- Ethereum Worth trades almost $4,031 right now after falling beneath the $4,239-$4,360 EMA help cluster.

- The online movement of $175 million is worthwhile, however the change stability drops to a nine-year low at 14.8m ETH.

- Lengthy-term provide squeezes help bullish papers with rising targets of $4,712 and $5,000.

Right now, Ethereum costs are buying and selling almost $4,031, slipping virtually 3% after dropping a help cluster of $4,239 to $4,360. Though the failure controls the vendor, the pattern of shrinking substitute provide and long-term accumulation means that the downsides could also be restricted.

Ethereum costs are beneath EMA help

The Ethereum Each day Chart exhibits that ETH is beneath the 20- and 50-day EMA. That is at present serving as a resistance near $4,239 and $4,360. Costs additionally immersed beneath the ascending trendlines that supported gatherings from July onwards, confirming modifications in momentum.

The subsequent main help is round $3,850, with a 100-day EMA per earlier demand zones. If this degree fails, a deeper loss to $3,392, a 200-day EMA might unfold. The benefit is that patrons might want to regain $4,239-$4,360 to reestablish bullish momentum, with a $4,712 and $5,000 resistance goal remaining.

Associated: XRP Worth Forecast: Can SEC ETF approvals trigger rebounds above $3?

The momentum indicators maintain bearish. The parabolic SAR outweighs worth motion, however the RSI slips in direction of the impartial realm, indicating that the Bulls have misplaced management after months of highs.

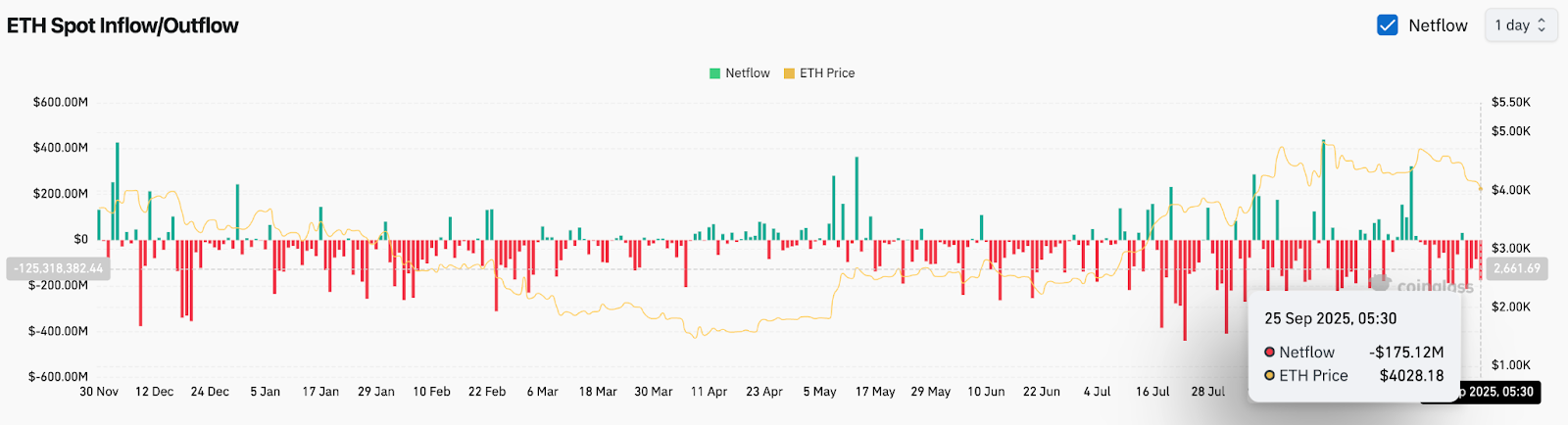

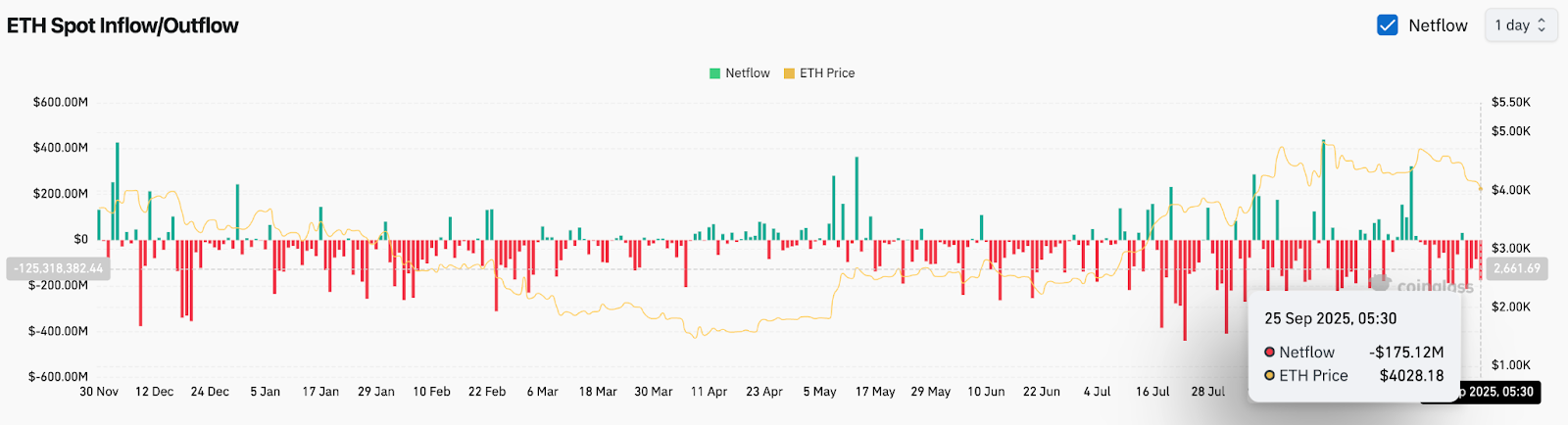

On-chain movement signifies heavy movement

Alternate movement information highlights up to date gross sales stress. ETH recorded a internet spill of $175 million on September twenty fifth, working with pullbacks from the $4,200 degree. Persistent redprints on Netflow charts throughout September mirror rising change deposits and earnings.

Nonetheless, the broader pictures stay constructive. In accordance with GlassNode, the change’s Ethereum Provide highlights its long-term accumulation pattern, falling to its nine-year low at 14.8 million ETH. A discount within the liquid provide usually serves as a cushion in opposition to expanded drawbacks, even when the current movement is unfavorable.

Decreasing provide strengthens bullish narratives

The structural decline within the change’s ETH stability signifies an rising variety of traders’ convictions. Gross sales stress from centralized venues is on the weakest level since 2016, as extra ETH are trapped in staking contracts, debt protocols and long-term wallets.

Associated: Bitcoin Worth Forecast: BTC holds $111K as ETF Demand and Company Buy Absorbed Provide

This tight provide narrative goes via a cycle by which Ethereum’s decreased availability coincides with a speedy rebound. Analysts recommend that after the influx is secure, ETH can regain traction and revisit the $4,600-$5,000 resistance band later this 12 months.

Technical outlook for Ethereum costs

Quick-term Ethereum worth forecasts spotlight essential ranges of play.

- Upside Goal: If patrons regain momentum, they are going to be $4,239, $4,360, and $4,712. Past this, $5,000 stays at breakout degree.

- The chance of drawbacks: $3,850 for fast help, adopted by $3,392 for deeper protection zones.

- Pattern Context: The long-term uptrend is above the 200-day EMA, however the short-term construction is beneath stress.

Outlook: Will Ethereum rise?

Ethereum’s fast trajectory is dependent upon whether or not patrons are capable of defend their $3,850 help flooring after dropping an EMA cluster that’s near $4,239. On-chain information indicators accumulation regardless of momentary spills, however change balances collide with multi-year lows, including weight to bullish long-term papers.

If ETH can recuperate past $4,360, momentum merchants could goal $4,712 and $5,000 within the coming weeks. Nonetheless, should you do not personal $3,850, the modification could possibly be prolonged to $3,392 earlier than making an attempt a rebound. For now, Ethereum stays within the corrective part inside the wider bull cycle.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version isn’t chargeable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.