- Ethereum will check the $4,734 resistance. If confirmed by Breakout, the goal is $4,800-$5,000.

- Samsung will combine ETH into 200m galactic units to advertise retail adoption.

- Bitmine’s $13.4 billion Ethereum Treasury strengthens institutional belief in ETH.

As we speak, Ethereum costs are buying and selling almost $4,680, consolidating beneath the $4,734 resistance stage after a pointy restoration from $4,400. The market balances sturdy institutional inflow and new adoption tailwinds after Samsung launched Native Ethereum, the place Galaxy Units is staking.

Ethereum Worth Take a look at is a serious breakout construction

The every day chart reveals Ethereum pushing down triangle breakout zones close to $4,700-4,750. A profitable breakout over this space will affirm the continuation of uptrends inside the broader upward channels that started in Might.

Help ranges are clustered between $4,400 and $4,290, with 20 and 50 days of EMA, with a daring bullish base. The $3,959 100-day EMA marks a deeper stage of help that maintains medium-term traits within the occasion of a repair.

Associated: SUI Worth Prediction: Mainnet Upgrades Will increase Momentum

Momentum stays optimistic as there may be extra worth buying and selling than all main Emmas, indicating that the underlying construction stays intact within the retest within the $4,800-5,000 vary within the brief time period.

Samsung’s staking integration creates a wave of retail adoption

Ethereum’s bullish outlook gained momentum after Samsung confirmed that Ethereum staking is built-in into the galactic ecosystem. This replace will permit over 200 million customers to wager ETH straight from their units, marking one of many largest mass recruitment rollouts of their blockchain historical past.

Analysts level out that the combination dramatically will increase retail dyeing participation and successfully tightens circulating provide. Decrease liquidity and stronger staking engagement are inclined to strengthen Ethereum harvest story, offering a primary cushion of worth stability. The announcement additionally adjustments market sentiment, with merchants anticipating adoption metrics to result in sustained demand.

Demand for the power might be strengthened at Bitmine’s $13.4 billion Treasury Division

Additional strengthening the bullish narrative, Bitmine’s third quarter report revealed that its Ethereum Treasury Division has reached 2.83 million ETH, presently valued at $13.4 billion. The corporate is presently the twenty eighth most liquid stake in the US, buying and selling greater than $2.5 billion every day.

Associated: XRP Worth Prediction: Trump’s Crypto Recognition Causes Rippling Momentum

The dimensions of this company publicity highlights the rising function of Ethereum within the facility’s steadiness sheet and echoes the playbooks as soon as seen in Bitcoin. Analysts view Bitmine’s accumulation as an indication of “institutional FOMOs,” and the liquidity-driven Treasury has added depth to Ethereum’s worth construction.

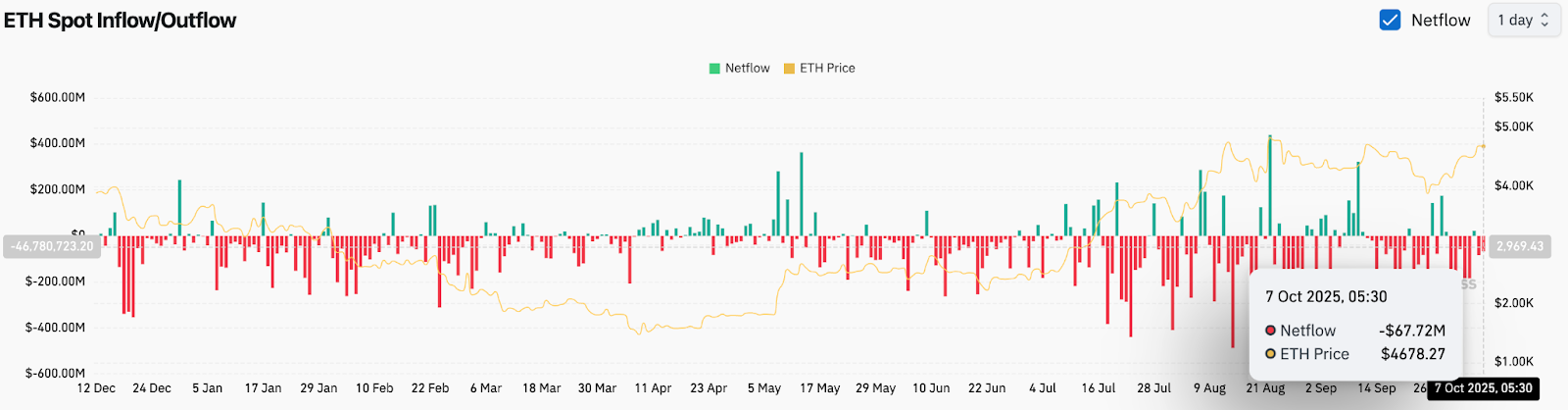

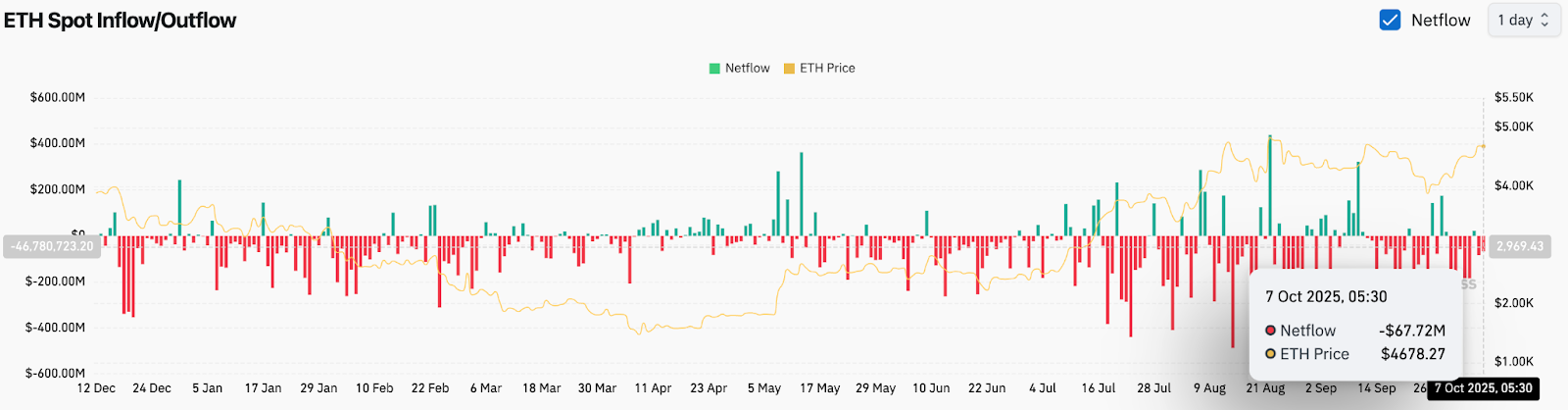

On-chain stream reveals sustained accumulation

Alternate information confirmed a web spill of $67.7 million on October seventh, persevering with its multi-day withdrawal sample from the centralized platform. A sustained spill normally suggests accumulation by long-term holders and verification units, reinforcing the narrative of present demand.

The spill has been risky all year long, however the newest collection of drawers coincides with Ethereum’s regular rise from the $4,200 area. Analysts emphasize that by sustaining web outflows of over $50 million every day, they’ll keep their upward momentum by mid-October.

Technical outlook for Ethereum costs

Brief-term Ethereum worth forecasts in sustaining momentum above the key breakout zones:

- Upside Stage: $5,000 with $4,734, $4,800 and $5,000 targets

- Drawback stage: Sturdy help clusters $4,405, $4,291, $3,959

- Development Help: $3,500 (200-day EMA) for long-term construction

Outlook: Will Ethereum rise?

Ethereum stays a crucial inflection level as each institutional and retail catalysts align. Samsung’s staking integration will enhance accessibility, whereas Bitmine’s massive Treasury ministry will strengthen belief amongst institutional contributors.

Technically, a clear closure above $4,734 may ignite a push to $4,950-$5,000, extending Ethereum’s cycle rally. Nevertheless, failing to exceed $4,400 can result in short-term advantages in the direction of the $4,200 zone.

Associated: Bitcoin Worth Prediction: Technique’s $3.9 billion achieve boosts feelings

For now, Ethereum’s construction is solidly bullish, with recruitment and accumulation forming a twin pillar of help forward of October buying and selling week.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version is just not accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.