- Ethereum has fallen under the 200-day EMA following $355 million in liquidations and huge ETF redemptions led by BlackRock.

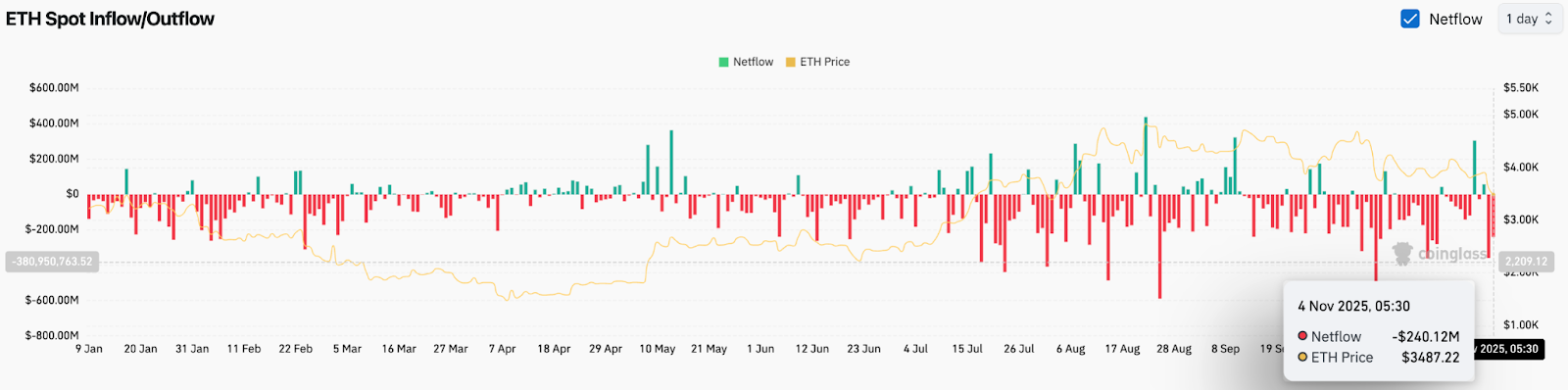

- The $240 million spot outflow confirms that momentum is popping bearish, with sellers exiting each ETF and trade positions.

- A restoration would require a return to $3,607, with draw back assist between $3,350 and $3,000 if flows and volumes don’t enhance.

Ethereum worth is at the moment buying and selling round $3,485, down greater than 3% up to now 24 hours after breaking under the 2025 uptrend line. The decline has weighed on sentiment following a surge in ETF redemptions and bodily outflows, forcing traders to unwind leveraged positions.

ETF outflows set off danger discount

Promoting stress started with aggressive withdrawals by institutional traders. In line with the newest ETF knowledge, yesterday’s outflows have been $135.7 million, together with $81.7 million bought by BlackRock. These redemptions mark one of many largest exit dates since launch and point out the fund is lowering its publicity reasonably than rotating elsewhere.

Spot buying and selling flows assist that pattern. Coinglass recorded internet outflows of $240 million on November 4th. When each spot and ETF flows decline on the identical time, costs sometimes comply with. This explains the sudden change in Ethereum’s worth motion over the previous two classes.

Futures market is exhibiting capitulation

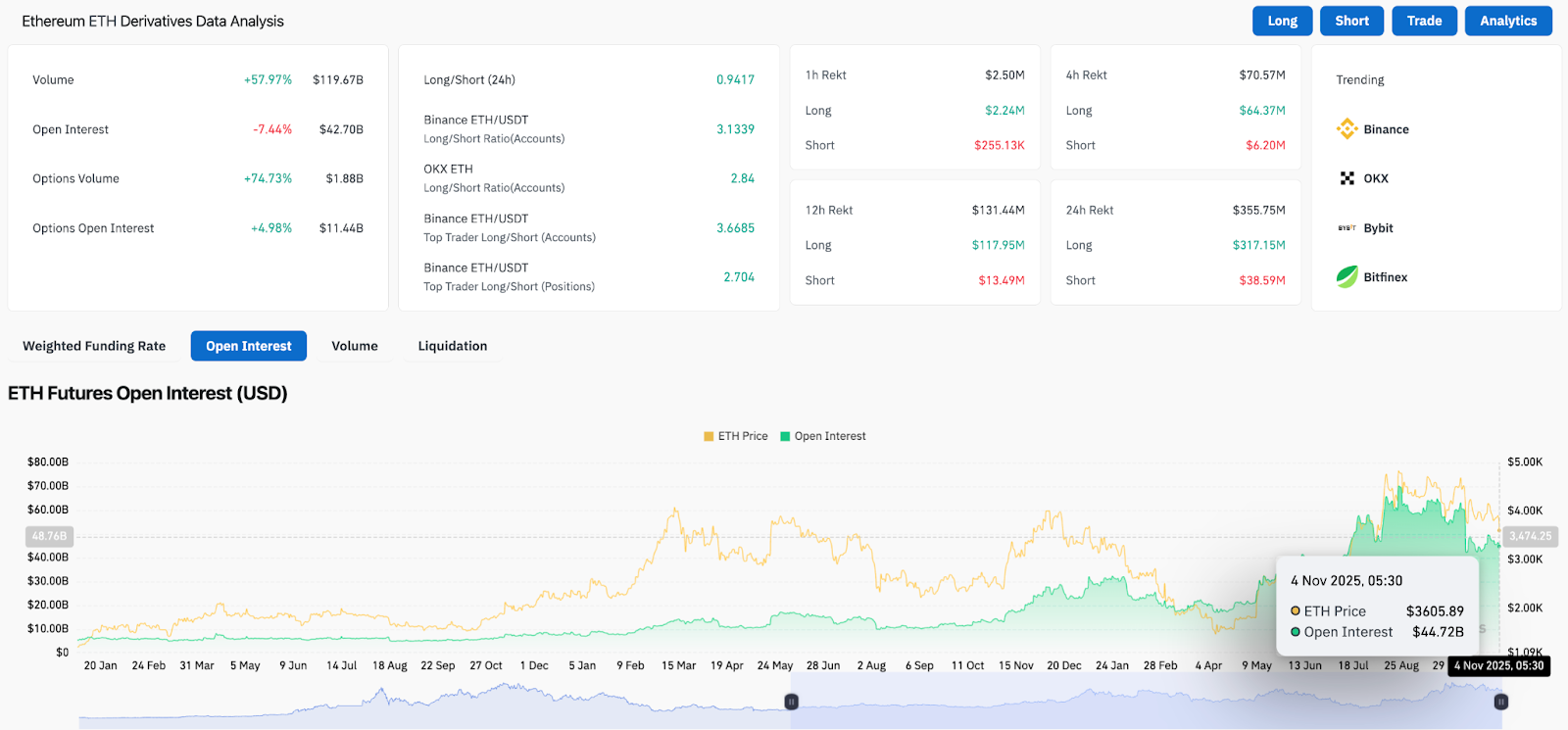

In derivatives, open curiosity decreased by 7.44%, indicating that leveraged positions are being unwound. Almost $355 million in liquidated funds entered the market up to now 24 hours. This flush eradicated overleveraged lengthy positions that had beforehand supported a slender buying and selling vary above the 200-day EMA.

High merchants’ positioning nonetheless confirmed a protracted bias, which means leverage was biased bullishly heading into the breakdown. When worth breaks by main assist with leverage on one aspect, the follow-through is normally stronger. Ethereum worth actions this week replicate that imbalance.

Breakdown under the 200-day EMA turns the construction bearish

Ethereum worth in the present day fell under the 200-day EMA at $3,607, breaking out of trendline assist for the primary time since April. Sellers defended the $3,893-$4,034 EMA cluster the place the 20EMA and 50EMA converge. That cluster has now became a resistance.

On the every day chart, the construction has shifted from lows and highs to a wedge break. Repeated failures close to $4,030 and losses on the 200-day EMA point out purchaser fatigue.

Present main stage:

- Quick resistance: $3,607

- Principal resistance zones: $3,893 – $4,034

- Help to defend: $3,350 – $3,250

- Principal demand zones: $3,000

The RSI stays impartial, however worth motion tells the reality. The market is now not forming lows. Sellers keep management till Ethereum regains misplaced ranges.

outlook. Will Ethereum recuperate in November?

The pattern has modified within the brief time period, however it’s not but an entire macro reversal. Ethereum must regain its 200-day EMA and present improved move to return momentum to the upside.

If the value stays under $3,607, the correction will stay energetic and merchants will proceed to deal with the pullback as a pullback reasonably than a pattern. Restoration remains to be doable, however we’d like clear affirmation, not simply short-term aid.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.