- ETH is dealing with recent stress following a pointy drop at $3,350, with outflows of over $112 million indicating a decline in threat urge for food.

- The value is holding the 0.618 Fib close to $3,195, however momentum is weakening because the SAR stays bearish and the RSI is hovering within the mid-$30s.

- To rebound, you’ll want to get again $3,260. Shedding $3,175 reveals deeper targets at $3,084 and $2,973.

Ethereum worth is buying and selling round $3,195 as we speak after a major rejection on the $3,350 zone the place a number of resistance ranges had been concentrated. The pullback pressured ETH again into a decent vary as outflows surged once more and consumers tried to guard the uptrend line that had supported the worth since final week.

Outflows soar as merchants cut back publicity

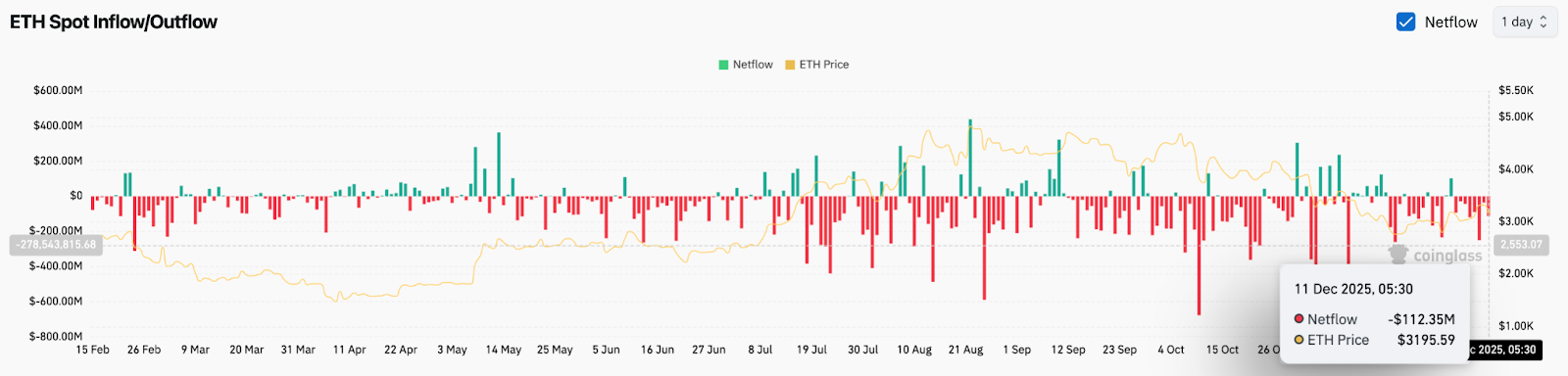

In line with Coinglass, ETH recorded web outflows of over $112 million on December eleventh. Capital outflows proceed a sample that has lasted a number of months, with massive purple marks dominating the board in each October and November.

A big outflow of cash upon a rejection of a serious resistance usually signifies that consumers aren’t motivated to chase the breakout. That is what occurred right here. ETH approached a technical tipping level however was unable to interrupt by, and merchants responded by pulling liquidity from exchanges.

Associated: XRP Value Prediction: XRP Vary Tightens as Outflow Continues…

The latest decline in broader market sentiment has added to that stress. Bitcoin can be slowing down, so massive holders stay cautious. Till the outflow cools, the bounce will face resistance earlier than regaining the higher band of the vary.

Whale rotation provides an emotional twist

Regardless of the leak, the information on the chain exhibits some attention-grabbing adjustments. Previously two weeks, whales have offered $132 million price of Bitcoin and acquired greater than $140 million in Ethereum. Such a rotation sometimes signifies an early try and take a place forward of a possible development change.

One whale alone would not change the construction, nevertheless it does add an attention-grabbing layer. This exhibits that large capital is intently monitoring the present stage of ETH. As soon as costs stabilize, any such exercise might type the idea of a bigger accumulation zone.

Rejection at $3,350 confirms sturdy multi-layer resistance

The day by day chart exhibits how the worth was rejected cleanly within the $3,350 space. This zone consists of:

- 50EMA

- 100EMA

- higher bollinger bands

- 0.786 Fibonacci Retracement

ETH briefly entered the cluster, however was pushed again inside hours. I discovered that the candle had a protracted wick printed on it, which clearly indicated that it was sourced from the vendor.

As a consequence of this rejection, ETH is presently caught close to the 0.618 stage close to $3,195, which is performing as short-term assist. Shedding this stage exposes $3,084 after which $2,973, matching the 0.5 and 0.382 Fibonacci ranges. These are the following demand zones that merchants will concentrate on throughout a pullback.

Associated: Bitcoin Value Prediction: BTC Stays Close to $90,000 as Market Waits…

The supertrend indicator additionally stays bearish and is buying and selling above worth, confirming the downward stress that has prevailed since November.

Trendline assist nonetheless holds, however momentum is weak

On the 30-minute chart, ETH is clinging to the uptrend line that has guided its latest restoration. Value has tapped this line a number of instances as we speak, indicating that it’s an lively assist stage.

Parabolic SAR reversed bearishly throughout the decline however has not but reversed and the sign momentum stays weak. With the RSI sitting round 34, ETH stays near oversold territory, however there is no such thing as a sturdy reversal sign.

For consumers to regain short-term management, ETH might want to regain the $3,240-$3,260 area the place the collapse started. That area coincides with the midpoint of the underside of the SAR flip and the ultimate push.

If ETH fails to rebound cleanly from the development line, the following check would be the $3,175 space. A break beneath this stage might speed up the selloff in the direction of $3,084.

outlook. Will Ethereum go up?

If the development line holds and consumers defend the 0.618 stage, ETH nonetheless has an opportunity to stabilize. A rebound to $3,260 would be the first signal of power. A follow-through above $3,350 will affirm the return of momentum.

If ETH falls beneath $3,175, sellers will regain full management and the market will transfer right into a deeper correction in the direction of the $3,000 space.

Above $3,350, it’s prepared for a restoration. A break beneath $3,175 will flip the development bearish once more.

RELATED: 2025-2030 NIGHT Value Prediction: Can New Privateness Layer Maintain Early Breakout?

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.