- Ethereum is buying and selling round $3,805 and is testing the bull market assist band round $3,700 after falling beneath $4,000.

- The Senate’s DeFi proposal raises considerations concerning the Ethereum protocol, including to the strain from persistent change outflows.

- Over $3 billion in stablecoin inflows highlights Ethereum’s structural benefits regardless of short-term bearish momentum.

Ethereum (CRYPTO: ETH) worth is buying and selling close to $3,805 at present, struggling to get well after dropping key assist from an ascending channel construction. The sharp rejection round $4,800 triggered an enormous sell-off, with ETH falling beneath the 20-day and 50-day exponential transferring averages (EMAs) and heading straight into the $3,700-$3,750 assist zone. This space at present coincides with the Ethereum bull market assist band, making it an essential line for consumers to stick to.

Ethereum Worth Check Bull Market Help

The day by day chart exhibits that ETH has damaged out of the ascending channel and is testing the decrease sure of the long-term symmetrical triangle. This breakdown has pushed the worth beneath the 100-day EMA ($3,968) and nearer to the weekly bullish assist band between $3,573 and $3,725.

Momentum indicators counsel continued strain. The RSI is beneath the impartial 50 mark, indicating weakening buying energy, however the MACD histogram continues to be considerably unfavourable. Until Ethereum is ready to regain the $4,000 stage quickly, a deeper retrace in direction of $3,523 can’t be dominated out.

DeFi coverage threats forged a shadow on Ethereum

The Senate’s new decentralized finance proposal is shaking sentiment throughout Ethereum-related markets. Though the invoice doesn’t explicitly point out Ethereum, its broad scope locations the community on the middle of potential regulatory implications.

Beneath the proposal, entities offering front-end entry to DeFi protocols could be required to register as brokers with the SEC or CFTC. This might embody builders and organizations working standard Ethereum-based functions resembling Uniswap and Aave.

Market analysts have warned that such guidelines might drive builders offshore, restrict U.S. entry to decentralized functions, and gradual Ethereum buying and selling exercise and liquidity within the brief time period.

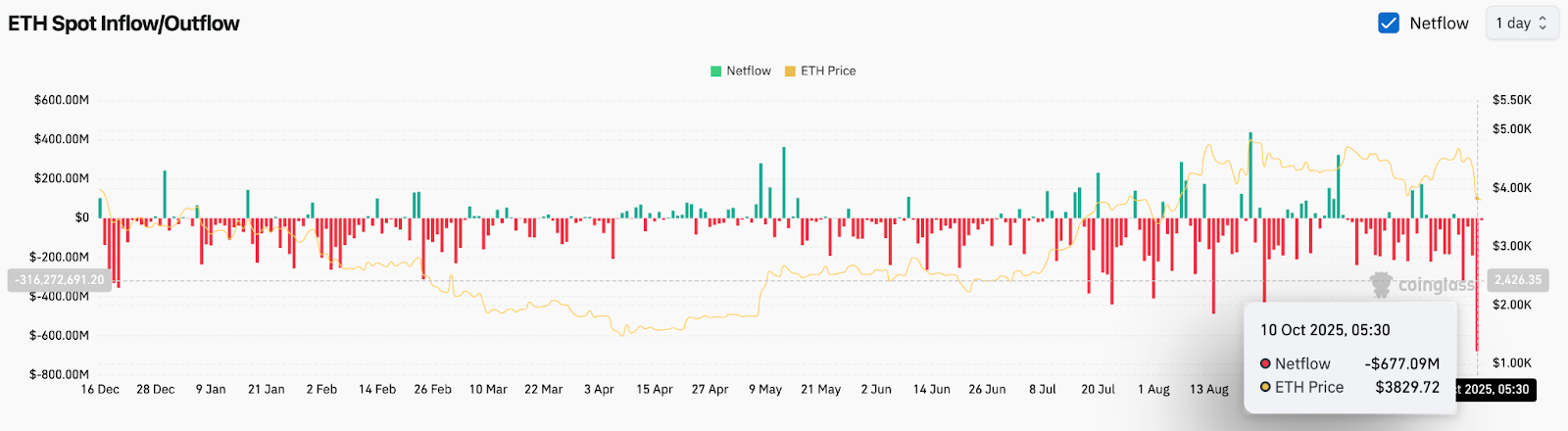

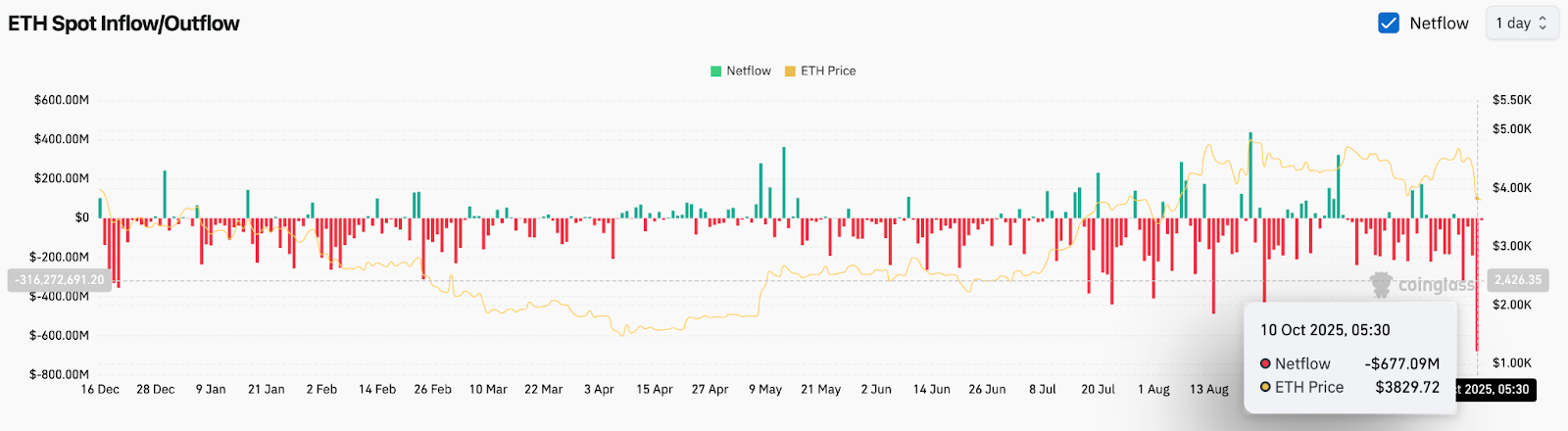

On-chain information exhibits persistent leakage

Alternate information from Coinglass highlights important outflows from Ethereum. Internet outflows on October 10 reached $677 million, the most important single-day outflow in latest months. The subsequent day started with one other $9 million in outflows, reflecting deep-rooted warning amongst merchants.

A persistent pink bar in latest periods signifies traders are withdrawing funds from exchanges and could also be self-storage or sidelining capital amid regulatory uncertainty. This pattern has traditionally coincided with spikes in volatility and short-term worth declines.

Stablecoin inflow brings partial aid

Regardless of promoting strain, Ethereum continues to steer the broader cryptocurrency ecosystem as the first fee layer for stablecoins. Based on information shared by X’s Coin Bureau, greater than $3 billion of stablecoins have flowed into Ethereum prior to now seven days. That is greater than all different main chains mixed.

This influx highlights Ethereum’s structural benefits in DeFi and funds. Analysts notice that stablecoin development usually precedes new exercise on decentralized exchanges and lending markets, suggesting liquidity might shortly return to the community as soon as coverage readability emerges.

Technical outlook for Ethereum worth

Ethereum’s quick resistance lies close to $3,968 (100-day EMA) and $4,259 (50-day EMA). A definitive shut above these ranges might sign a short-term restoration and goal the $4,420 and $4,600 zones. On the draw back, the $3,725-$3,573 assist band is the final buffer earlier than the 200-day EMA at $3,523.

Failure to keep up this space might open the door to a $3,400 ordeal with historic unmet demand from mid-July.

| Ethereum technical predictions | stage |

| resistance stage | $3,968, $4,259, $4,600 |

| assist stage | $3,725, $3,573, $3,523 |

| Foremost EMA cluster | 20 EMA $4,290 – 50 EMA $4,259 |

| bias in momentum | Bearish beneath $4,000 |

| construction | Breakdown from rising channel to bullish assist zone |

Outlook: Will Ethereum Rise?

Ethereum stays below strain, buying and selling close to the decrease finish of its long-term assist construction. A mixture of enormous capital outflows, technical glitches, and uncertainty about US DeFi coverage has curbed bullish momentum.

Nevertheless, the surge in stablecoin deposits exhibits that the community’s utility and capital base stay intact. Analysts consider that if ETH maintains the $3,700 space and regains $4,000 within the coming periods, the broader uptrend might resume.

For now, Ethereum’s subsequent transfer will rely on whether or not consumers can defend the bull market bands earlier than sellers drive an additional decline in direction of $3,500.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.