- If the worth closes above the $2,720 resistance, ETH may attain $3,000.

- The whale gathered $99.5 million price of ETH and borrowed extra.

- Ethereum’s TVL is growing, suggesting that ETH’s ATH may rise earlier than the top of 2024.

In accordance with Lookonchain, whales are accumulating Ethereum (ETH) and borrowing extra within the course of whereas opening lengthy positions in ETH. In accordance with the put up, the whale withdrew 39,900 ETH from Binance, Bybit, Bitfinex, and OKX since February 1st.

The whale then borrowed 56.8 million DAI from the lending platform Spark and altered its decentralized stablecoin to ETH.

ETH appears able to explode

Accumulating ETH on this scale and borrowing extra meant that individuals have been assured of a big value enhance. On the time of writing, ETH value was $2,661, up 14.35% prior to now 7 days.

This value enhance signifies that whales have made unrealized features on among the ETH they beforehand gathered. From February ninth to twelfth, ETH traded between $2,483 and $2,540. Nevertheless, the bulls have been capable of push the worth above the $2,600 resistance.

Wanting on the 4-hour chart, ETH may face new resistance round $2,720. Clearly above this, ETH may rise to $3,000. Nevertheless, if the altcoin fails to clear the trail, it may fall to the subsequent help close to the Fibonacci retracement stage at $0.786.

On this case, ETH may fall to $2,355. Nevertheless, indicators from the Shifting Common Convergence Divergence (MACD) indicated {that a} value crash is unlikely within the quick time period. It’s because the MACD confirmed a optimistic quantity.

ETH/USD 4-hour chart (Supply: TradingView)

Moreover, the 12-day EMA (blue) is above the 26-day EMA (orange), suggesting that the bulls have eliminated the bears from their means. If this place stays the identical, ETH value may rise additional whereas serving to the altcoin break by the $2,720 resistance.

Ethereum TVL hits yearly excessive

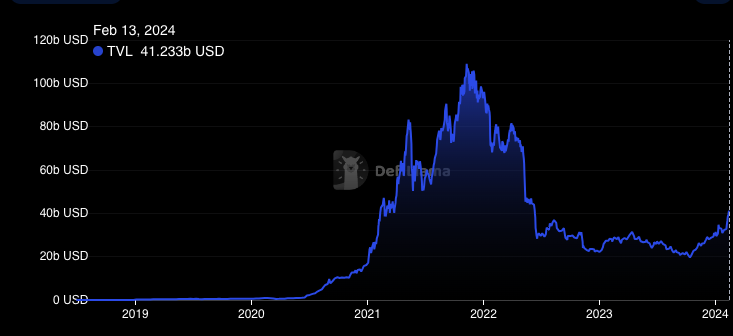

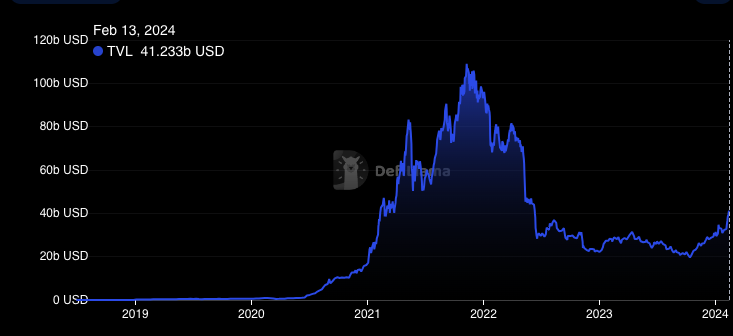

From an on-chain perspective, Ethereum’s Whole Worth Locked (TVL) can also be according to ETH’s value enhance. In accordance with DeFiLlama, Ethereum TVL elevated to $41.23 billion, marking the very best year-to-date (YTD) worth for the protocol.

TVL is a metric that signifies the general well being of your community. When this decreases, it means fewer belongings are staked or locked. If this have been true, it will even have implied that individuals didn’t belief Ethereum to generate sufficient income.

Ethereum TVL (Supply: DeFiLlama)

Nevertheless, the latest enhance in TVL suggests a surge in belongings being staked and locked on the blockchain. This means excessive utility of the community, which may have a optimistic impression on the worth of ETH.

Within the quick time period, ETH could attempt to take a look at $3,000. If that is profitable, the worth may head in the direction of $3,500. Furthermore, a brand new all-time excessive (ATH) for cryptocurrencies may emerge earlier than 2024 ends.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.

Comments are closed.