- Ethereum fell beneath $3,000 for the primary time in six weeks, breaking beneath the help of the descending channel that had been in place since December.

- Bitmine Immersion purchased 35,268 ETH price $106.2 million final week, bringing its complete holdings to greater than $12.5 billion as establishments accrued the drop.

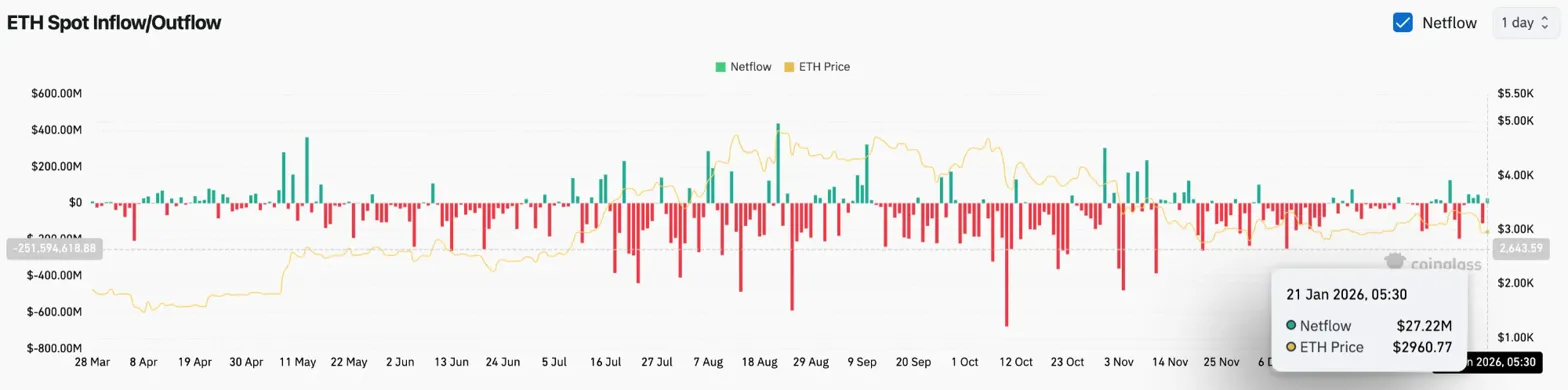

- Inflows into spot buying and selling reached $27.22 million, displaying that patrons are coming in regardless of the 8% decline in two weeks.

Ethereum worth at this time broke out of a descending channel that features worth actions since December lows and is buying and selling round $2,957.50. The transfer marked the primary shut beneath $3,000 since early December, and the technical construction turned bearish at the same time as institutional patrons intervened.

Bitmine buys $106 million throughout crash

Not everybody sells. Bitmine Immersion revealed on Tuesday that it bought 35,268 ETH final week, price $106.2 million at present costs. With this acquisition, the corporate’s complete Ethereum holdings will exceed 4.2 million tokens (price $12.5 billion).

Chairman Tom Lee cited the advance within the ETHBTC ratio as a motivation for buying. This indicator has been steadily rising since mid-October, suggesting that Ethereum is gaining relative power towards Bitcoin regardless of general market weak spot.

Institutional accumulation throughout a crash usually suggests long-term felony convictions. The added publicity of presidency bonds as retail exits creates a possible decrease certain that may help future restoration makes an attempt.

Affirmation of accumulation attributable to spot influx

Alternate movement knowledge helps the buying principle. Coinglass recorded web inflows of $27.22 million on January twenty first. Which means the cash are being moved from an trade to a private pockets moderately than being ready on the market.

Associated: Axie Infinity 2026 Worth Prediction: GameFi’s $380M Quantity Surge Indicators Turnaround

The influx follows a sample established earlier this week, when the buildup occurred throughout a broader cryptocurrency selloff linked to tariff issues and geopolitical tensions over Greenland. Costs have fallen 8% up to now 14 days, however patrons proceed to soak up provide.

This divergence between worth motion knowledge and movement knowledge creates a possible setup for restoration. Accumulation at decrease costs reduces the availability obtainable on exchanges and may speed up the rally when sentiment modifications.

Channel breakdown turns construction bearish

On the every day chart, Ethereum has damaged beneath the decrease certain of the descending channel that was maintained from December to early January. This sample had help close to $3,100, however Monday’s decline didn’t hesitate to interrupt beneath that degree.

Worth is at present buying and selling beneath all 4 EMAs, and the hole is widening because the correction drags on. EMA stack displays technical injury.

- Rapid resistance: $3,142 to $3,147 (20/50 EMA cluster)

- Key resistance: $3,273 (100 EMA)

- Supertrend resistance: $3,321

- Pattern resistance: $3,328 (200 EMA)

- Present help: $2,900 to $2,920

- Breakdown purpose: $2,800

The Supertrend indicator turned bearish at $3,321 and is now almost 12% above the present worth. Recovering to this degree would require a big reversal of momentum.

Intraday momentum reaches oversold excessive

A shorter time-frame signifies the severity of the decline. On the hourly chart, ETH fell from $3,370 to a low of $2,920 in simply three classes. Parabolic SAR is at present buying and selling slightly below its worth at $2,937.73, suggesting that the downtrend could also be pausing in the meanwhile.

Associated: Bitcoin Worth Prediction: BTC faces short-term strain after breakout failure

The RSI crashed to 30.39 and entered oversold territory. Readings at this degree usually precede a short-term pullback as promoting strain dries up. Nonetheless, throughout sturdy tendencies, oversold situations can persist earlier than a significant reversal happens.

The $2,900 to $2,920 zone has obtained shopping for curiosity in a number of intraday assessments. If this degree could be maintained, it can verify that accumulation is laying the foundations. Shedding it opens the best way to $2,800.

Outlook: Will institutional purchases help costs?

This setup creates a battle between technical weaknesses and elementary strengths. Charts are displaying promote and monetary establishments are displaying purchase. An answer comes when one overpowers the opposite.

- Bullish case: Worth holds the $2,900 help and collects $3,000. Sustained institutional accumulation will gas a restoration in the direction of the 20EMA of $3,142.

- Bearish case: If the closing worth for the day is beneath $2,900, the breakdown might be confirmed and the goal might be $2,800. A lack of $2,800 reveals the November low close to $2,600.

Ethereum is working out of help and dealing with a felony trial. Institutional shopping for suggests there may be worth within the push, however bulls want to shut above $3,000 for the construction to stabilize.

Associated: Cardano Worth Prediction: ADA faces new strain as outflows decline however construction stays weak

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.