- Ethereum will commerce practically $4,505 and can mix $4,200 in help and $4,600 in resistance.

- The liquidity warmth map reveals signaling breakout threat for whale clusters starting from $4,000 to $4,200 and $4,600 to $4,700.

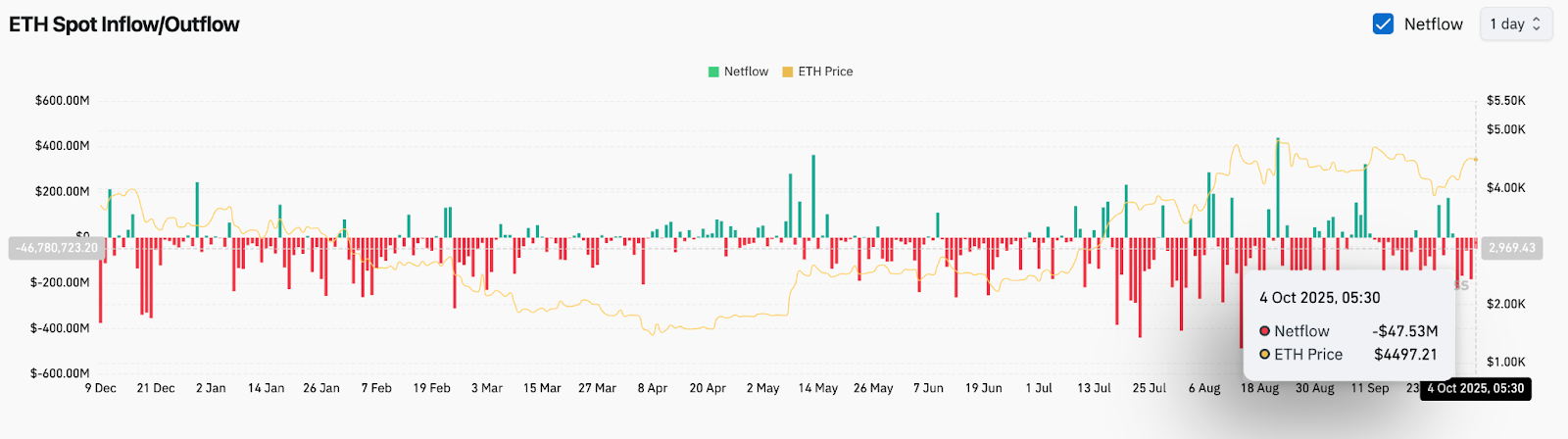

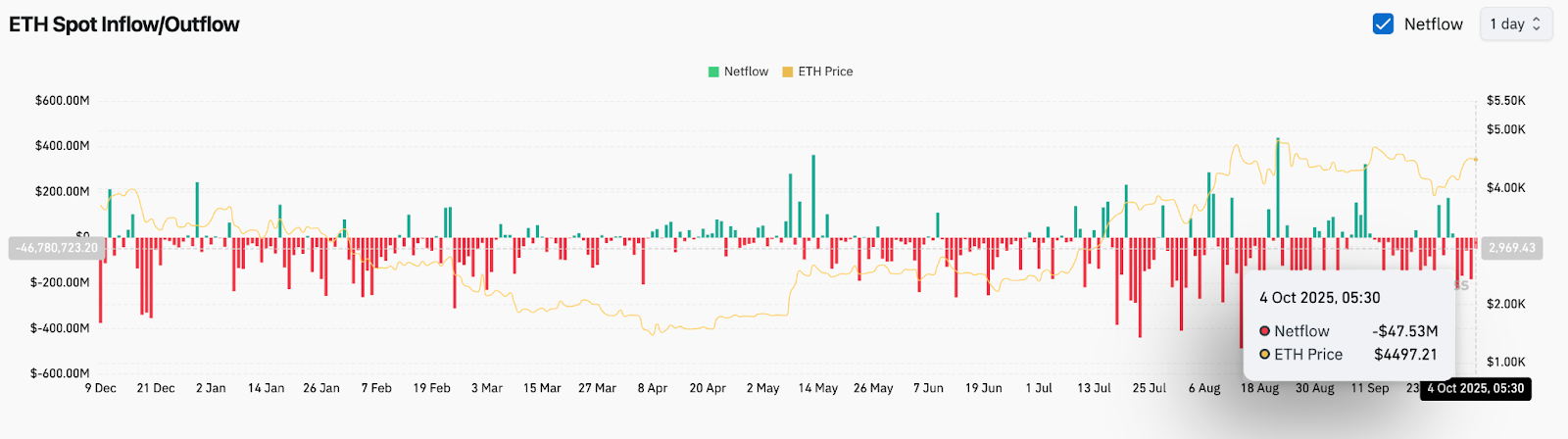

- On-chain knowledge reveals the outflow of $47.5 million, suggesting average accumulation regardless of the risky move.

Ethereum Worth trades practically $4,505 at present, under $4,600 just below resistance because it weighs on merchants whether or not whales defend a decrease liquidity zone or push for an upside breakout. Market consideration focuses on help areas of $4,000-$4,200 highlighted by the liquidity warmth map, with the $4,600-$4,700 vary rising as the subsequent main take a look at.

Ethereum Costs Maintain Compression Zones

Day by day charts present that Ethereum is under the trendline, descending from its late August excessive. Costs stay compressed at a cap of practically $4,327 and $4,600 throughout the 20-day EMA, usually forming a tightening construction that precedes the enlargement of volatility.

The momentum sign stays impartial. The RSI of 57 displays balanced feelings, and flattening the EMA slope signifies that merchants are ready for affirmation earlier than committing within the course. The $4,249 50-day EMA continues to function pivot help, according to the $4,200 liquidity band noticed within the spinoff order guide.

If Ethereum exceeds $4,600, Momentum Merchants might facilitate a fast retest between $4,700 and $4,800, however in the event you fail to clear this ceiling, the token may very well be pulled again to $4,200 and $4,000.

Liquidity clusters outline the battlefield of whales

Analyst Ted Pillow It ought to be famous that ethereum fluidity clusters are concentrated within the downsides of round $4,000-$4,200 and the advantages of $4,600-$4,700, creating an equilibrium that may be rapidly disrupted by whale exercise.

His liquidity heatmap reveals deep relaxation orders in each zones, suggesting that the whales are ready to lock in short-term liquidity earlier than selecting a course. Traditionally, when one aspect of fluidity is consumed, comparable setups have preceded a significant directional motion.

For now, ETH might expertise minor pullbacks that would wipe out decrease liquidity zones earlier than rising the upper push. A clear absorption of bids near $4,200 will bolster bullish continuity to $4,700.

On-chain move signifies up to date accumulation

Coinglass’ alternate Netflow knowledge confirmed a $47.53 million spill on October 4, reflecting a average accumulation. Regardless of continued volatility, the outflow in early October reveals traders are positioned for potential continuity, reflecting the buildup stage seen in August earlier than ETH rebounds above $4,000.

This alteration in alternate habits helps a constructive tone as a lower in alternate provide usually precedes tightness of floats and expands in costs. Nonetheless, the magnitude of the move is often under $100 million to substantiate institutional convictions, leaving room for warning if short-term revenue acquisitions resume.

Technical outlook for Ethereum costs

- Upside Stage: $4,600, $4,700, $4,800

- Drawback degree: $4,200, $4,000, $3,918

- Pattern Help: $3,466 (200-day EMA)

Outlook: Will Ethereum rise?

The short-term course for Ethereum is dependent upon whether or not the whales will trigger liquidity sweeps of lower than $4,200 or drive a breakout of greater than $4,600. On-chain spills and secure EMA alignment recommend that patrons nonetheless have management, however skinny liquidity between $4,200 and $4,700 will increase the chance of sharp whipping.

Analysts are cautiously bullishly sustaining stigma so long as at present’s Ethereum costs are above $4,200. A essential breakout of over $4,600 might lengthen the rebound to $4,800-$5,000, whereas a breakdown under $4,200 would shift focus to $3,900. For now, Ethereum stays in the important thing compression zone the place whales positioning determines the subsequent pattern:

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version will not be chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.