- ETH maintains help above $3,300 and short-term bullish construction stays in place

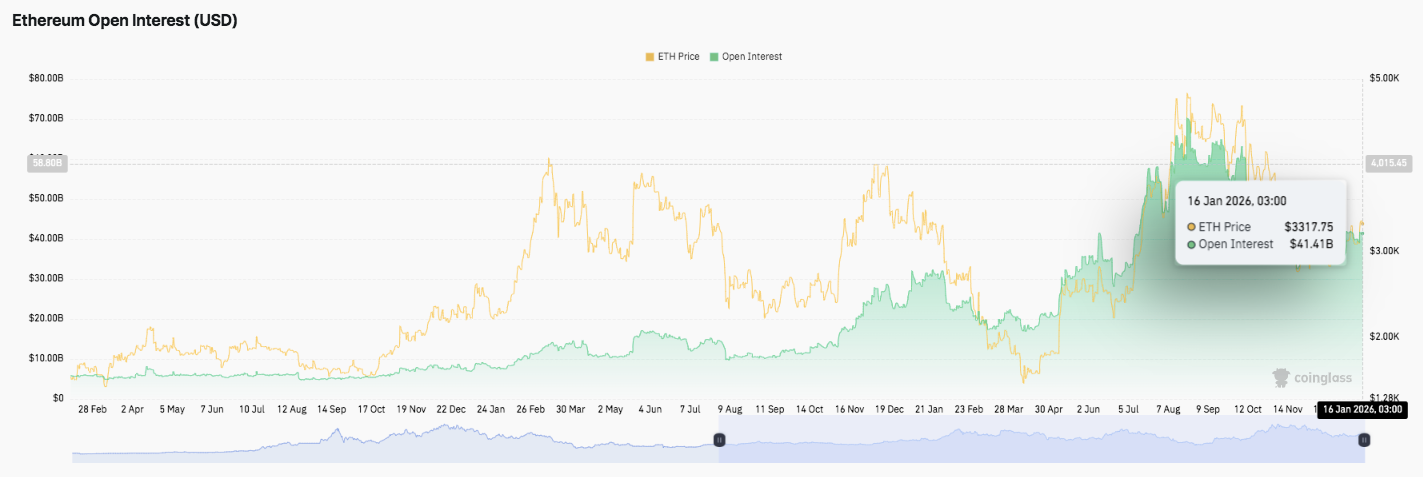

- Rising open curiosity of almost $41 billion suggests leverage danger regardless of secure value actions

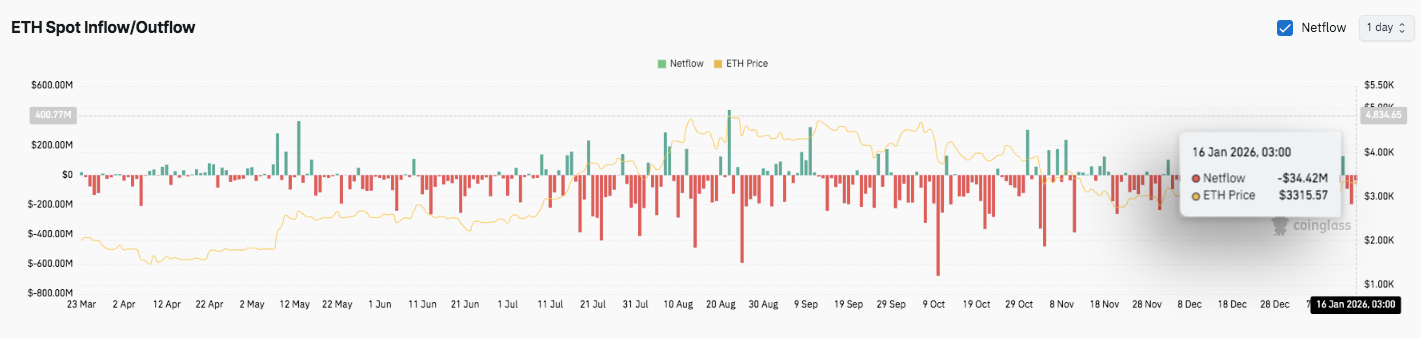

- Slower spot outflows recommend much less promoting stress, however faces upside resistance

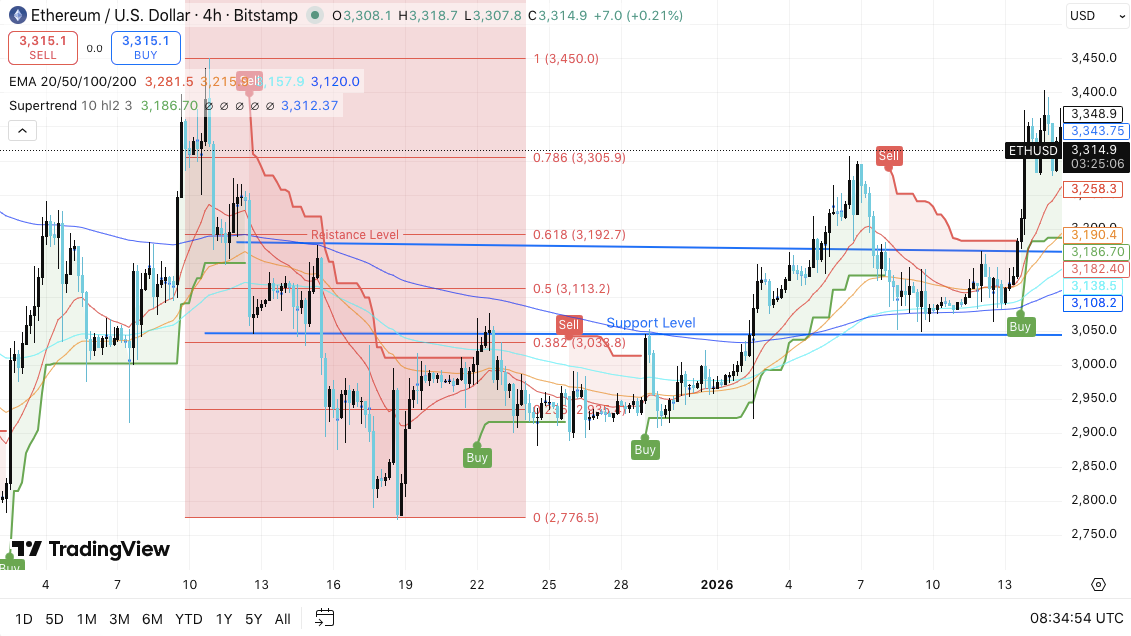

Ethereum stays agency on its footing close to $3,317, whereas merchants want to see if the rally will lengthen additional up on the four-hour chart. Latest value motion reveals that ETH is regaining momentum after clearing a key resistance zone round $3,300 to $3,320.

This transfer helped affirm the setup for a short-term bullish continuation, with larger highs and better lows forming all through the most recent swing. Along with the breakout, Ethereum is buying and selling above main shifting averages, which merchants typically deal with as a sign that patrons are nonetheless answerable for the development.

ETH breakout holds above key technical zones

Ethereum rose above the $3,300 space and held that degree as help through the current pullback. Due to this fact, the $3,305 to $3,315 vary is at the moment serving as the primary line of protection for the bulls. The EMA cluster can also be under the value and continues to carry as dynamic help. Moreover, the supertrend indicator stays bullish, supporting the case for follow-through income.

A shallow decline was additionally noticeable in current instances. Due to this fact, this transfer signifies a gentle decline in demand and restricted profit-taking stress. If ETH stays above $3,300, merchants are more likely to proceed focusing on the following rising band.

ETH is at the moment going through instant resistance between $3,350 and $3,380, the place sellers had been defending current highs. Moreover, a stable break above this zone might pave the best way to $3,405-$3,450. This space coincides with the excessive of a significant earlier vary and is in keeping with extension targets on many short-term charts.

Associated: Bitcoin Worth Prediction: ETF inflows and spot outflows collide as value stalls…

Nonetheless, costs might nonetheless stall if patrons fail to soak up provide close to the highest of the present vary. Merchants shall be holding an in depth eye on the momentum close to $3,380 because it might decide the following path.

Watch out for derivatives and spot movement indicators

Ethereum’s open curiosity development continues to rise, suggesting elevated participation in derivatives. Notably, the open curiosity is near $41.41 billion and the value is buying and selling round $3,317. This degree reveals that leverage stays elevated even after a slight cooldown. Due to this fact, sudden volatility can nonetheless happen if a dealer exits a place shortly.

Spot influx and outflow information additionally present a relaxed tone. Internet outflows have been largely damaging for a number of months, with the most recent figures exhibiting modest web outflows of almost $34 million. Moreover, outflows have slowed in comparison with earlier spikes, suggesting a decline in gross sales depth.

Associated: Shiba Inu value prediction: Burn price collapses by 87% as there are solely 550,000 Shiba Inu…

Technical outlook for Ethereum value

Ethereum’s key ranges stay well-defined as value stabilizes above current breakout help.

Noteworthy upside ranges embody the primary resistance zone at $3,350 to $3,380. A clear break might open room for $3,405 and $3,450, in keeping with the earlier vary excessive and Fibonacci extension.

On the draw back, instant help lies between $3,305 and $3,315, with earlier resistance turning into demand. Beneath that, $3,190-$3,200, which mixes EMA help and the 0.618 Fibonacci degree, exists as an necessary confluence zone. Deeper help lies round $3,040 to $3,080.

Technical situations recommend that Ethereum is consolidating inside a bullish continuation construction after retrieving main shifting averages. This compression part typically precedes volatility enlargement.

Will Ethereum go up?

The short-term bias hinges on whether or not patrons defend the $3,300 space whereas constructing momentum in direction of the $3,380 resistance. Stronger inflows and sustained leverage might speed up the transfer in direction of $3,450.

Nonetheless, failure to carry $3,190 dangers weakening the construction and exposing ETH to a deeper decline in direction of the $3,080 zone. For now, Ethereum is buying and selling in a definitive vary, the affirmation of which can form the following leg.

Associated: Web Laptop Predictions for 2026: Mission70 to scale back inflation by 70%, AI integration targets $8-12

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.