hovering slightly below the EMA cluster right now, so a decisive transfer above $0.21 may set off a short-term breakout in the direction of $0.23 and $0.25.

Nevertheless, except this transfer is accompanied by an growth in quantity, this setup dangers turning into one other failed rally inside a descending sample. Assist at $0.18 stays essential to keep up structural integrity.

In a broader context, Dogecoin’s resilience round $0.19 means that long-term holders are nonetheless accumulating buys on the dip. The subsequent 48 hours may decide whether or not the Musk-led enthusiasm develops right into a technological breakout or fades into one other consolidation section.

.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.