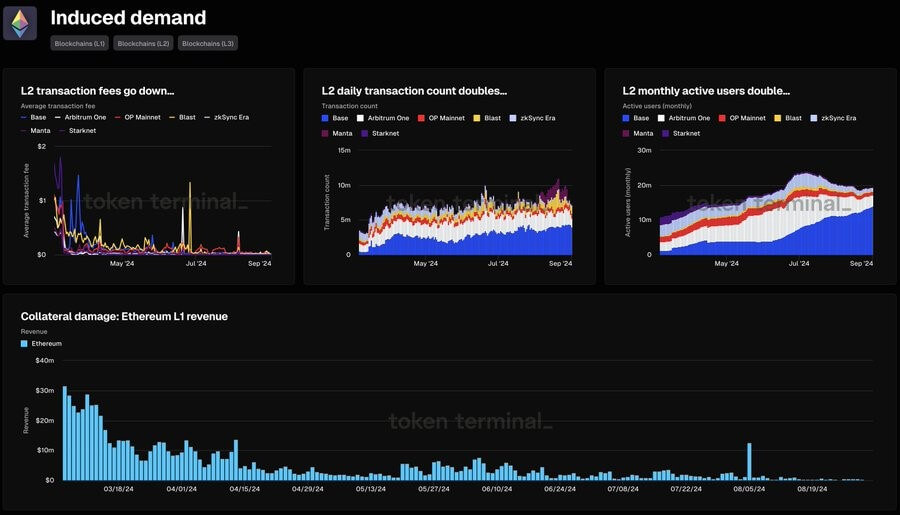

Ethereum’s Layer 1 community has seen a large decline in income, plummeting by 99% since March 2024.

In accordance with information from TokenTerminal, community income peaked at over $35 million on March 5. Nonetheless, by September 2, each day income had plummeted to an annual low of round $200,000.

Market observers attribute the decline to the expansion of Layer 2 (L2) networks and the Dencun improve in March, which decreased charges for L2 transactions and restructured Ethereum's income construction. Token Terminal said:

“A key indicator that decrease L2 transaction charges have elevated utilization, but in addition decreased L1 income.”

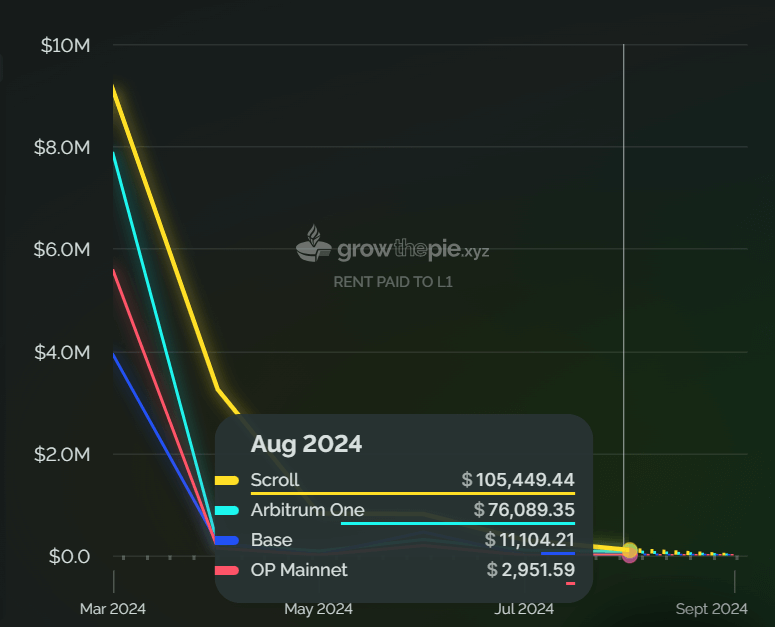

Following the improve, transaction exercise shifted from Ethereum’s mainnet to the L2 community, resulting in a rise in each day transactions and lively customers on these platforms.

Nonetheless, this transition has had a big affect on Ethereum’s payment revenues: for instance, Coinbase’s L2 community, Base, generated $2.5 million in income in August however paid out simply $11,000 for mainnet settlements, highlighting the shift in worth away from Ethereum’s base layer.

Crypto analyst Kun warned that if this pattern continues, L2 networks may dominate Ethereum mainnet, resulting in its abandonment, particularly in consumer-facing purposes. He careworn that Ethereum dangers dealing with severe valuation issues if it doesn’t develop worthwhile use circumstances on its mainnet.

He added:

“ETH L1 must have a worthwhile use case on mainnet that isn’t open to assault, in any other case we now have to hope for L2 utilization to be so giant that to basically get a small share of the identical worth we bought on mainnet, we would wish 100,000 occasions the utilization on L2, making a valley of valuation issues.”

“Demise Spiral”

Bitcoin investor Fred Krueger echoed these issues, suggesting that Ethereum may enter a “demise spiral” if weak earnings proceed.

He famous that Ethereum’s present payment income is $200,000 per day, which equates to $73 million per 12 months, hardly sufficient to maintain a market cap of $300 billion.

Krueger argued {that a} extra life like valuation could also be nearer to $3 billion, highlighting the disconnect between Ethereum’s payment earnings mannequin and market valuation.

“(Ethereum) just isn’t equal to an organization that makes $73 million a 12 months in earnings or an organization that makes $73 million a 12 months in income. That $73 million is Not Sufficient That is to purchase again all the naturally occurring inflation that happens amongst ETH validators.”

Talked about on this article

(Tag ToTranslate) Ethereum