- Ethereum dangers deeper losses when gross sales pressures push costs larger than their essential assist zones.

- On-chain knowledge suggests a possible accumulation of almost $1,886 and supplies non permanent assist.

- Worry-driven gross sales by long-term holders can create main accumulation alternatives.

Ethereum has fallen beneath its essential assist degree of $2,200, bolstering a bearish temper and triggering a warning of a possible decline to $1,250.

Well-known analyst Ali Martinez emphasizes that Ethereum’s breakdown from parallel channels reveals a possible decline to $1,250 if downward momentum continues.

After Ethereum fell to $1,840, analysts recognized key assist zones at $1,640 and $1,250. If gross sales pressures do not wander, ETH may plummet additional in direction of a $1,250 goal, a degree according to historic assist and Fibonacci’s retracement ranges.

Are you able to see the view?

In accordance with GlassNode, Ethereum’s cost-based distribution (CBD) has elevated from 1.6 million to 1.9 million ETH on the $1,886 degree. Elevated provide in sure worth ranges suggests potential accumulation by traders.

Along with blended alerts, customized yield metrics that combine CBD with realized loss knowledge spotlight the elevated yield stress available in the market. These metrics recommend that ETH can discover non permanent assist in about $1,886 earlier than figuring out its subsequent transfer.

Associated: ETH plunged to 13.40%, then whipped: $330 million in liquidation – Worth evaluation

Buy alternatives for long-term holders

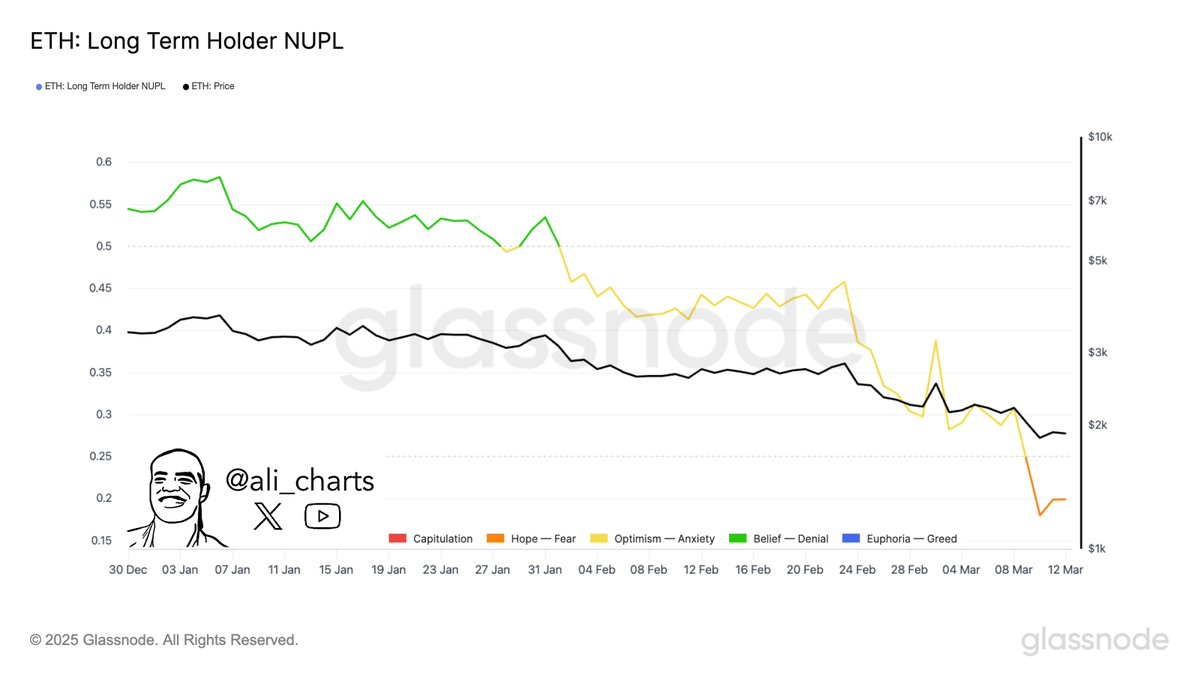

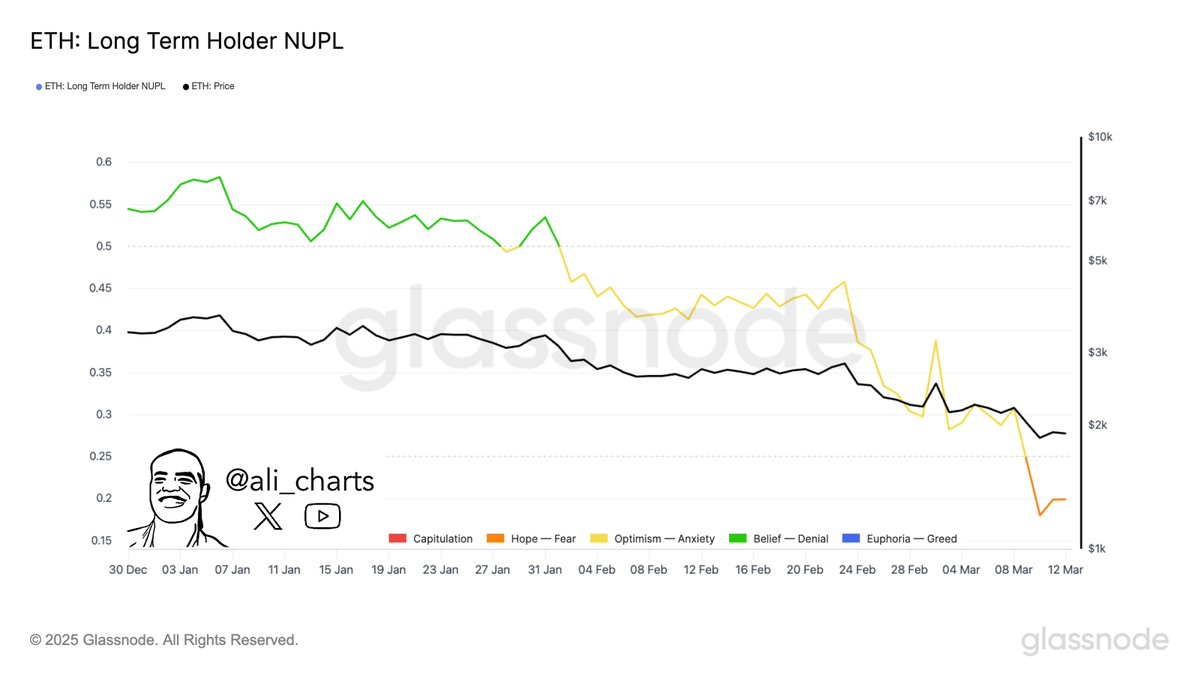

Ali Martinez additionally factors to Ethereum’s long-term holder web unrealized revenue/loss (NUPL) metrics. That is at present within the concern zone. This displays long-term traders abandon their holdings as ETH falls beneath $2,000.

Traditionally, such terror-driven gross sales have created main accumulation alternatives. As traders’ emotions change, Ethereum may expertise sturdy rebounds, reflecting previous restoration patterns. The query is, will enough patrons intervene to cease the bleeding?

Technical indicators verify bearish traits

As of press time, the value is at present at $1,930.19, a restoration of three.08% over the previous 24 hours, however general down 11.82% over the previous week.

The relative energy index (RSI) is 35.68, indicating that ETH is approaching its promoting state. This implies potential buy rights at a decrease degree, however short-term positive factors stay restricted with out the restoration of misplaced assist zones.

Associated: Ethereum (Eth) Change Exodus: 600,000 ETH withdrawal – A fast rise in potential costs for provide squeeze alerts

Ethereum’s MACD (shifting common convergence divergence) stays within the damaging area. The MACD line is at -209.5 beneath the sign line at -195.4, confirming the continued bearish momentum. Constructive modifications in these indicators are mandatory for reversal. Till then, merchants might want to monitor responses at these key assist ranges ($1,640 and $1,250).

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version shouldn’t be chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.