Ethereum’s value has soared to a notable milestone over the previous day, at one level surpassing the $3,000 mark for the primary time in 22 months.

Throughout this era, the worth of ETH peaked at round $3,025, marking a formidable 27% enhance up to now 30 days. Nevertheless, its worth has rebounded barely to round $2,920 on the time of writing, experiencing a 3.5% decline. crypto slate information.

Why did ETH rise?

ETH's current value surge has been extensively attributed to hypothesis over the opportunity of the U.S. Securities and Change Fee (SEC) approving a spot Ethereum exchange-traded fund (ETF) in Could.

Commonplace Chartered, a British multinational financial institution, predicted a good end result for the approval of the Spot ETH ETF. Main figures at crypto asset administration corporations equivalent to Bitwise, Grayscale, and Galaxy Digital estimate that these pending spot Ethereum ETF purposes have a 50% probability of being authorized.

In the meantime, candidates equivalent to VanEck, Ark Make investments, and 21Shares are adjusting their purposes to the SEC's requirements for approval of Bitcoin ETFs.

Moreover, Dencun's upcoming upgrades are boosting market sentiment. This improve introduces options equivalent to proto-dunk sharding and charge discount. Moreover, this improve will assist improve Ethereum's community efficiency, scale back transaction prices, and enhance ecosystem interoperability.

The broader market sees crimson.

The broader cryptocurrency market declined throughout the reporting interval, with the worldwide cryptocurrency market capitalization lowering by 0.32% to $1.96 trillion.

In keeping with , Bitcoin soared to a brand new yearly excessive of slightly below $53,000, however shortly fell to $51,268 on the time of writing. crypto slate information.

Massive digital property equivalent to Solana, Avalanche, Cardano, and Ripple's XRP skilled losses of greater than 3%. Nevertheless, Binance-backed BNB coin and Tron’s TRX token bucked this pattern, posting positive aspects of lower than 3%.

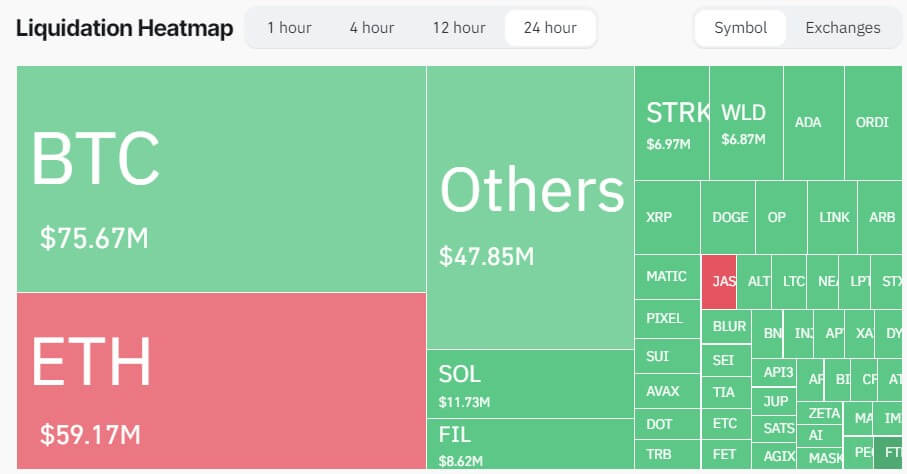

In keeping with information from Coinglass, these value actions led to large-scale liquidations, totaling greater than $291 million in liquidations from greater than 92,000 merchants.

Bitcoin topped the checklist when it comes to liquidations, with whole losses amounting to $75 million. Lengthy Bitcoin merchants misplaced $42 million, whereas brief merchants misplaced $28.46 million. Ethereum adopted carefully, contributing $59.1 million to general liquidations, with brief merchants bearing the brunt of the losses.