The Dubai Worldwide Monetary Middle (DIFC), a number one international monetary heart within the Center East, Africa and South Asia (MEASA) area, right now introduced that it’s going to host the 2nd Dubai Fintech Summit on 6-7 Might 2024. . In a press release by His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, First Deputy Governor of Dubai, Deputy Prime Minister of the United Arab Emirates, Minister of Finance and President of the Dubai Worldwide Monetary Middle (DIFC), The primary summit ended on a excessive notice. From 92 nations he was a convincing success with 5,300 guests.

The first Dubai Fintech Summit highlighted the significance of accelerating funding in digital banking providers, e-commerce web sites and contactless funds because the inhabitants strikes from money to digital fee strategies. In keeping with co-organizer Visa, 4 out of 5 shoppers surveyed within the UAE change retailers based mostly on the fee methodology supplied, with most preferring digital funds to money. matter.

“Dubai Fintech Summit, in its first version, shall be a robust platform to showcase innovation, develop significant dialogue on the problems and challenges going through the business, and generate engagement on the way forward for Fintech. “It is unimaginable to see the success in 2019. As Dubai emerges as a serious hub for innovation and entrepreneurship, we have now reached an vital milestone for fintech within the area.” Mohammad Albrusi, CEO of DIFC Innovation Hub mentioned. “With the business rising at an unprecedented tempo, the 2024 Dubai Fintech Summit shall be a worthwhile alternative for business leaders and specialists to come back collectively to debate alternatives and chart a blueprint that may proceed to information the way forward for finance. It’ll present us with an awesome platform,” he added.

A platform for collaboration

The 2023 Dubai FinTech Summit signed over 20 MoUs with international monetary leaders.

DIFC signed 12 MOUs in the course of the Summit alone with main international monetary and expertise corporations, together with Normal Chartered Financial institution, to offer digital asset custody providers (regulatory topic to approval).

growth and development

To reveal the super development and potential of the fintech sector within the area, Brad Garlinghouse, CEO of main cryptocurrency options supplier Ripple, has introduced plans for the corporate to broaden into the area. Together with his 20% of shoppers being his MENA base, Ripple is selecting to:

Leveraging the Metropolis of Dubai’s superior regulatory framework and ecosystem, Dubai’s first regional hub will open at DIFC.

World cryptocurrency alternate Coinbase has additionally introduced thrilling growth plans, with CEO Brian Armstrong citing the UAE as a future hub for operations within the Center East, Africa and Asia. The corporate said its intention to discover.

Jenny Johnson, CEO of Franklin Templeton, a worldwide chief in wealth administration, shared insights on rising accessibility to smarter expertise, saying: For instance, tax efficiencies and customization in methods conventional banks have by no means been capable of obtain. ”

Commenting on the UAE’s imaginative and prescient for financial diversification, she added: “It was reform, funding and transformation. We have now seen reform accomplish two issues. First, it attracted human capital and expertise. Reforms round capital necessities One of many issues I recognize about this area is its intergenerational pondering: How can we diversify our financial system to make sure success for generations to come back? It is very important do

Piyush Gupta, Group CEO of DBS Financial institution, mentioned of adjustments in rates of interest: “A 4% to five% rate of interest setting is just not unusual. The massive distinction this time is just not rates of interest, however the tempo of change. Often. , the Federal Reserve (FED) takes years, or 2-2.5 years, to slowly enhance.This time, many argued that the Fed was lagging behind, so the Fed will reply extra rapidly. There’s a want.”

The occasion was co-sponsored by VISA, a monetary and expertise firm. e& as Headline Sponsor; Geidea as Presenting Sponsor. Finvasia, Emirates NBD and Paxos are lead sponsors. Blue, Normal Chartered Financial institution, Ripple and Side be a part of as platinum sponsors. atPay, Dubai Monetary Markets and Dubai Industrial Financial institution are taking part as Gold Sponsors, and Huawei as Lead Cloud Sponsor.

Dubai FinTech Summit to be held once more in 2024

Trying forward, the 2nd Dubai FinTech Summit guarantees larger impression to form the way forward for FinTech within the area. Mark your calendars for Might 6 and seven, 2024 and be a part of us as soon as once more in pushing the boundaries of innovation and transferring the FinTech business ahead.

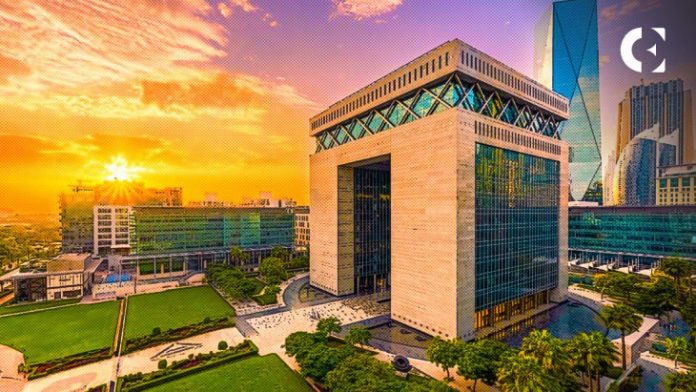

About Dubai Worldwide Monetary Middle

The Dubai Worldwide Monetary Middle (DIFC) is without doubt one of the world’s most superior monetary facilities and a serious hub within the Center East, Africa and South Asia (MEASA), comprising 72 nations with a inhabitants of roughly 3 billion and an estimated GDP. monetary hub. 8 trillion USD.

With almost 20 years of expertise facilitating commerce and funding flows throughout the MEASA area, the middle connects these fast-growing markets with the economies of Asia, Europe and the Americas via Dubai.

Disclaimer: All info on this press launch was offered to Coin Version by a 3rd celebration. This web site doesn’t endorse, are liable for, or management this content material. COIN EDITION, THIS WEBSITE, DIRECTORS, OFFICERS AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OR LOSSES ARISING DIRECTLY OR INDIRECTLY FROM THE USE OF ANY CONTENT, PRODUCTS OR SERVICES DESCRIBED IN THIS PRESS RELEASE. is just not liable for

Comments are closed.