The Ethereum Basis (EF), the nonprofit group supporting the Ethereum blockchain ecosystem, has launched its 2024 annual report detailing monetary updates, Treasury holdings, and up to date coverage initiatives.

The report highlights the group's price range breakdown, latest spending, and new insurance policies designed to advertise transparency and integrity throughout the Ethereum ecosystem.

Owned by the Ministry of Finance

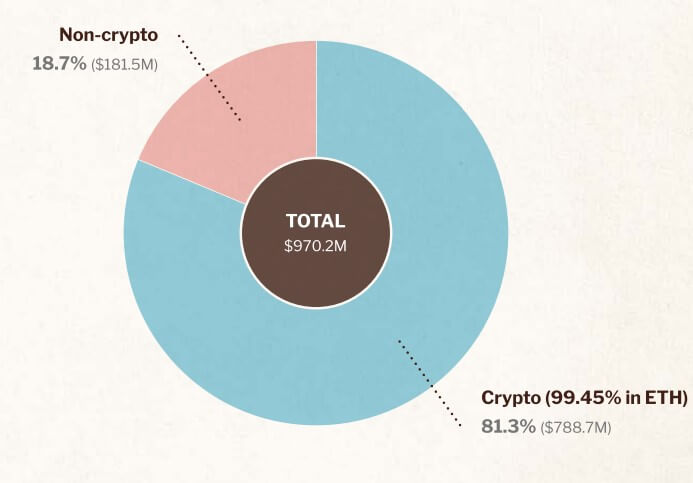

As of October 31, 2024, EF's whole treasury was roughly $970.2 million, together with $788.7 million in cryptocurrencies (primarily ETH) and $181.5 million in non-cryptocurrency investments. It turns into.

EF mentioned its ETH holdings represented roughly 0.26% of the full provide of Ethereum as of October thirty first. These massive ETH reserves replicate the Basis's confidence in Ethereum's long-term potential and its dedication to sustaining a robust presence inside the community.

EF has made it clear that its treasury serves because the monetary spine of essential tasks inside the Ethereum ecosystem. The Basis will periodically alternate a portion of its ETH holdings into fiat forex, particularly throughout market upswings, to make sure sufficient assets throughout market downturns.

Treasure trove of ecosystem

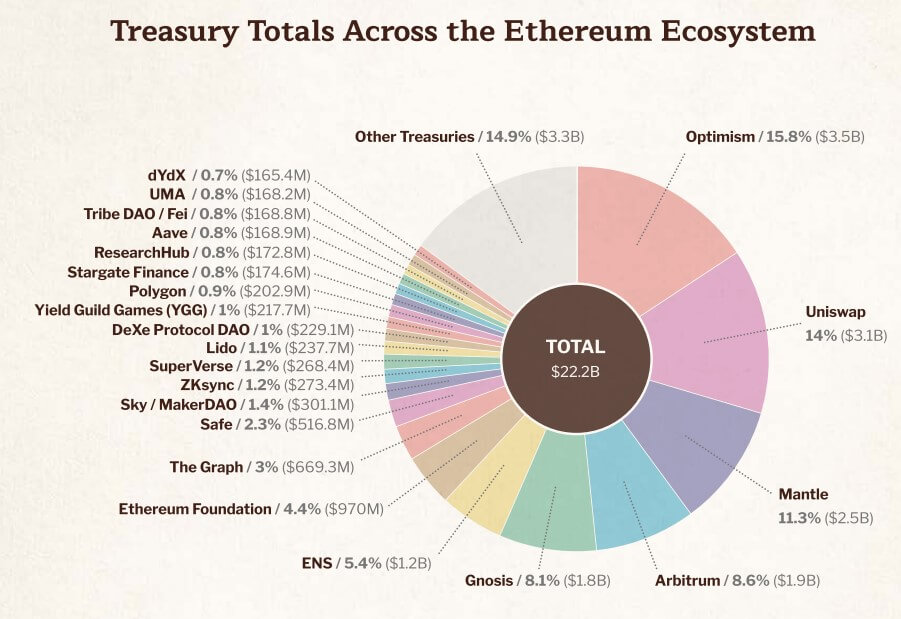

Along with EF's holdings, the Ethereum ecosystem advantages from monetary property totaling over $22 billion held by varied foundations, organizations, and DAOs.

The treasury primarily consists of native tokens of crypto tasks resembling dYdX, Aave, Polygon, The Graph, Optimism, Uniswap, Mantle, Arbitrum, Lido, Gnosis, and Ethereum Title Service.

The report highlights that even these small allocations from the Treasury will present vital assets to maintain and develop the Ethereum ecosystem in the long run.

Funding the ecosystem

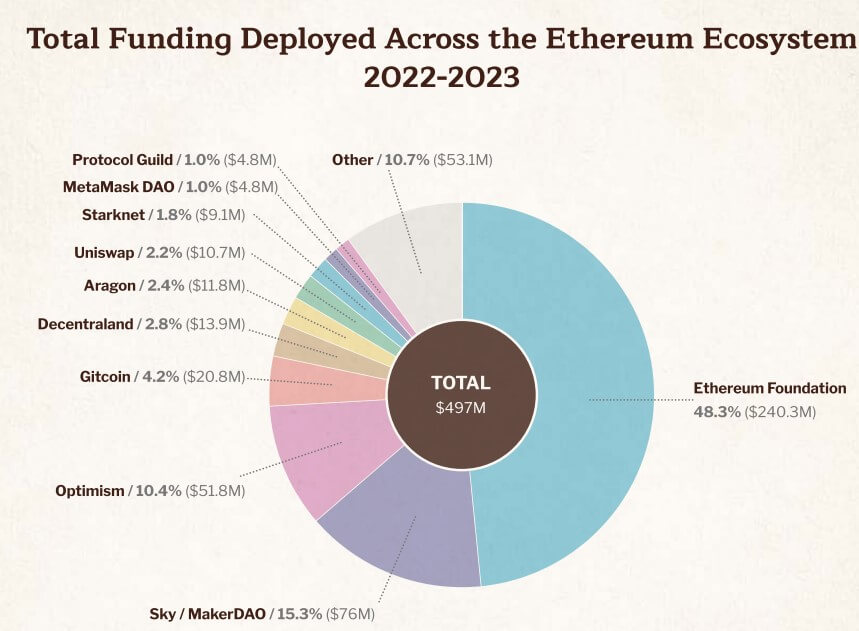

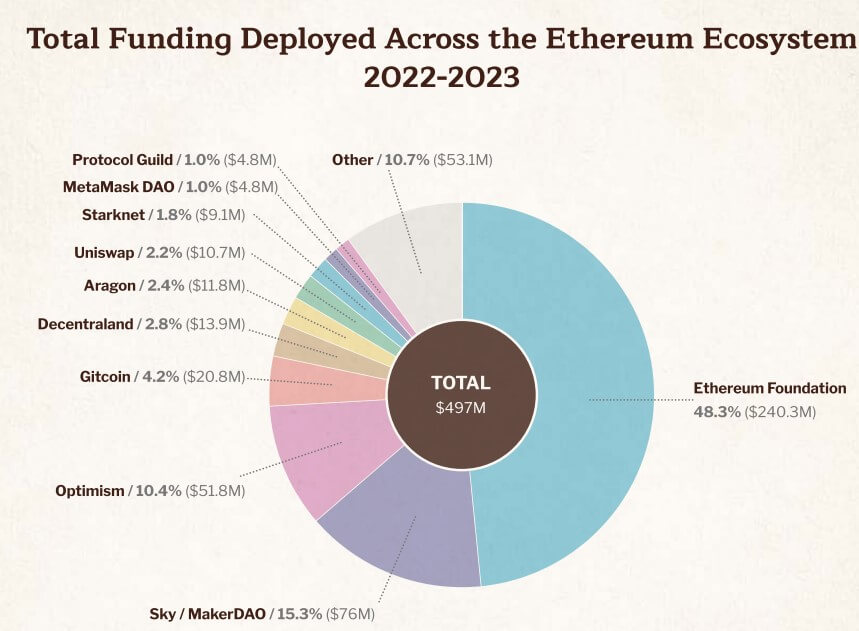

The Ethereum Basis and ecosystem companions have allotted practically $500 million to ecosystem tasks from 2022 to 2023.

EF contributed $240.3 million (48.3% of whole funding), with the remaining coming from organizations together with MakerDAO (renamed Sky), Optimism, Gitcoin, Decentraland, Aragon, Uniswap, Starknet, MetaMask DAO, and Protocol Guild. I acquired it.

This co-funding highlights the collaborative nature of the Ethereum ecosystem and drives innovation and assist for builders inside the neighborhood.

EF Director Aya Miyaguchi emphasised that this funding method is much like Ethereum's decentralized R&D course of, which fosters collaboration and resource-sharing tasks. She mentioned:

“We are able to say that ecosystem funding, like Ethereum’s analysis and improvement course of, is a collaborative effort at present and can assist builders throughout the Ethereum ecosystem discover extra avenues to proceed innovating. I'm pleased with that.”

Battle of curiosity coverage

To strengthen transparency, the Ethereum Basis has applied a battle of curiosity coverage that requires disclosure for investments over $500,000 (excluding ETH).

This coverage goals to stop potential conflicts between EF members by excluding them from associated choices if they’re uncovered to associated property. Miyaguchi defined that this transfer represents a step towards strengthening integrity inside EF and the broader Ethereum ecosystem.

That is particularly prescient on condition that Ethereum Basis researchers just lately got here beneath hearth for his or her advisory position in restaking the protocol EigenLayer.