- Analysts anticipate ETH to make new highs after the bullish flag formation.

- Ethereum is approaching the midline of the linear regression channel and will transfer as much as the primary half of the channel.

- Merchants could must take precautions as ETH could also be in a correction or looking for help on the decrease trendline.

Crypto analyst and dealer Brantz tweeted that he expects Ethereum to hit new highs. He made the prediction after witnessing Ethereum hit a brand new all-time low, adopted by a bull market.

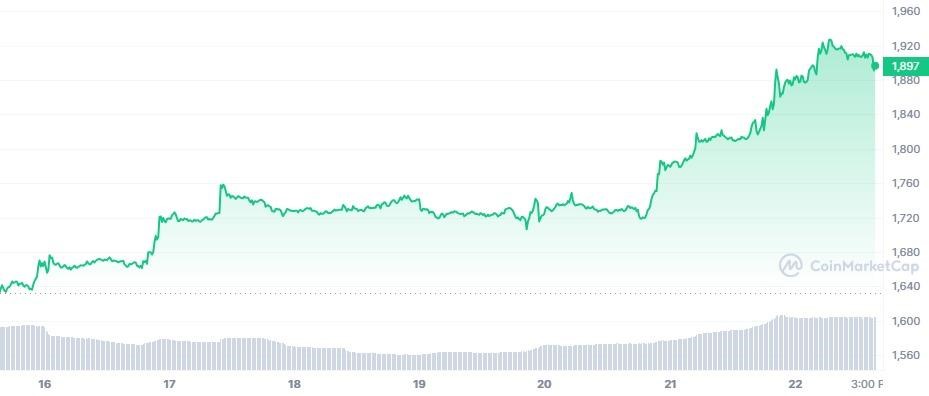

Trying on the graph above, Brandts’ optimism could also be justified. Ethereum has been profitable previously week. Notably, the market opened at $1,633 on June sixteenth however immediately climbed to $1,758 by June seventeenth. Nonetheless, between June seventeenth and June twentieth, Ethereum rose once more after consolidating between $1,720 and $1,760.

The chart above reveals Ethereum fluctuating inside a linear regression channel. Most of that exercise appears to happen within the prime half of the channel. Each time ETH plunged into the decrease part of the linear regression channel, it solely discovered help on the decrease trendline.

ETH is at the moment near the center line of the pattern channel and appears to be on the upside, but it surely’s clear to assume that it may rise additional to succeed in the higher trendline of the regression channel, i.e. resistance 1 at $2,140. is.

Nonetheless, Bollinger Bands seem to contradict the above principle. ETH has touched the highest of the Bollinger Bands, so additional upside is extremely unlikely. Due to this fact, ETH could undergo an adjustment interval. Moreover, the Bollinger Bands Width indicator with a studying of 0.17 is positioned parallel to the horizontal axis. So consolidation is feasible.

Nonetheless, as we scrutinize the January 2023 ETH surge, we can’t ignore the opportunity of a spike. Particularly, ETH has the attribute of constantly touching the bands, and slight corrections can happen if the market deems it overbought.

In lots of circumstances, corrections do not even contact the Bollinger Bands SMA earlier than ETH begins to surge once more. Due to this fact, if there’s a slight correction in ETH, merchants could must see a bullish candle formation earlier than coming into an extended place.

In that case, ETH may break under the SMA and search for help on the decrease trendline of the linear regression channel. The aforementioned trendline presents a very good entry level for consumers.

Disclaimer: As with all data shared on this pricing evaluation, views and opinions are shared in good religion. Readers ought to do their very own analysis and due diligence. Readers are strictly accountable for their very own actions. COIN EDITION AND ITS AFFILIATES SHALL NOT BE LIABLE FOR ANY DIRECT OR INDIRECT DAMAGES OR LOSSES.

Comments are closed.