- Ethereum’s seven-day transaction common is approaching 2.5 million, a brand new all-time file.

- Common gasoline costs drop to $0.15 and a few swaps are executed at costs as little as $0.04.

- Stablecoin transfers account for 35-40% of community exercise, with ETH staking reaching 36 million.

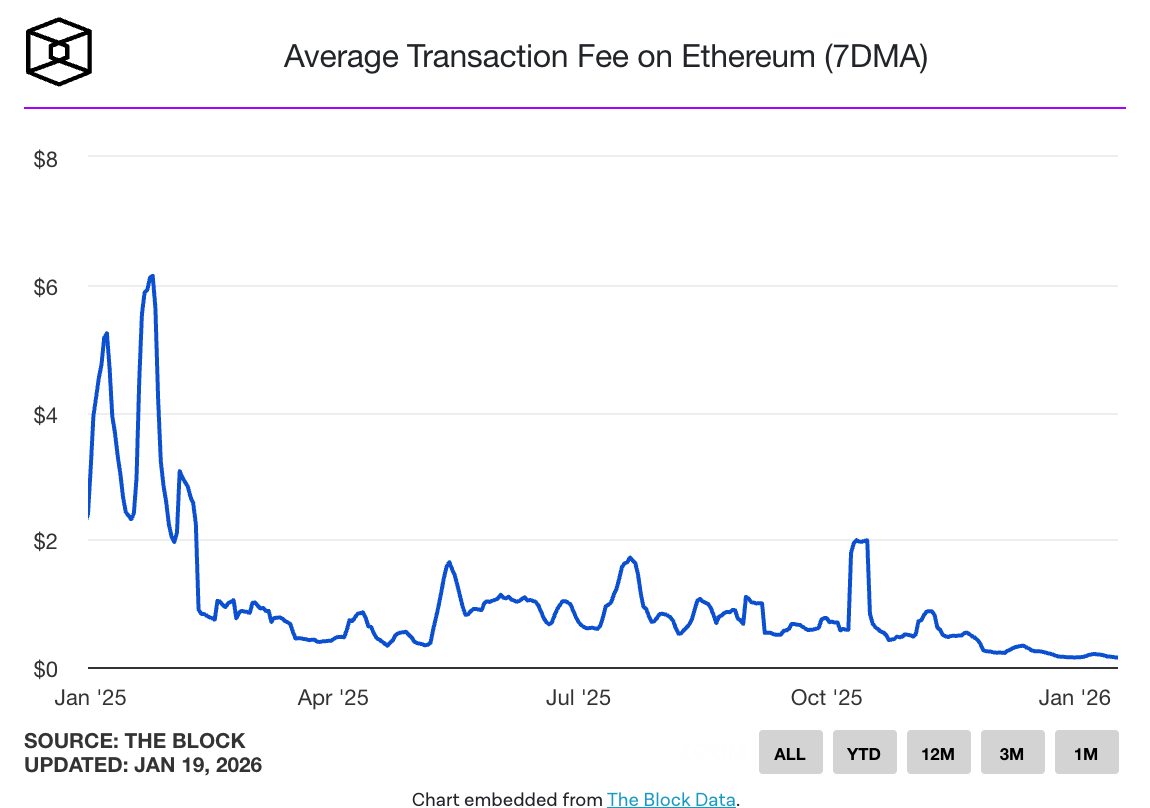

Ethereum buying and selling quantity has reached an all-time excessive, and gasoline charges have fallen to the bottom stage within the community’s historical past. The seven-day shifting common of transactions is approaching 2.5 million, almost double the quantity recorded a yr in the past. This surge in exercise started in mid-December and was a gradual decline that lasted till mid-2025.

Common gasoline costs have fallen to round $0.15 per commerce, in response to community information, and Etherscan has recorded estimated swap prices as little as $0.04. The mix of peak transaction exercise and traditionally low prices alerts a shift in Ethereum. ETH has beforehand confronted criticism for prime and unpredictable charges that exclude small customers throughout busy instances.

Value discount attainable by protocol upgrades

The spike in exercise comes seven weeks after the implementation of Ethereum’s Fusaka laborious fork, which launched PeerDAS (Peer Knowledge Availability Sampling) and initiated a twice-yearly improve schedule for the community. The blob parameter-only fork deployed on January eighth elevated the blob goal to 14 with a most restrict of 21, lowering information prices for layer 2 rollup options.

Ethereum’s block gasoline restrict elevated from 45 million to 60 million in late November, representing a 100% enhance from its early 2025 stage. As executions migrate to Layer 2 networks, demand for mainnet block area has eased, at the same time as total exercise ranges have elevated. This contributes to the present low value surroundings.

Stablecoin exercise drives transaction development

Stablecoin transfers account for roughly 35-40% of Ethereum transactions throughout the present interval. This class is a significant driver of community utilization, as customers leverage Ethereum infrastructure to switch dollar-denominated worth. The low-cost surroundings makes stablecoin transactions extra economically viable for small-scale transfers.

Ethereum staking has reached a file 36 million ETH locked, representing roughly 30% of the circulating provide. This milestone demonstrates continued validator participation regardless of market volatility. ETH is at present buying and selling round $3,200, with a rise of three.6% in 7 days and eight.1% in 30 days. The token has fallen by 2.8% prior to now 24 hours.

The collapse in costs signifies that mainnet demand is lowering as layer 2 options soak up the execution load. Rollup now handles nearly all of transaction processing whereas periodically deciding on the Ethereum mainnet. This structure permits the community to deal with extra combination exercise whereas preserving base layer prices low.

Associated: Vitalik Buterin advocates Ethereum’s simplicity to make sure trustlessness

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.