- ETH stability above key assist signifies patrons will defend the construction regardless of broader pressures

- Rising futures open curiosity suggests stronger confidence amongst merchants throughout current restoration

- Rising gasoline futures idea might improve worth predictability and long-term ecosystem demand

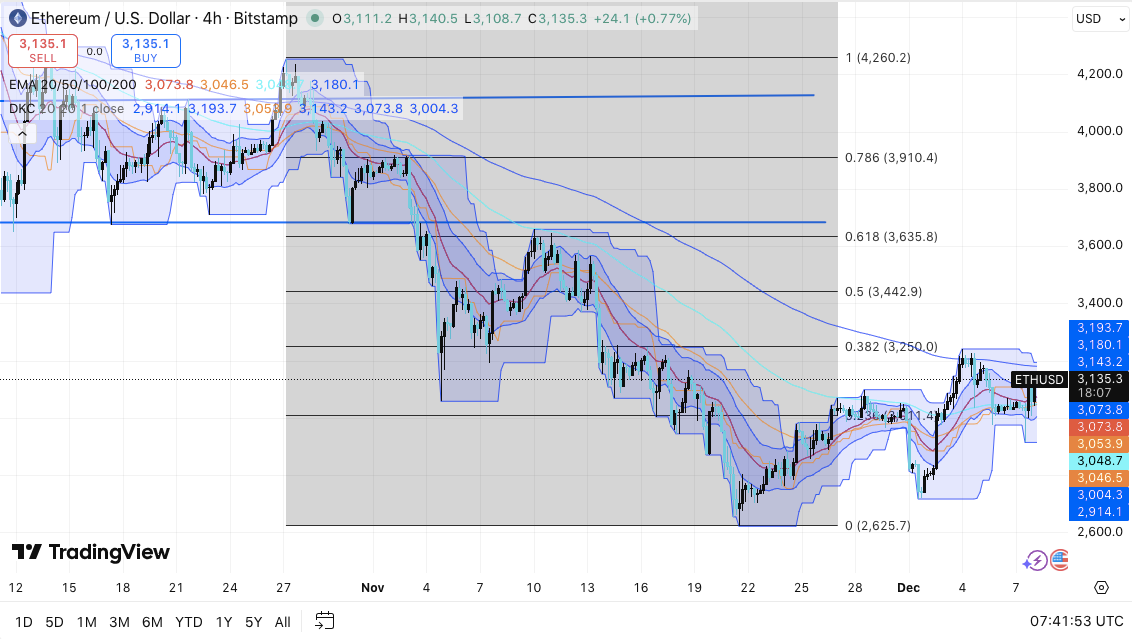

Ethereum is buying and selling close to a key resolution level because the market enters a interval of tense consolidation. The asset has risen above short-term assist close to $3,135 after recovering from a late November low of $2,625.

Broader tendencies proceed to indicate stress. Nonetheless, the construction is beginning to stabilize as patrons defend the $3,050 to $3,070 space.

Because of this, merchants at the moment are targeted on a confirmed breakout or breakout, as the following transfer might decide the path for early 2026. Moreover, improved derivatives exercise and new discussions about payment safety instruments have additional elevated curiosity in Ethereum’s near-term outlook.

Worth band narrows as key ranges maintain

ETH is buying and selling in a slim vary between the assist line at $3,050 and the resistance line at $3,180. The decrease zone accommodates the 20-day and 50-day averages, reinforcing that cluster. A break under this area might reopen the trail to $3,004 and $2,914.

Dropping these ranges might ship the value again to $2,625. Nonetheless, patrons continued to defend the vary, indicating an try to construct greater lows.

Associated: Cardano worth prediction: Market waits for Hoskinson’s ‘higher day’ sign

The upside degree stays clear. ETH must get better between $3,143 and $3,180 to achieve short-term momentum. An in depth above $3,250 might point out enhancing pattern power. Greater targets are close to $3,443 and $3,636. Importantly, if momentum expands, the following main zones will emerge round $3,910 and $4,260.

Strengthening market participation by means of derivatives actions

Open curiosity in Ethereum futures exhibits that dealer engagement is rising. It elevated by means of the second half of this 12 months and reached roughly $36.7 billion on December eighth.

This rally has developed as costs have recovered, suggesting that merchants elevated their publicity in the course of the rally. Moreover, open curiosity has remained robust even throughout short-term declines, indicating confidence in Ethereum’s broad positions.

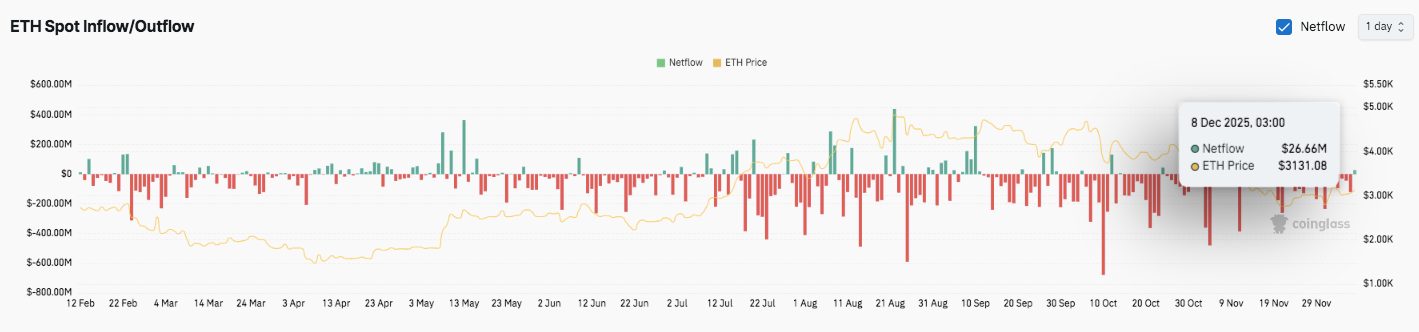

Spot circulation tells a special story. Purple runoff spikes have been dominant and had a powerful distribution from August to November. Nonetheless, just lately an inflow has began to be seen. ETH recorded an influx of $26.66 million on December eighth. This modification means that some patrons could return as the value stays above $3,100.

Buterin highlights new strategy to payment stability

Vitalik Buterin mentioned the potential of on-chain gasoline futures techniques. He claimed that customers can lock in future charges inside a sure time-frame. Subsequently, high-volume customers could make extra dependable plans.

Associated: Bitcoin worth prediction: Bulls want to interrupt above $97,000 or draw back dangers resurface

Moreover, such markets could present a clearer sign in regards to the anticipated base price. This concept provides a brand new layer to Ethereum’s evolving roadmap and will influence long-term demand.

Technical outlook for Ethereum worth

Ethereum is buying and selling inside a slim vary across the $3,100 zone, so key ranges stay well-defined. Upside ranges embody $3,143, $3,180, and $3,250 as the primary group of hurdles. As momentum builds, a breakout above $3,250 might prolong to $3,443 and $3,636.

Draw back ranges embody $3,073 and $3,050, which kind trend-defining assist. A deeper decline might see $3,004 and $2,914. Dropping this band dangers a return to the cycle low of $2,625. The 100-day and 200-day EMA are nonetheless above the value and function higher resistance limits for medium-term pattern power.

Trying on the technical image, it exhibits a transparent compression between the assist at $3,050 and the resistance at $3,180. The squeeze is now getting even tighter as merchants look ahead to a decisive transfer. Breaking out of this construction fully might result in a major improve in volatility in both path.

Will Ethereum rise additional?

Ethereum’s subsequent transfer will rely upon how lengthy patrons defend the $3,050 to $3,073 demand zone. A robust protection units the stage for a push in the direction of the $3,180 wall. A sustained rise above this may pave the way in which to $3,250 and even $3,443. If flows enhance, ETH might try a retest of $3,636.

Nonetheless, if you happen to fail to maintain $3,050, you’ll have $3,004 and $2,914 again in play. A break above these ranges weakens the construction and exposes the earlier low of $2,625. For now, Ethereum is in a pivotal area. Merchants anticipate volatility to rise as compression tightens and each side vie for management.

Associated: XRP Worth Prediction: Persistent Downtrend Threatens $2 Help as Flows Stay Damaging

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.