- Ethereum is buying and selling close to $4,334 after falling beneath the 20-day EMA and holding help at $4,300.

- The $8.7 million in outflows had been offset by $39.3 million in accumulations in BlackRock’s Ethereum fund, in accordance with ETF information.

- On-chain flows point out an outflow of $21 million, testing purchaser confidence on the $4,180 to $4,050 help zone.

Ethereum (CRYPTO: ETH) value is buying and selling round $4,334 in the present day, beneath the 20-day EMA of $4,388 as short-term sentiment turned cautious after ETF information confirmed contemporary outflows. Regardless of robust institutional shopping for from BlackRock, merchants stay defensive as technical indicators strategy a key choice zone round $4,300.

Ethereum value maintains Fib help regardless of weak momentum

The day by day chart exhibits Ethereum consolidating between $4,300 and $4,460, with the 0.618 Fibonacci retracement at $4,356 offering short-term resistance. The uptrend line from late September stays intact, with help at the moment seen at $4,184 (0.382 Fib degree).

Beneath this, deeper help lies close to $4,046, which coincides with the 0.236 retracement and August breakout base. A pullback from this zone might reignite the uptrend, however a breakout dangers a fall in the direction of the 100-day EMA, the place it at the moment rests at $3,980.

Associated: Dogecoin Value Prediction: Merchants Eye $0.30 Goal as DOGE Consolidates Once more

Momentum indicators are softening, with the RSI hovering round 46, indicating impartial to bearish sentiment. So long as ETH stays above the $4,180 line, the general development stays constructive, however the waning power suggests a doable consolidation earlier than the following uptrend.

ETF flows differ as BlackRock builds up

ETF circulation information launched on October 10 revealed internet outflows of $8.7 million from Ethereum funds, highlighting renewed promoting strain after weeks of regular inflows. Nevertheless, BlackRock has reportedly bought $39.3 million price of Ethereum, suggesting selective institutional accumulation, whilst different issuers like Constancy and Bitwise have made small redemptions.

Analysts say the divergence suggests cash circulating amongst ETF individuals moderately than a broader exit. If BlackRock continues to purchase whereas total outflows diminish, ETH might preserve the $4,300 flooring and supply the soundness it wants to arrange for a restoration towards $4,500.

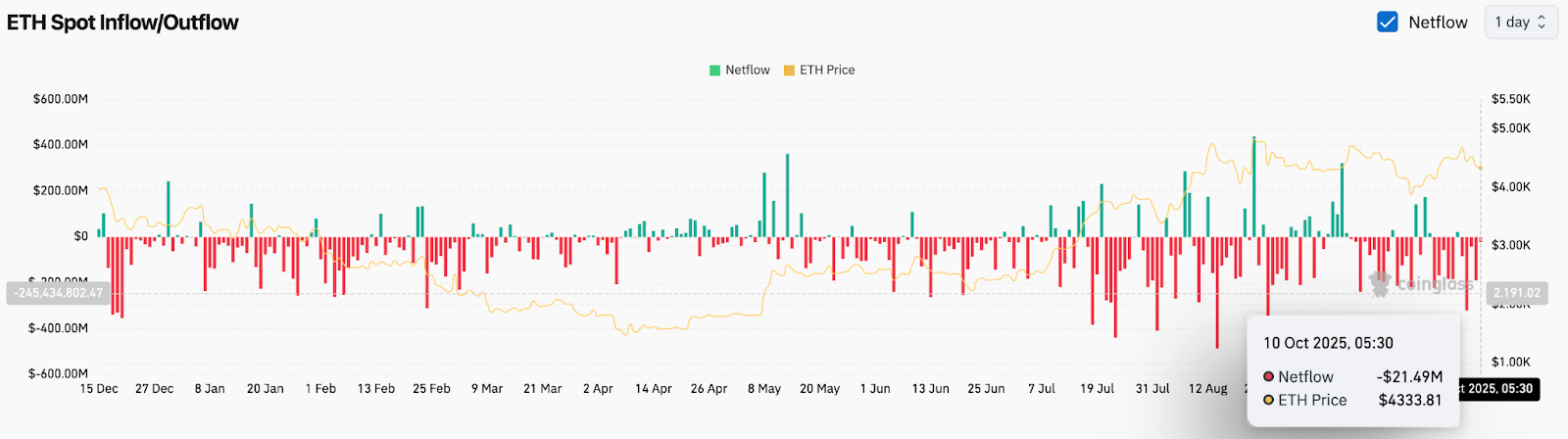

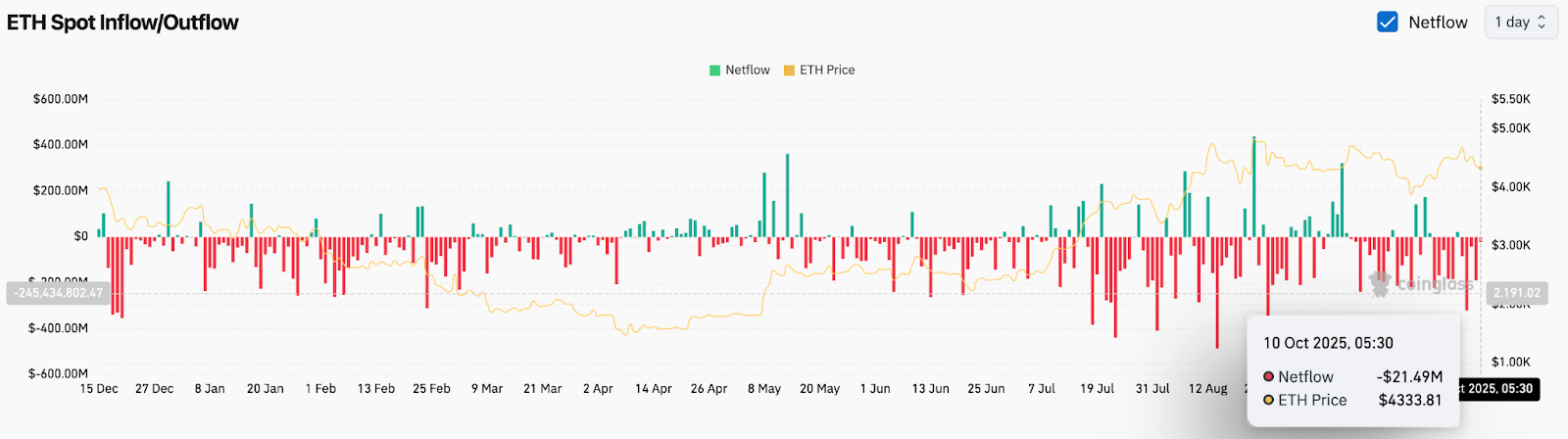

On-chain flows present a internet outflow of $21 million

Ethereum recorded internet outflows of $21.49 million on October 10, after every week of sunshine however constant gross sales exercise, in accordance with information from Coinglass. This reinforces the cautious tone mirrored in ETF actions, suggesting merchants are lowering positions moderately than constructing publicity.

Regardless of the outflow, Ethereum value efficiency stays resilient in comparison with August ranges, with no proof of large-scale panic promoting. Analysts be aware that day by day outflows beneath $50 million are manageable for now, however an acceleration might put strain on the $4,180-$4,050 help space.

Associated: Litecoin Value Prediction: Merchants bullish on LTC as ETF optimism positive aspects momentum

The on-balance quantity indicator (OBV) has stabilized round 12.9 million, indicating that accumulation by medium-term holders is offsetting the exits of short-term merchants.

Technical setup factors to essential crossroads

From a structural perspective, Ethereum is testing a serious confluence zone that mixes the uptrend line, the 38.2% Fibonacci retracement, and the 50-day EMA close to $4,184-$4,297. This vary will decide whether or not ETH resumes a broader uptrend or falls right into a correction section.

A bullish reversal above $4,420 might set off a push in the direction of the 0.786 retracement degree at $4,565 after which September highs at $4,766. Conversely, failure to defend $4,184 would open the door to $4,046 and even $3,981, with the following important protection being on the 200-day EMA close to $3,525.

Outlook: Will Ethereum Rise?

Close to-term Ethereum value predictions largely depend upon whether or not consumers can regain management above the 20-day EMA and reverse ETF-led warning. The $4,300 zone stays extraordinarily vital and acts as structural and psychological help.

If inflows resume and the worth sustains above $4,184, analysts anticipate ETH to try a rebound in the direction of $4,560 within the coming classes. Nevertheless, if ETF redemptions proceed and on-chain outflows improve, Ethereum might face a short-term decline in the direction of the $4,050 to $3,980 vary earlier than stabilizing.

General, the medium-term outlook stays constructive so long as ETH stays above $3,980, however confidence will depend upon whether or not institutional accumulation continues to outweigh profit-taking strain.

Technical outlook for Ethereum value

| path | main degree | index |

| Upside value goal | $4,420, $4,565, $4,766 | Fibonacci and EMA adjustment |

| draw back help | $4,184, $4,046, $3,981 | Development line and 100 day EMA |

| development bias | From impartial to bullish | RSI 46, consolidation section |

| catalyst clock | ETF flows, on-chain accumulation | Institutional investor buying traits |

Associated: Cardano Value Prediction: Hydra Node 1.0 launch sparks new optimism

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.