The ETH/BTC ratio represents the relative energy of Ethereum (ETH) in opposition to Bitcoin (BTC). Since these two are the second largest cash by market capitalization and the second largest cryptocurrency ecosystem generally, it is smart to match their relationship to raised perceive the market. Monitoring the ETH/BTC ratio is essential because it displays market sentiment relating to ETH versus BTC. A rise within the ratio signifies that ETH is outperforming BTC, which signifies both confidence in ETH is growing or BTC worth is falling.

Whereas long-term holders could not pay a lot consideration to this ratio, lively merchants use it to resolve on buying and selling positions to benefit from volatility. Moreover, the ratio supplies a measure of the relative energy of ETH in opposition to BTC and may also help perceive shifts in market dominance which will result in volatility.

This week began off with a bang, with the ETH/BTC ratio exhibiting unbelievable volatility. The market is buzzing with hypothesis relating to the approval of spot Ethereum ETFs within the US. This prediction had a noticeable impression on the costs of ETH and BTC, and subsequently on the ratio.

For almost all of the previous 30 days, this ratio has remained comparatively steady, hovering round 0.0485 round April 24. On the time, each ETH and BTC noticed average worth fluctuations and no main divergences that might have brought on the ratio to rise.

The primary important improve on this ratio occurred round April 27, when it reached 0.0513. This correlates with a small improve in his ETH worth from $3,140 to $3,250. This rally elevated the ratio as a result of BTC was comparatively steady on the time. This rise continued till the top of April. Nevertheless, this constructive momentum led to Could when the ratio fell. It fell to 0.0451 on Could sixteenth, however then began to get better and rose to 0.0513 on Could twentieth. This sluggish and regular rise was almost vertical from Could twentieth to Could twenty first, peaking at round 0.0560.

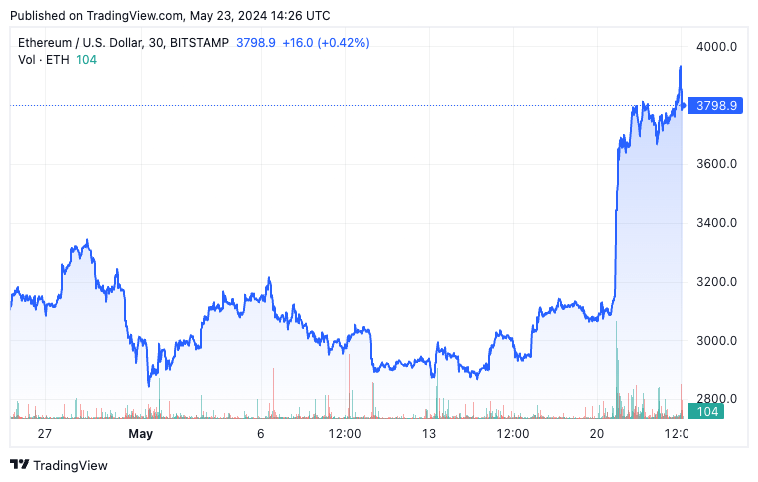

Bitcoin additionally noticed large worth actions on the time, reaching $71,400 on Could 20, however ETH noticed a a lot sharper surge, surpassing $3,790 on Could 21, correcting barely to $3,730 on Could 22, after which rising to $3,948 on Could 23, earlier than the choice on the Ethereum ETF was made.

Such a pointy improve within the ratio is no surprise as analysts have revised the likelihood of ETH ETF approval to 75% amid rumors of a probably favorable SEC stance. These rumors had been sufficient to spur hypothesis, as merchants stand to benefit from anticipated inflows into ETH following the ETF's approval.

The potential approval of the ETH ETF is a significant step in the direction of institutional adoption of Ethereum, just like the impression seen with the Bitcoin ETF. However U.S. regulators have struggled for years to resolve whether or not to categorise his ETH as a commodity or a safety, and approval of the ETH ETF would have a far better impression on the broader cryptocurrency market. It should have an effect on you. This outlook is driving ETH's rally, as seen within the tightening of Grayscale's Ethereum Belief low cost charge and elevated issuance of USDT on Ethereum in anticipation of ETFs.

The publish Ethereum ETF Rumors Will Driving a Dramatic Rise within the ETH/BTC Ratio appeared first on currencyjournals.