- Ethereum is buying and selling round $2,995 and is struggling to interrupt above the $2,950-$2,880 demand zone as sellers dominate.

- Coinglass information exhibits an outflow of $27.56 million, extending the multi-week circulation development since breaking beneath the 200-day EMA.

- An in depth beneath $2,950 would expose $2,800 and $2,600, whereas a retake of $3,083 and $3,392 may flip bullish short-term momentum.

Ethereum value is buying and selling round $2,995 at the moment, hovering simply above the important thing demand zone of $2,950 to $2,880 as sellers proceed to place strain on the construction heading into November nineteenth. The market remains to be trapped in a transparent downtrend, with the downtrend line dominating value actions and the EMA cluster reinforcing bearish management.

ETH breakdown expands as sellers defend development line

Ethereum has failed to interrupt out of the downtrend line that has capped any pullbacks since early October. Every try to maneuver up from $3,350 to $3,450 has been rejected beneath this line, confirming a gentle streak of highs.

Worth is at the moment situated beneath all main EMAs.

- 20EMA: $3,392

- 50EMA: $3,703

- 100EMA: $3,781

- 200EMA: $3,564

The slopes of those EMAs point out constant downward strain, however the day by day candlesticks have remained beneath the 200-day common for over two weeks. This confirms that patrons have misplaced management over the medium time period and the market is responding to pressured flows reasonably than danger urge for food.

Associated: Dogecoin Worth Prediction: Downtrend deepens as DOGE struggles to keep up assist

The RSI is close to 30, indicating that the market is approaching oversold territory, however there has not been a breakaway robust sufficient to cancel the general development.

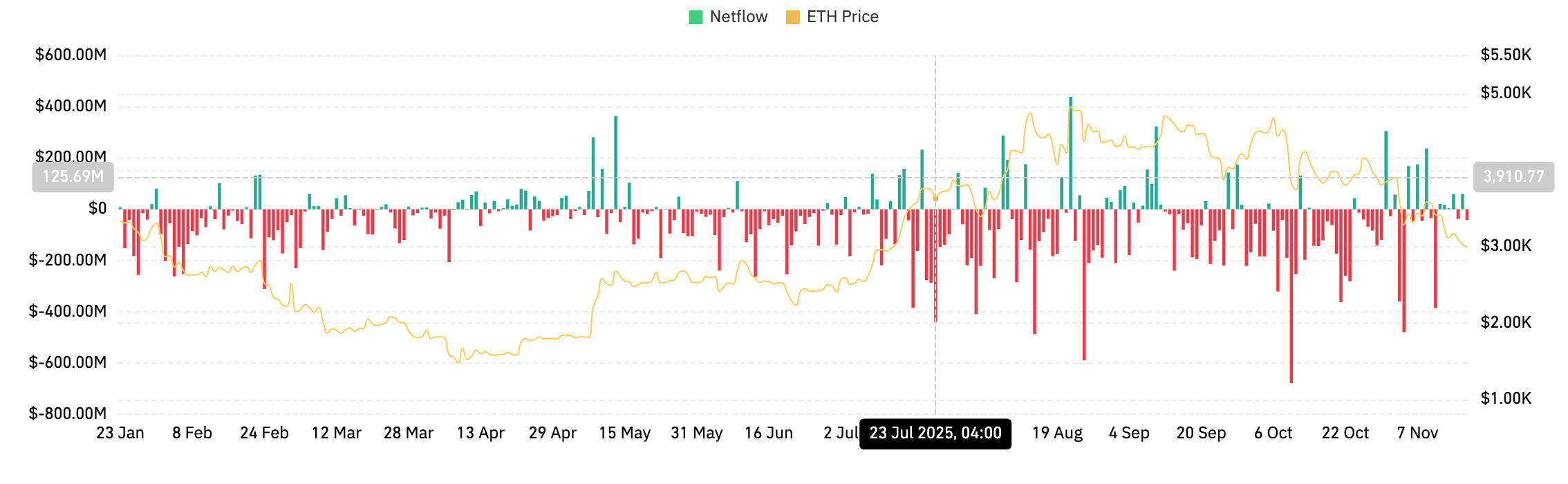

Spot outflows improve as promoting strain continues

In response to information from Coinglass, Ethereum recorded web outflows of $27.56 million on November 18, reinforcing the promoting bias seen over the previous week.

Many of the November session was tilted towards outflows, suggesting traders proceed to scale back publicity reasonably than accumulate weak spot.

That is in step with a broader sample of pink outflow bars relationship again to late October, when a break beneath the 200-day EMA first triggered a rotation in ETH. Elevated outflows throughout macro downtrends usually affirm that spot sellers, not simply spinoff liquidations, are pushing costs up.

Intraday momentum exhibits weak makes an attempt at stabilization

Trying on the short-term chart, ETH is attempting to stabilize above $2,980, however the restoration stays shallow. On the 30-minute timeframe, the supertrend sits overhead at $3,083, forming a ceiling that rejects any microbounces.

Parabolic SAR is above value, confirming that the draw back momentum remains to be energetic. Every try and get better from $3,050 to $3,100 rapidly stalls as sellers lean into intraday bearish construction.

Associated: Solana Worth Prediction: SOL Costs Face Stress as Market Construction Weakens

For patrons to achieve a foothold, ETH wants an in depth above $3,083 to reverse the supertrend. This may mark the primary signal of vendor momentum drying up. Till that occurs, conferences stay corrective reasonably than constructive.

outlook. Will Ethereum go up?

Ethereum developments stay bearish heading into November nineteenth, with the burden of proof shifting fully to the customer.

- Bullish case: ETH holds above $2,950, regaining $3,083 and breaking above $3,392. If this occurs, the short-term momentum may reverse and the downtrend line may try one other breakout.

- Bearish case: A day by day shut beneath $2,950 exposes $2,800, adopted by a deeper assist zone close to $2,600. If it stays beneath the EMA, your entire construction will stay tilted downward.

Patrons will regain management if ETH regains $3,083 and crosses the 20 EMA. A lack of $2,950 confirms the continuation of the downtrend.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.