- Ethereum Value holds $4,500 in help as patrons defend themselves from repeated assessments of resistance partitions starting from $4,800 to $4,880.

- Analysts spotlight the potential for a supercycle that may deliver the institutional accumulation and Q3 again with gasoline and refueling momentum.

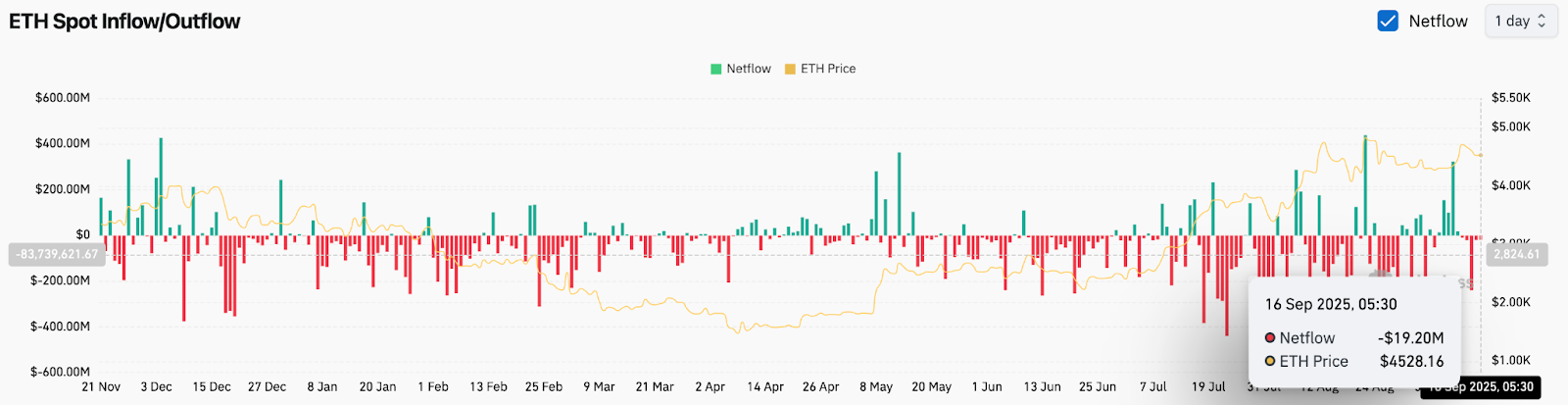

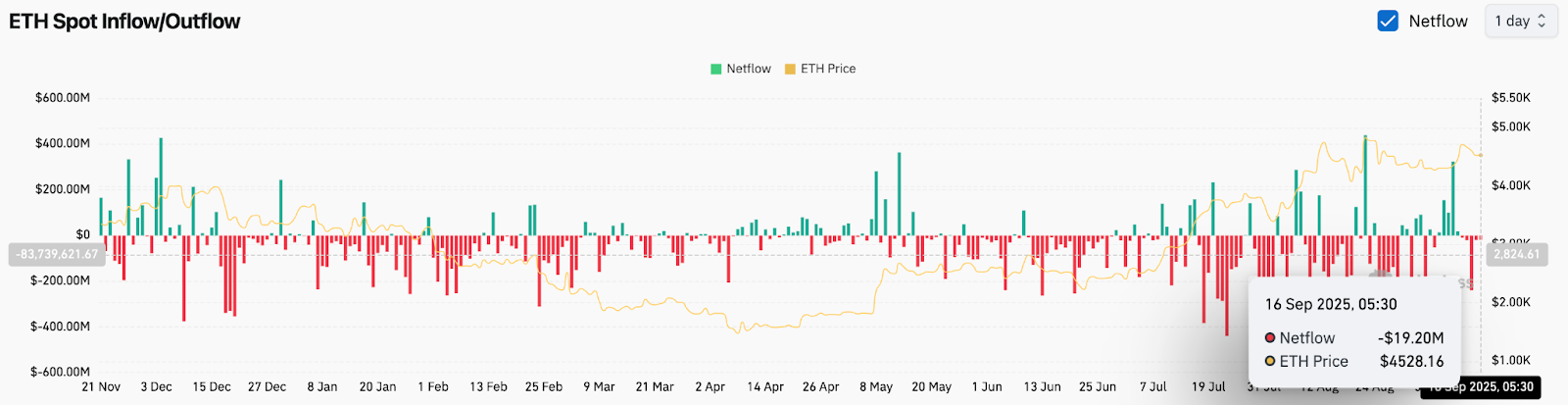

- On-chain information exhibits a internet outflow of $19.2 million, strengthening provide squeezes to help bullish circumstances above $4,500.

In the present day’s Ethereum costs are buying and selling almost $4,528, and are steady after a pointy pullback from final week’s $4,800 take a look at. Consumers proceed to defend the $4,500 zone, however the market now faces a crucial barrier between $4,800 and $4,880. Analysts argue that this clear break above the wall may unleash the following stage of the rally.

Ethereum Value defends $4,500 in help

The 4-hour chart exhibits ETH that consolidates ETH above $4,500 after testing a low of almost $4,493 right now. The $4,512 20 Emma and $4,462 50 Emma strengthened the ground and have become quick help. The obstacles right here may expose ETH to 200 Emmas for $4,350, the place the broader bullish construction would face the primary main take a look at.

Associated: Cardano (ADA) worth forecast for September seventeenth

Overhead, resistance stacks between $4,800 and $4,880. The zone has rejected costs many instances and now represents a gateway to larger progress. Clearing it opens the best way to $5,000, adopted by the following main provide space: $5,120.

At present, parabolic SARs replicate short-term bear pressures past spot ranges. Nevertheless, so long as the ETH is above $4,500, the momentum will stay constructive and can preserve the bullish cycle intact.

Analysts spotlight the potential of a supercycle

Market sentiment has develop into significantly bullish after Tomley, chairman of the $9 billion Bit Mine Immersion (BMNR), stated he was including Ethereum publicity. “Ethereum is within the supercycle,” Lee stated, suggesting structural drivers, reminiscent of institutional adoption and provide constraints, may lengthen the gathering.

That is in step with the broader analyst commentary pointing at $4,880 as an necessary inflection level. In the event that they violate, many anticipate that ETH couldn’t solely revive its report excessive, but in addition speed up in direction of new cycle targets.

Associated: XRP (XRP) Value Forecast for September seventeenth

Including gasoline, Crypto Rover identified that the Q3 2025 marked Ethereum’s highest quarter with a return of 84.3% on report. Such a historic efficiency referred to as for ETH to increase to $10,000 if momentum lasted within the fourth quarter.

On-chain circulation signifies provide drainage

Spot change information highlights bullish papers. ETH continued its a number of weekly development of cash leaving the change, recording a internet outflow of $19.2 million on September sixteenth. Persistent destructive Netflows point out a drop in sell-side strain because the tokens transition to chilly storage or institutional custody.

This provide squeeze was a dependable tailbone throughout traditionally sturdy gatherings. Until the circulation is reversed to a big inflow, present drains counsel that patrons will proceed to regulate the broader tendencies.

Technical outlook for Ethereum costs

The quick roadmap facilities round $4,500 in help and $4,800 in resistance. As soon as above $4,500, the bullish bias continues, with the targets being $4,880 and $5,000. A clear breakout there may spark momentum to $5,120, and will attain $5,300 if the acquisition accelerates.

Associated: Bitcoin (BTC) Value Prediction for September seventeenth

On the draw back, shedding $4,500 dangers a retest of $4,350. A break under this degree marked a change within the short-term construction, exposing ETH to $4,200, and the client lastly gave a powerful protection.

Outlook: Will Ethereum rise?

Ethereum costs right now replicate the consolidated market, with technical compression buildings beneath the primary boundaries of resistance. Analysts are bullish on the mix of destructive internet circulation, sturdy quarterly returns, and facility accumulation.

So long as the ETH exceeds $4,500, the likelihood is supported by one other try at $4,880. A profitable breakout will can help you study your supercycle paper and set the stage for a push to over $5,000. Nevertheless, if you happen to do not preserve help, you decelerate the bullish narrative and danger deeper corrections to the $4,200 zone.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version shouldn’t be chargeable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.