- ETH has been correlated with BTC’s actions as quick shares have acquired a big sweep from their positions.

- With the 20EMA breaking under the 50EMA, ETH could not be capable of override the promoting strain.

- The funding charge is optimistic, indicating broad bullish sentiment and potential high-end threat.

Over $25 million in Ethereum (ETH) positions have been liquidated within the final 24 hours. Coinglass additionally revealed that merchants with quick positions accounted for the most important proportion of the victims.

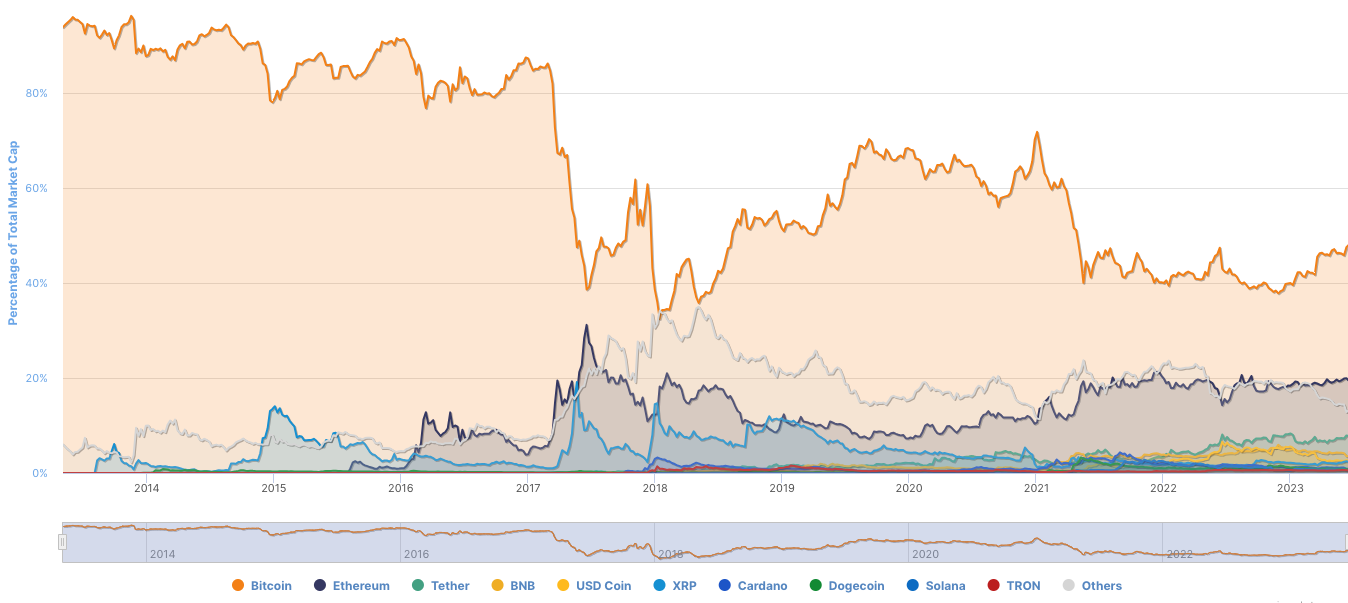

This is because of ETH rising 5% to $1,814, the final time it hit this degree two weeks in the past. This value enhance may come as a shock to merchants, particularly because the present market situations are tilting in the direction of Bitcoin (BTC)’s 50% dominance.

In the meantime, Ethereum held a 19.42% lead, in keeping with Coinmarketcap. Normally, this implies that the altcoin could have issue outperforming his BTC. Due to this fact, seeing ETH correlated with the motion of BTC could have perplexed market contributors.

Drained Consumers May Drive ETH Down

One of many causes ETH was in a position to cross the $1,800 mark was the bullish push fashioned at $1,650 on June fifteenth.

Since then, costs have risen persistently, though purchaser hunger seems to have emerged now and again. Sluggish demand briefly halted value will increase at $1,748.

Regardless of being pushed upwards, the chance nonetheless existed for ETH to return to bearish territory. On the time of writing, the 20-day EMA (blue) is under the 50-day EMA (yellow).

Due to this fact, it could be unlikely that costs will rise once more within the quick time period. And if promoting strain seems to outweigh shopping for momentum, ETH may lose its dominance within the $1,800 area.

One more reason why altcoins are unable to maintain value will increase is the Directional Motion Index (DMI). On the time of this writing, +DMI (blue) and -DMI (orange) had been 21.79 and 23.41 respectively.

Such shut values indicated that management of the market was nonetheless not totally break up between consumers and sellers.

Longs dominate the market

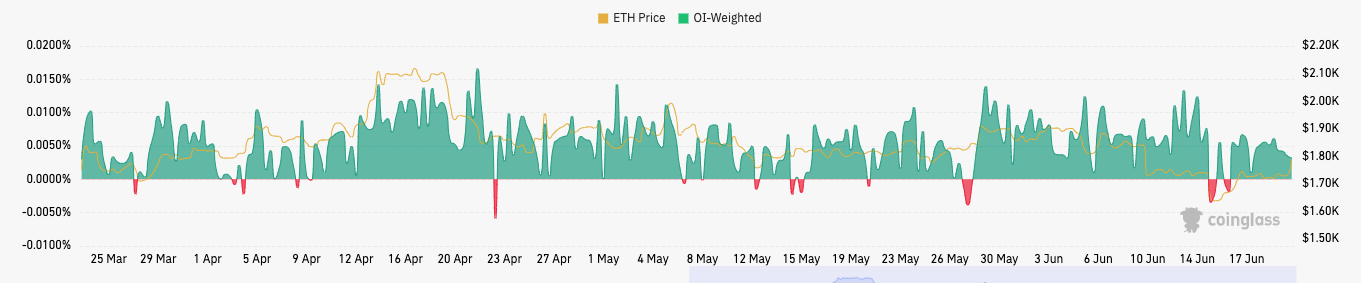

On the derivatives market facet, Coinglass confirmed a weighted funding charge of 0.0032%. To clarify, the funding charge is meant to carefully comply with the spot value on which the perpetual contract value is predicated.

ETH’s optimistic funding charge normally signifies that longs pay funding charges to shorts whereas supporting a bullish bias. Conversely, if the funding charge is adverse, the shorts pays the longs to take care of their bearish positions.

Because it stands, the funding charge additionally factors to a possible all-time excessive. However this could solely occur if merchants stay grasping.

Due to this fact, the upside potential of ETH remains to be questionable. But when the market as a complete decides to copy Q1’s breakthrough, one other spherical of short-term liquidation may emerge.

Disclaimer: The views, opinions and knowledge shared on this value forecast are printed in good religion. Readers ought to do their analysis and due diligence. Readers are strictly accountable for their very own actions. Coin Version and its associates are usually not accountable for any direct or oblique damages or losses.

Comments are closed.