- ETH maintains a stable short-term uptrend as patrons maintain tight to the rising assist zone.

- Futures open curiosity has been steadily rising, indicating elevated dedication from merchants on the rally.

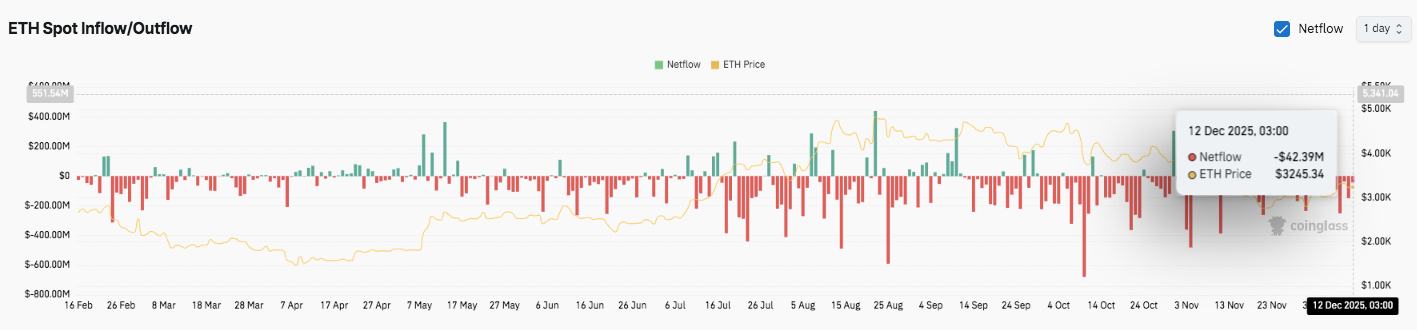

- The outflow of spot exchanges continues, decreasing promoting stress and tightening Ethereum provide.

Ethereum continues to point out regular resilience on the 4-hour chart as patrons defend the upper value zone. The asset is buying and selling round $3,250 after rebounding sharply from late November lows round $2,625. Importantly, the worth motion is outpacing the short-term common enhance, reinforcing the constructive development construction.

Along with regaining momentum, Ethereum is presently approaching a key technical degree that would outline its subsequent directional transfer. Market individuals are carefully monitoring whether or not the bullish stress persists as the worth assessments the overhead resistance zone.

Ethereum 4H development construction sign suppresses upside

Ethereum has maintained a sequence of distinct lows, confirming a sustained short-term uptrend. Moreover, the worth has regained its 20, 50, and 100 interval exponential transferring averages, which are actually appearing as dynamic assist. This variation means that patrons are sustaining management through the pullback.

Nonetheless, value is approaching the Fibonacci resistance cluster that traditionally attracts provide. Consequently, short-term consolidation could happen earlier than continuation. Nonetheless, the development construction stays intact so long as ETH stays above the $3,120 space.

The principle resistance degree lies between $3,280 and $3,300, which was beforehand aggressively defended by sellers. Moreover, a break above this zone may pave the best way to $3,440 alongside the 0.5 Fibonacci retracement.

Associated: Shiba Inu value prediction: Shiba Inu value stalls as technological pressures counteract ecosystem…

Past that, the $3,630 degree represents an essential continuation threshold. Subsequently, a decisive breakout may speed up the upward momentum in the direction of the $3,900 space.

Futures open curiosity displays elevated market dedication

Ethereum futures knowledge exhibits a gradual enhance in open curiosity, highlighting rising participation in derivatives. Open curiosity elevated constantly all through 2024 and accelerated through the current rally. Importantly, ranges stay elevated through the correction section.

This habits means that merchants are sustaining publicity quite than actively exiting positions. Moreover, the most recent studying of practically $41 billion displays sturdy speculative involvement as ETH trades above key psychological ranges. Consequently, value reactions close to assist or resistance can grow to be sharper as leverage will increase.

Spot flows point out tight change provide

Spot change knowledge exhibits continued web outflows, suggesting a decline in promoting stress. Latest periods have been dominated by crimson outflow bars, indicating continued withdrawals to personal wallets.

Moreover, inflows seem like small and rare, suggesting restricted distribution at present costs. Particularly, the surge in outflows coincides with value stability, reinforcing a holding-driven market surroundings. Based on the most recent knowledge, ETH is buying and selling at round $3,245, whereas web outflows are round $43 million.

Technical outlook for Ethereum (ETH) value

Ethereum’s technical construction stays constructive as value stays above key short-term assist ranges. ETH continues to commerce inside the formation of highs and lows, reflecting secure demand after the rally in late November.

Associated: Basic Featured Token Worth Prediction: BAT Stays Bullish Construction As Merchants Flock

The upside degree stays well-defined, with $3,280-$3,300 serving as a direct resistance zone. If a breakout above this vary is confirmed, it may open the door to $3,440 after which $3,630, which matches the 0.618 Fibonacci retracement. Past that, $3,905 turns into a significant barrier to upside.

On the draw back, supported by the rising EMA, $3,150-$3,120 stays the primary space patrons want to guard. Dropping this zone may expose ETH to the psychological degree of $3,000. Under that, $2,875 to $2,900 represents the earlier vary breakdown space, however $2,625 stays the broader development invalidation degree.

The technical state of affairs means that Ethereum is consolidating beneath resistance quite than exhibiting depletion. Compression close to the higher sure usually precedes an enlargement in volatility. Subsequently, directional affirmation will depend upon how the worth reacts round $3,300.

Will Ethereum rise additional?

Ethereum’s near-term outlook depends upon whether or not it could maintain above $3,120 whereas establishing acceptance close to resistance. Robust participation in derivatives and sustained spot outflows verify tight provide. Consequently, a clear break above $3,300 may proceed in the direction of increased Fibonacci targets.

Nonetheless, failure to guard the EMA assist may result in a managed decline in the direction of $3,000 earlier than renewed shopping for curiosity emerges. For now, Ethereum stays in a key inflection zone, the place affirmation will form its subsequent large transfer.

Associated: Bitcoin Worth Prediction: Symmetrical Triangle Tight as Bulls Stay Alert After $77M ETF Outflow

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.