- ETH defends $3,000 for the third session as spot outflows decline to $27.3 million.

- The intraday chart exhibits that consumers are holding the ascending channel and momentum is above VWAP.

- Value has rebounded from long-term assist at $2,603, however the important thing EMA remains to be limiting the upside path.

Ethereum worth is buying and selling round $3,028 at this time after defending the $3,000 stage for 3 consecutive classes. The maintain is at a key level within the broader construction as spot outflows ease and intraday charts present consumers sustaining management of the ascending channel. The market is trying to stabilize after a pointy correction in November that took ETH out of the $4,800 vary and again into long-term assist.

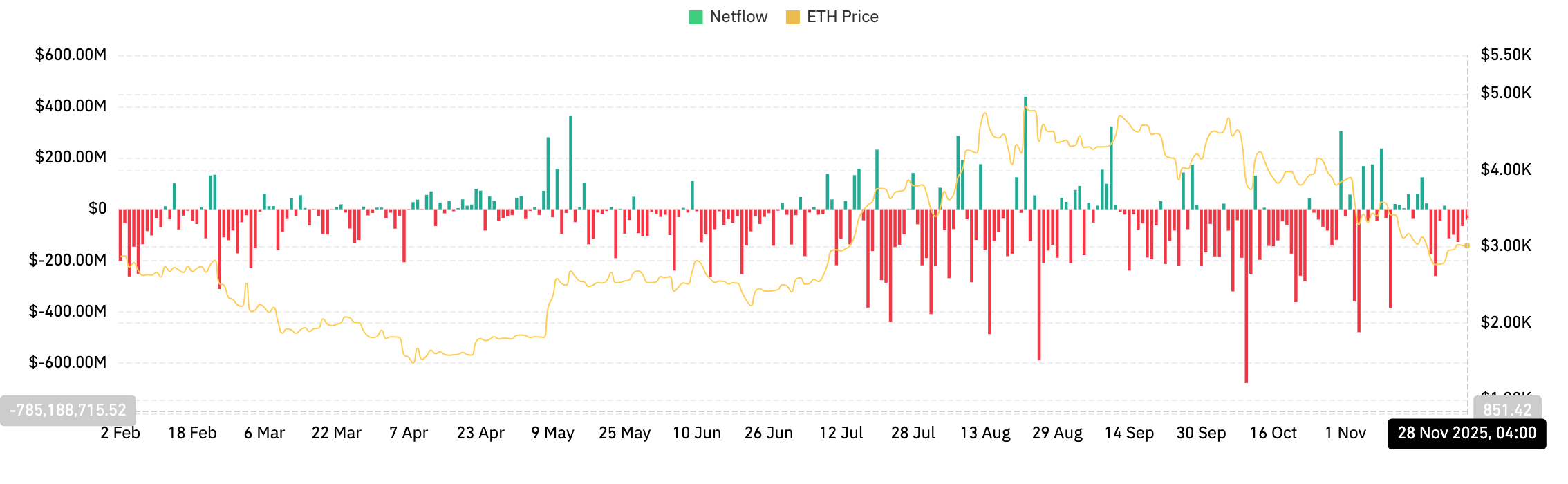

Spot outflows ease as sellers lose momentum

Web outflows on November 28 have been $27.32 million, in keeping with the most recent Coinglass knowledge. Whereas nonetheless damaging, the magnitude is far smaller than the large distribution seen earlier within the month, when print volumes exceeded $150 million per day. Coupled with improved derivatives positioning, the near-term image is extra balanced than every week in the past.

Adjustments will be confirmed on the chart. ETH has rallied above VWAP on the hourly foundation and is presently buying and selling persistently above $3,002. Value continues to respect the ascending channel that led to the four-day rally. Each drop to the decrease trendline attracts consumers, with the higher trendline close to $3,080 offering the primary barrier to continuation.

Associated: Solana (SOL) Value Prediction: Can Consumers Maintain the Line Above $140?

The RSI is close to 55 within the intraday timeframe, indicating constructive momentum with out going overboard. Bollinger Bands present average compression, which helps the concept of a managed restoration relatively than an impulsive reversal.

ETH maintains long-term assist close to $2,600

The bigger construction signifies the significance of this rebound. Ethereum lately retested the $2,603 assist zone, a stage that served as a serious pivot from 2024 to early 2025. This modification revealed that consumers have been positioned exactly on this horizontal shelf, the place numerous nodes have been focused on the seen vary of profiles.

The rebound from $2,603 is according to a broader vary of demand extending to the $2,230 stage. ETH has constructed a number of areas within the area over the previous two years, making it a pure place for worth consumers to re-enter. Current reactions have bolstered this development.

Associated: Bitcoin Value Prediction: Consumers Maintain $90,000 as Whales Flip to Aggressive Additions

Nevertheless, the worth remains to be beneath the each day EMA cluster. The 20-day EMA is $3,107, the 50-day EMA is $3,449, the 100-day EMA is $3,627, and the 200-day EMA is $3,503. All of those ranges kind a broad higher sure that ETH should face if it desires to maneuver from restoration to development continuation.

Momentum stays impartial to cautious. The breakdown from the $4,800 zone was sharp, with a descending purple development line nonetheless limiting any upside makes an attempt. ETH wants to interrupt above its trendline cleanly for consumers to construct confidence for a bigger reversal.

Derivatives market exhibits gradual enchancment

Derivatives knowledge reveals refined however vital adjustments. Open curiosity decreased by 3.67% previously 24 hours to $35.86 billion. The decline in OI coincides with a decline in leverage, permitting the market to reset after weeks of crowded positions.

Choices open curiosity elevated barely by 0.64%. This means that merchants are beginning to rebuild their positions relatively than unwinding them. Choices quantity stays low, however adjustments in curiosity are constructive for stability.

Main exchanges have a bullish lengthy/quick ratio. Binance’s prime merchants have an extended to quick place ratio of two.94, whereas OKX is 1.75. The broader 24-hour ratio is holding at 0.897, which is impartial, however prime merchants’ actions point out an accumulation of pullbacks.

Liquidation knowledge helps a slowdown in stress. The overall liquidation recorded previously hour was simply $1.82 million, and within the 12-hour timeframe it was simply $7.91 million. That is considerably decrease than earlier within the week, when liquidations soared to greater than $40 million throughout the peak of the decline.

outlook. Will Ethereum go up?

The trail ahead will rely upon whether or not ETH can regain the 20-day EMA and get away of the downtrend line.

- Bullish case: A excessive quantity shut above $3,107 will begin a transfer in the direction of $3,449 after which $3,627. This variation confirms the restoration and permits the worth to problem the following stage at $3,823.

- Bearish case: A decline beneath $2,950 may prolong to $2,880 and $2,603, extending the correction and delaying the development reversal.

Associated: Cardano Value Prediction: ADA Value Stabilizes as Futures Buying and selling Exercise Cools

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not answerable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.