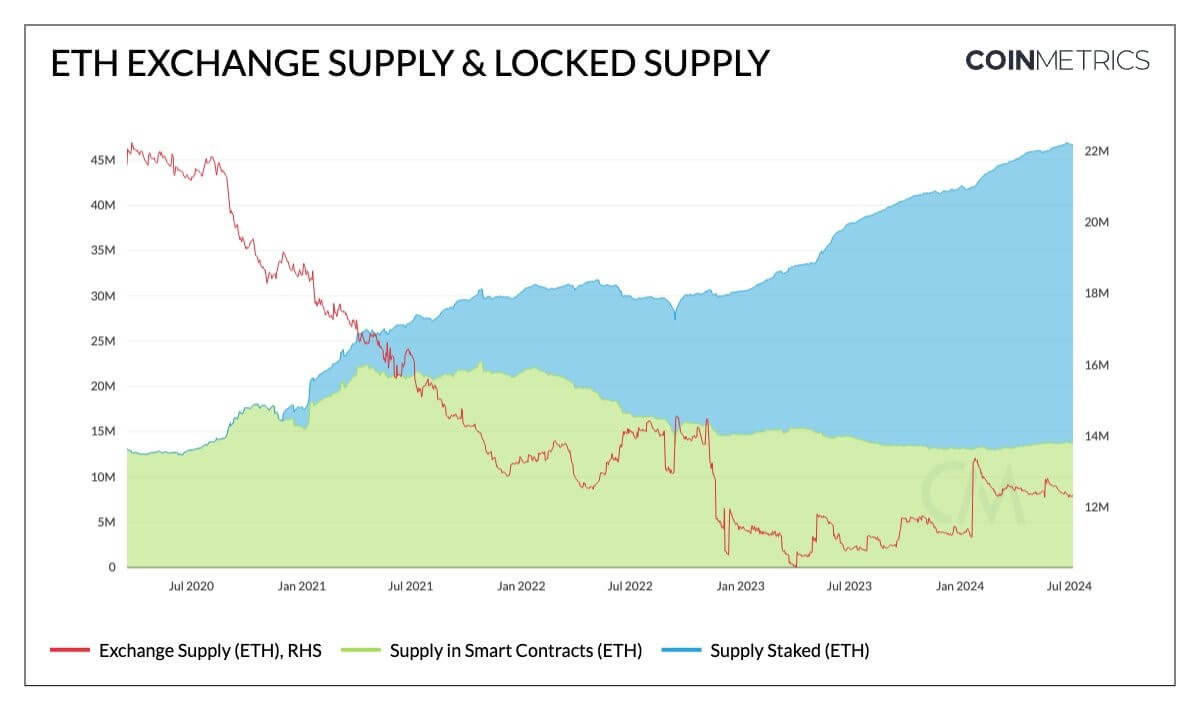

Round 40% of the Ethereum provide has been locked up because the market anticipates the ultimate approval of an ETH spot-based exchange-traded fund (ETF).

Breaking down this “locked provide,” information from Dune Analytics reveals that greater than 33 million ETH is staked on the community, which represents roughly 28% of Ethereum's whole provide.

Proof-of-Stake networks like Ethereum require customers to “lock up” digital belongings to assist safety and operations, and obtain rewards in return.

Moreover, 12% of the provision is locked in sensible contracts and bridges, which have seen a surge in adoption not too long ago: AJ Warner, chief technique officer at Offchain Labs, for instance, famous that ETH within the Arbitrum One bridge has grown steadily over the previous three years.

Market observers count on this important ETH lockup and the approaching ETF approval to drive ETH costs larger. Tom Dunleavy, managing associate at MV Capital, famous that the approval of a spot Ethereum ETF would have a serious impression in the marketplace. He stated:

“Spot ETH ETF flows will transfer this market shortly.”

ETF Approval

In the meantime, hopes proceed to develop over the ultimate approval of a spot Ethereum ETF in america.

On July 9, Bitwise Chief Industrial Officer Katherine Dowling stated the ETF is near approval, noting that the Securities and Trade Fee (SEC) is barely addressing just a few remaining points.

Dowling steered the merchandise may very well be accredited as quickly because the summer season, a view echoed by Bloomberg ETF analyst James Seifert.

Whereas Seifert wasn't assured in predicting an actual launch date, he speculated that approval might come by the top of the month.

“At this level I don't have a lot confidence in predicting these launch dates. There isn’t a deadline and the SEC's Corp Fin is taking its time right here (I don't blame them). However these adjustments are very minimal and I don't see why the ETFs can't be prepared inside two weeks.”

In the meantime, crypto bettors at Polymarkets predict that there’s an 87% probability that the product will likely be launched by the top of this month and listed on exchanges by July 26.