- Ethereum’s RSI is at 38.49, suggesting a attainable oversold state which, if confirmed by different indicators, suggests the value might flip round.

- Blended sentiment within the Ethereum derivatives market signifies a decline in open curiosity and a rise in choices buying and selling quantity.

- Massive holders management 89% of Ethereum provide, which may result in potential volatility if a serious sell-off happens available in the market.

Based on new evaluation by CryptoQuant, Ethereum's realized value has remained secure regardless of the market experiencing vital declines over the previous 5 months. This value stage has traditionally acted as robust assist, and when Ethereum performs above it, it usually alerts the beginning of an altcoin bull run. Merchants are intently watching these tendencies for indicators of an upswing.

At present, Ethereum value is $2,500.09 with a 24-hour buying and selling quantity of $13.78 billion. It’s down 2.37% within the final 24 hours with a market cap of $300.76 billion. There are roughly 120.3 million ETH cash in circulation.

The relative power index (RSI) on the every day chart is at 38.49, suggesting that Ethereum is oversold and a value reversal is feasible. Merchants are monitoring different technical indicators and market situations to verify the underlying pattern earlier than making any buying and selling selections.

Furthermore, Ethereum’s Transferring Common Convergence Divergence (MACD) indicator is barely above its sign line, suggesting a possible bullish pattern. This technical setup may current a shopping for alternative for merchants seeking to reap the benefits of a future value upswing.

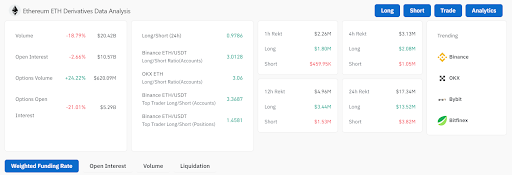

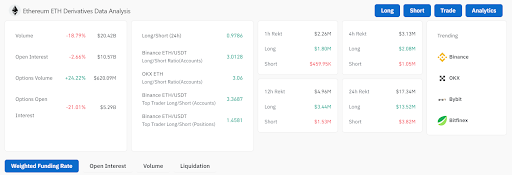

Nevertheless, sentiment within the Ethereum derivatives market is combined, with latest knowledge displaying buying and selling quantity declining 18.79% to $20.42 billion, whereas open curiosity additionally fell 2.66% to $10.57 billion, reflecting cautious market exercise.

In the meantime, choices buying and selling grew, with buying and selling quantity surging 24.22% to $620.09 million. Nevertheless, choices open curiosity fell 21.01% to $5.29 billion. The lengthy/brief ratio signifies a slight predominance in shorts total, though exchanges reminiscent of Binance and OKX present a powerful lengthy bias.

Whole liquidation up to now 24 hours was $17.34 million, of which $13.52 million was from lengthy positions. Regardless of these notable lengthy liquidations, merchants on main platforms stay bullish, with exchanges reminiscent of Binance and OKX enjoying a key position in Ethereum derivatives buying and selling.

A better take a look at Ethereum market tendencies highlights the difficult market situations, with solely 8% of holders at present in earnings and 71% in losses. Massive holders account for 89% of Ethereum possession, suggesting potential volatility may happen if these holders resolve to promote.

Moreover, the correlation coefficient between Ethereum and Bitcoin is excessive at 0.73, indicating that Ethereum value actions usually transfer in tandem with Bitcoin. The vast majority of Ethereum holders (64%) have been holding for 1-12 months, whereas 35% are new buyers.

Excessive worth transactions above $100,000 reached $3.6 billion final week, indicating robust curiosity from excessive internet value people, and internet inflows to exchanges reached $1.86 million, indicating lively buying and selling exercise. Geographically, buying and selling participation is balanced with 52% from the West and 48% from the East.

Disclaimer: The data introduced on this article is for informational and academic functions solely. This text doesn’t represent any form of monetary recommendation or counsel. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to our firm.