- Ethereum consolidates close to key EMAs as merchants anticipate breakout affirmation

- Elevated open curiosity and forex outflows counsel a powerful accumulation section

- Developer tensions spotlight governance challenges amid scalability ambitions

Ethereum (ETH) is exhibiting renewed volatility as merchants deal with developments in each value compression and tensions inside the neighborhood. After failing to take care of momentum above the Fibonacci resistance at $4,254, ETH has entered a correction section and is consolidating under the important thing exponential transferring common (EMA). The 20-EMA at $3,947, 50-EMA at $3,987, and 100-EMA at $4,075 presently type key resistance zones that restrict any upside restoration. The general pattern stays cautious as market sentiment shifts amid elevated derivatives buying and selling and developer dissonance.

Pricing consolidation and key assist ranges

The 4-hour chart reveals that Ethereum’s value construction is tightening between the 0.382 Fibonacci degree at $3,943 and the 0.236 retracement round $3,750. This compression displays a short-term accumulation zone the place merchants anticipate directional affirmation. If the worth closes under $3,850, ETH might be uncovered to even larger losses in the direction of $3,750 and even the latest native low of $3,439.

Nevertheless, if patrons defend the $3,850 to $3,900 space, the primary resistance problem lies at $4,075, matching the 100-EMA. A decisive break above the 200-EMA at $4,166 would sign a reversal and open the best way to $4,254 and $4,476.

Associated: Bitcoin Worth Prediction: BlackRock Promoting Challenges Bullish Sentiment

Subsequently, ETH’s subsequent transfer will rely on whether or not it may maintain above $3,850. The zone between $3,400 and $3,450 stays a security web if promoting strain intensifies. The upper timeframe assist at $3,750 will proceed to draw patrons hoping for a rebound, particularly if Bitcoin stabilizes above $108,000.

Futures market reveals robust participation

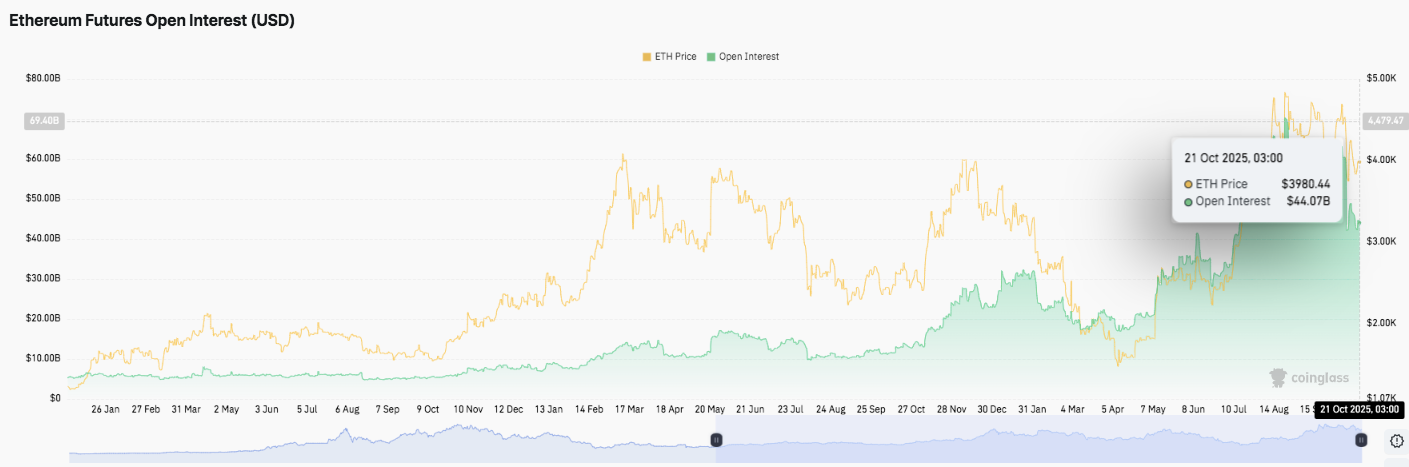

Importantly, Ethereum futures open curiosity greater than doubled in 2025, reaching over $44 billion by mid-October. This progress signifies lively participation of merchants and capital inflows.

The correlation between open curiosity and spot costs suggests elevated speculative demand forward of huge value actions. Sustained progress in each indicators displays renewed confidence amongst institutional traders and will set off a interval of elevated volatility as merchants place for a breakout.

On-chain outflow sign accumulation

Moreover, October was dominated by spot Ethereum outflows, with almost $97.6 million leaving the alternate on October twenty first. These constant outflows counsel that traders are transferring property into self-custody or staking, suggesting that provide on exchanges is reducing. Traditionally, such a sample precedes a medium-term restoration as soon as gross sales stabilize.

Amid these market adjustments, Ethereum’s management faces inside tensions. Core developer Péter Szilágyi just lately accused founder Vitalik Buterin and his internal circle of getting an excessive amount of management over the community’s selections.

Associated: Cardano Worth Prediction: ADA faces vary strain as momentum cools

In response, Buterin acknowledged the challenges whereas praising Polygon’s position in driving Ethereum’s scalability. Analysts consider the continuing discussions spotlight the rising strain inside the Ethereum ecosystem, which is concentrating on a 10x scalability milestone inside a 12 months.

Technical outlook for Ethereum (ETH) value

As Ethereum enters its subsequent consolidation section, the important thing ranges stay clearly outlined. Upside ranges: $4,075, $4,254, and $4,476 function instant resistance zones. If a breakout above $4,254 is confirmed, the rally may prolong in the direction of $4,600 and $4,850.

Draw back Ranges: Close to-term pivot assist at $3,850, adopted by latest native lows at $3,750 and $3,439. The 200-EMA at $4,166 stands because the medium-term higher certain that the bulls have to regain to decisively shift momentum upwards.

Technical imagery reveals Ethereum compressing between the 0.382 and 0.236 Fibonacci zones ($3,943-$3,750), suggesting an space of accumulation earlier than the subsequent pattern extension. A decisive transfer above $4,075 (100-EMA) may sign bullish management as soon as once more, however a break under $3,750 dangers paving the best way to $3,400-$3,450.

Will Ethereum rebound?

Ethereum’s near-term trajectory will rely on the way it reacts across the $3,850 to $3,900 assist vary. Continued protection at this degree may spark contemporary momentum above $4,254.

Associated: Chainlink Worth Prediction: Are Fed Valuations and Oracle Power Sufficient to Cease the Drop?

Nevertheless, a failed maintain may expose ETH to a extra extreme correction earlier than the subsequent restoration leg. Elevated open curiosity and constant forex outflows make extra volatility look imminent, suggesting that Ethereum may escape of a tightening vary quickly.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.