- Ethereum Worth will commerce practically $3,992 after testing a 50-day EMA and falling beneath help of lower than $4,035-$4,080.

- $248 million in ETF spills, together with $200 million, from BlackRock, underscores company gross sales strain on ETH.

- Analysts think about $3,850-$3,900 as the principle help cluster, suggesting a cycle flooring with RSI close by.

Ethereum Worth is $3,992 after falling beneath the $4,035-$4,080 help zone. Gross sales strain has been strengthened as ETH failed to keep up its foothold above the $4,285 resistance, and momentum has been decreased additional by a big ETF outflow. Instant testing is at present in a help space starting from $3,850 to $3,900. This determines whether or not the customer can reestablish management or whether or not the modifications will deepen.

Ethereum costs are retained with necessary help

Each day charts present that ETH breaks from the built-in triangle and checks a 50-day EMA of practically $3,990. Instant resistance is $4,080, adopted by a powerful provide of $4,216 and $4,285. It’s essential to get again to those ranges to revive bullish momentum.

The $3,854 100-day EMA has turn into an necessary defensive position. This degree of loss may open a deeper retracement to the EMA for $3,500, for $3,403, for a 200-day, $3,403. The momentum indicator emphasizes strain and the RSI exhibits a pattern of promoting at 37, however nonetheless doesn’t trigger sturdy bounce.

ETF spill provides to gross sales strain

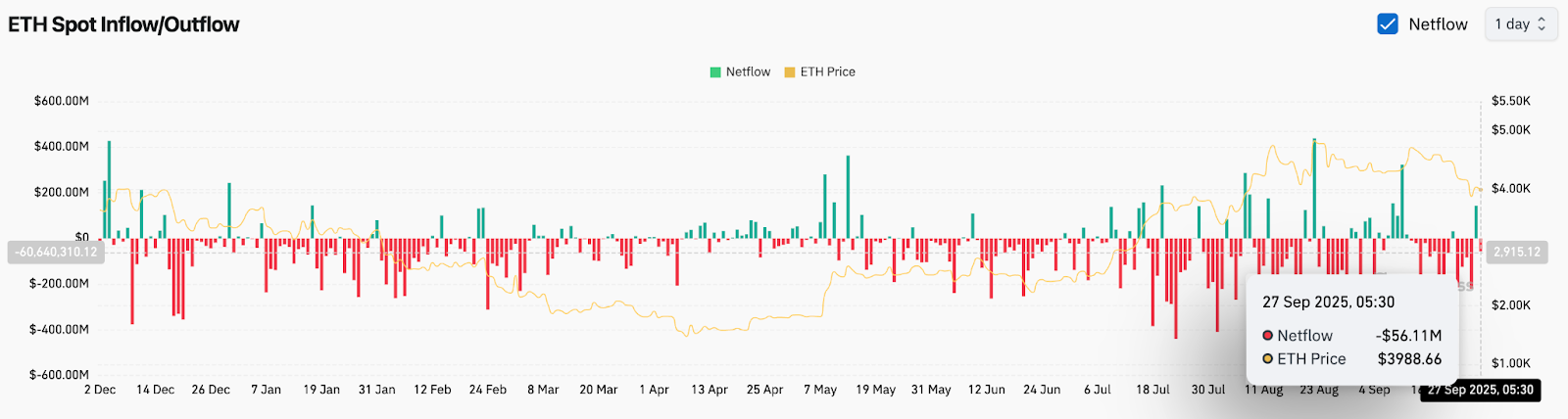

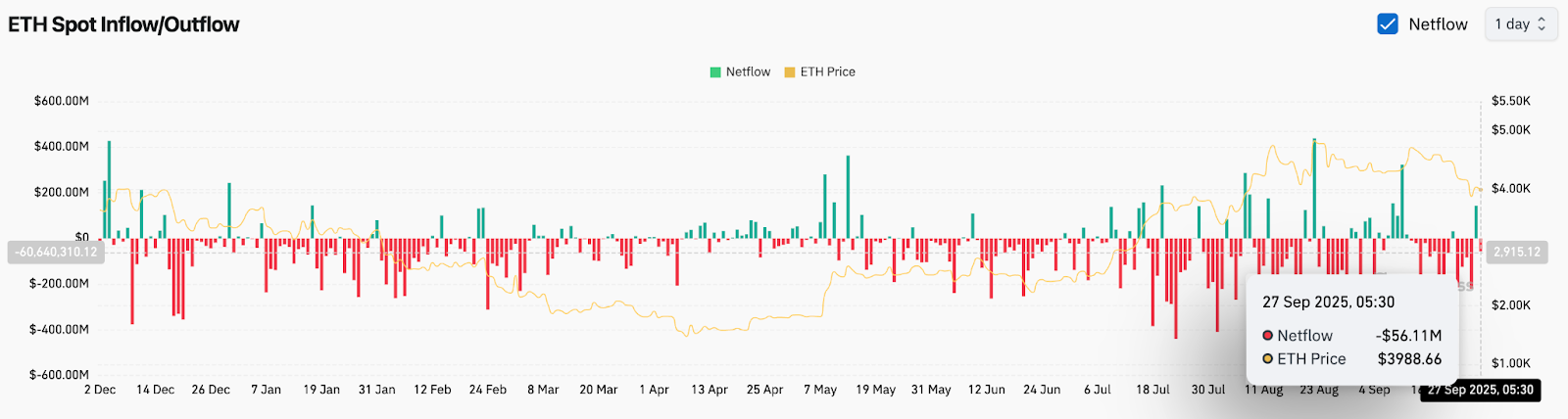

Flows Information emphasizes the bearish tilt. On September 27, Ethereum recorded a internet outflow of $506.1 million throughout the alternate, sustaining its gross sales exercise. Particularly, ETF merchandise noticed a $248 million spill, and BlackRock alone dropped practically $200 million of ETH Holdings.

Such an enormous withdrawal impairs market confidence and means that amenities are lowering publicity slightly than accumulating dips. Analysts warn that everlasting spills can lengthen the mixing section, particularly if Spot ETF redemption continues.

Merchants emphasize low cycles

Regardless of the adverse movement, some merchants argue that ETH could also be approaching the cyclical mattress. Widespread analyst Jake Wujastyk factors to similarities between present RSI patterns and former backside formations, suggesting that ETH could also be testing key accumulation zones.

Traditionally, ETH has bounced again after a protracted upward pattern approaching 100 days of EMA. A brief-term restoration to $4,200 stays attainable if patrons defend help between $3,850 and $3,900. But convictions require a stronger inflow to offset ETF-related pressures.

On-chain information signifies weak participation

Change information helps much more cautious feelings. Netflows has been negatively dependent for a number of weeks, with solely brief influx spikes rapidly reversing. Open curiosity has additionally been cooled, reflecting merchants’ reluctance to commit aggressively.

This lack of sustained participation underscores the hole between retail enthusiasm and institutional positioning. With out clear proof of inflow, at this time’s ETH worth actions stay susceptible to additional volatility.

Technical outlook for Ethereum costs

Quick-term Ethereum worth forecasts fluctuate relying on whether or not the area is retained between $3,850 and $3,900.

- Rising Stage: If momentum returns, $4,080, $4,216, $4,285.

- Drawback ranges: 3,854, $3,500, and $3,403 key defence strains.

- Momentum: RSI is near overselling, however it requires affirmation as a consequence of a better influx.

Outlook: Will Ethereum rise?

Ethereum faces a troublesome balancing act between bearish ETF spills and technical help ranges. If the customer is ready to exceed $3,850, a reduction of $4,200-$4,285 stays. Nevertheless, dropping that zone places a deeper correction to $3,500 in danger.

For now, at this time’s costs at Ethereum mirror susceptible sentiments. Institutional outflows dominate the narrative, and the extent of expertise suggests the potential of the ground. Merchants are wanting fastidiously to see if the ETH is steady earlier than the vendor forces one other leg.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version is just not answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.