Right this moment’s Ethereum costs are buying and selling at $4,333 and are built-in close to the underside fringe of the downward channel. Merchants are weighing technical indicators, on-chain inflow and cycle-based breakout patterns towards the information that the Ethereum Basis will promote 10,000 ETH to fund ecosystem growth.

Ethereum Value retains channel help

The 1-hour chart exhibits ETH pinned throughout the falling channel since late August. Help stays clustered round $4,250-4,280, with repeated defenses stalling sellers. Overhead resistance is near $4,420 for 200-hour EMA. Clearing this threshold may trigger upward momentum in the direction of the subsequent provide zones on the chart: $4,600 and $4,700.

Associated: Cardano (ADA) Value Forecast: Analysts Predict $0.92 Breakout

The RSI measurements hover at about 49, indicating impartial momentum. Quick-term EMA alignment simply above spot stage retains gatherings down, whereas flattening momentum suggests sellers are dropping grip. The decisive push via $4,420 bangs the current construction.

Analysts spotlight historic breakout patterns

Widespread market strategist Mr. Crypto famous that Ethereum’s long-term cycles show a repeating breakout construction. His charts in contrast the 2017, 2020 and 2025 setups, every forming a tightening wedge earlier than breaking greater. “Each cycle performs the identical factor about Ethereum, and this time it isn’t totally different,” he mentioned in a put up on X.

The comparability has inspired optimism that ETH may very well be caught up in one other massive breakout, particularly if it clears the $4,600 barrier within the coming days. Cycle evaluation means that if historical past repeats itself, bigger gatherings may very well be prolonged to $5,000 later this yr.

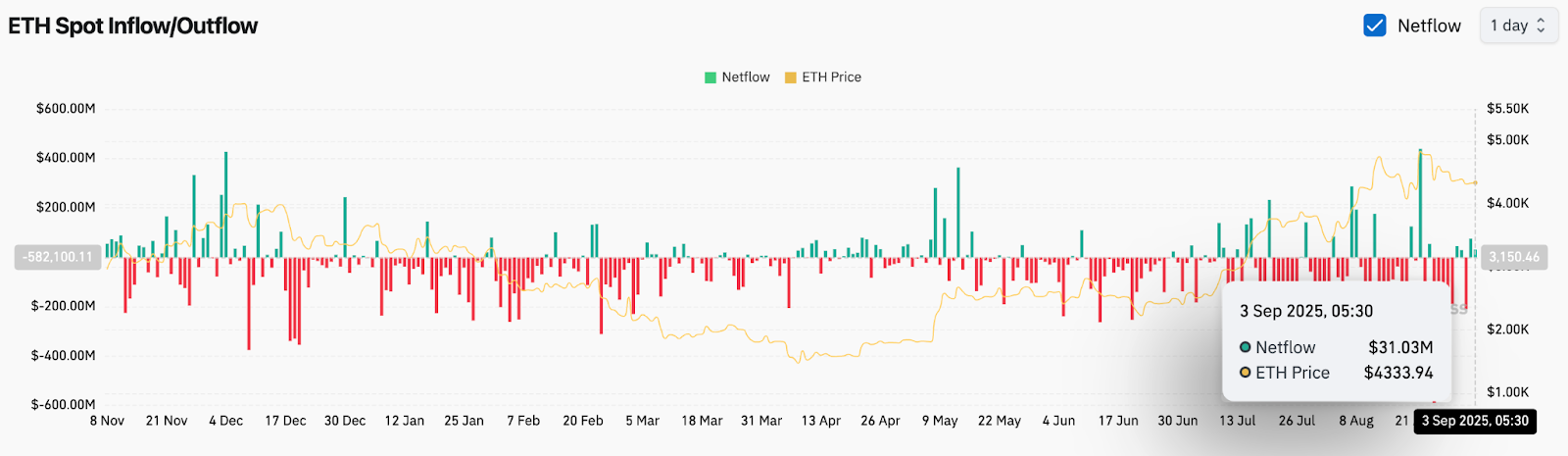

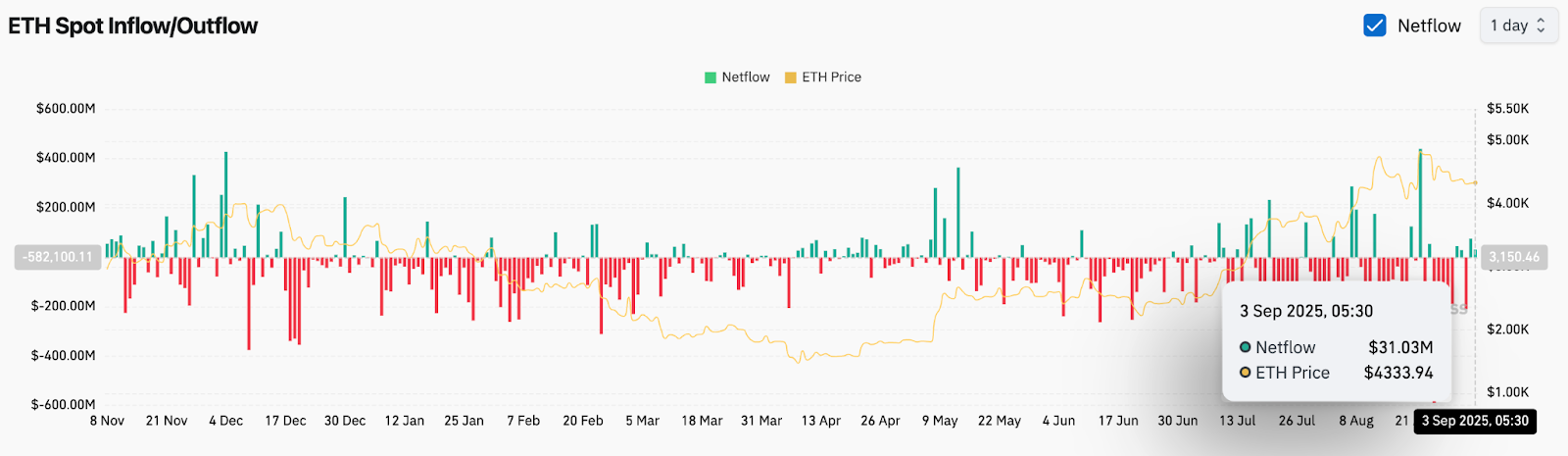

On-chain knowledge refers to contemporary inflow

Alternate knowledge confirmed a internet influx of $31 million on September 3, indicating an up to date accumulation at present ranges. This has been one of many greater day by day inflow since mid-August, suggesting that merchants are positioning for breakouts regardless of value consolidation.

The movement stays risky, with a heavy spill over a number of weeks all of the sudden turning right into a burst of purchases. Analysts level out {that a} sustained inflow of over $50 million is required to substantiate a conviction, however current picks present early proof to enhance feelings.

Associated: Solana (SOL) Value Prediction: Can the Bulls push $220?

Basis gross sales spark market debate

Information of the Ethereum Basis’s plans to promote 10,000 ETH, value round $43 million, are being launched fastidiously. The muse mentioned gross sales will step by step happen via central exchanges to fund analysis, grants and donations.

Whereas some merchants view gross sales as a bearish provide injection, others emphasize a comparatively modest dimension in comparison with day by day market quantity. The transfer follows an identical 10,000 ETH gross sales to Sharplink video games in July, highlighting the inspiration’s new monetary technique, which limits annual spending and prioritizes long-term reserves.

Technical outlook for Ethereum costs

ETH’s direct roadmap is positioned on the $4,250 help flooring and the $4,420 resistance ceiling. A clear break above $4,420 may invite momentum merchants concentrating on $4,600-$4,700 within the brief time period.

Failure to stick to $4,250 may expose your ETH to $4,100, and there’s a deeper threat in the direction of $3,900 when gross sales strain accelerates.

Associated: XRP (XRP) Value Forecast: Analyst Eye $3.60 Breakout

Outlook: Will Ethereum rise?

Ethereum’s short-term trajectory is dependent upon whether or not the bullish cycle narrative and rising inflow can offset considerations in regards to the basis’s gross sales. Analysts stay cautiously optimistic. So long as the ETH exceeds $4,250, the bias is leaning in the direction of rebound.

A breakout over $4,420 will bolster the lawsuit with a retest of $4,600 and $4,700, however dropping $4,250 may delay the papers within the bullish cycle. For now, ETH stays on the key fork that determines the subsequent leg, with technical compression, institutional movement and basic choices.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version just isn’t answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.