- Ethereum stabilizes close to $3,350 as futures buying and selling exhibits renewed investor consideration

- Enhance in open curiosity of over $39 billion highlights institutional confidence in ETH restoration

- Sustained overseas change outflows counsel rising accumulation and lowered promoting stress

Ethereum (ETH/USD) is exhibiting renewed stability after weeks of downward stress, indicating potential restoration momentum within the broader crypto market. The asset discovered a brief dwelling close to $3,320-$3,350, with patrons stepping in to defend key technical ranges. This stabilization coincides with a rise in participation in Ethereum futures, suggesting renewed investor engagement regardless of continued volatility.

Worth construction and main know-how ranges

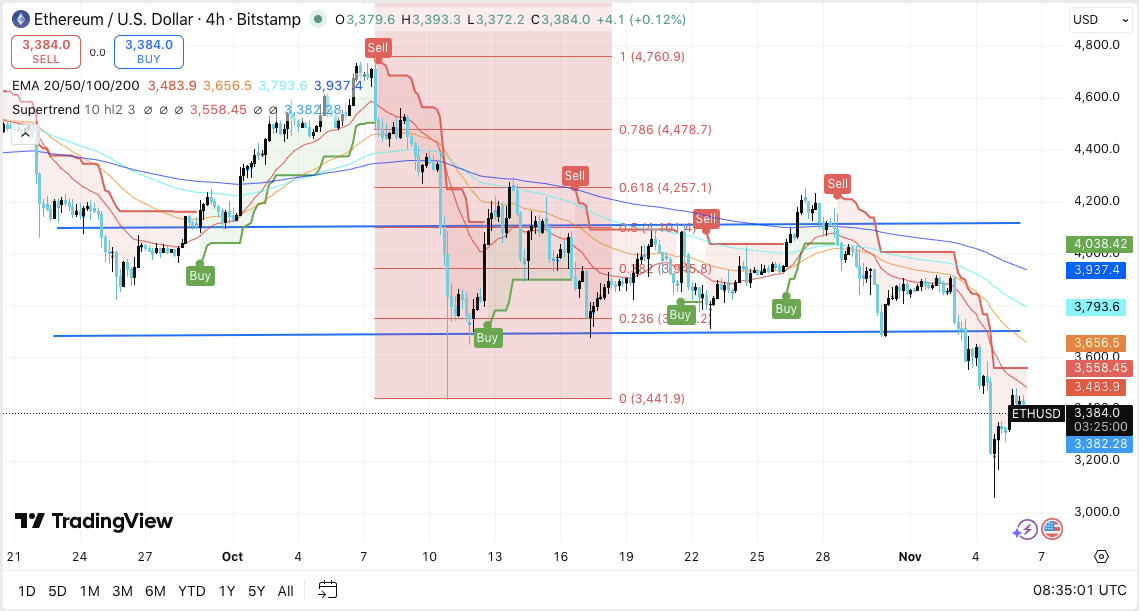

On the 4-hour chart, Ethereum is holding agency above a key help zone round $3,382, with a secondary cushion at $3,320. Sustaining above these ranges is essential to take care of short-term construction.

The primary resistance stage seems at $3,558, which coincides with the supertrend resistance. Past this, there’s a tight cluster of 20-day and 50-day exponential transferring averages within the $3,656 to $3,793 band that merchants are watching carefully for route.

A decisive break above $3,937 might validate the bullish continuation in the direction of $4,038, the place the 200-EMA and psychological resistance converge. Conversely, failure to maintain above $3,382 might set off a pullback to $3,200, exposing Ethereum to extra severe correction threat.

Market traits and derivatives exercise

The Ethereum derivatives market continues to indicate sturdy participation, highlighting elevated speculative exercise. Futures open curiosity elevated to $39.99 billion on November 6, one of many highest ranges this quarter.

This development signifies rising liquidity and capital flows into Ethereum-linked derivatives. Moreover, the regular enhance in open curiosity since early 2025 means that institutional buyers stay energetic, betting on the prospects for a medium-term restoration.

Nevertheless, fluctuations in open curiosity throughout October mirrored profit-taking habits and market repositioning as buyers tailored to elevated volatility within the crypto market. Due to this fact, continued momentum above $3,650 stays important to substantiate a real reversal slightly than a brief reduction rally.

International change outflows and investor sentiment

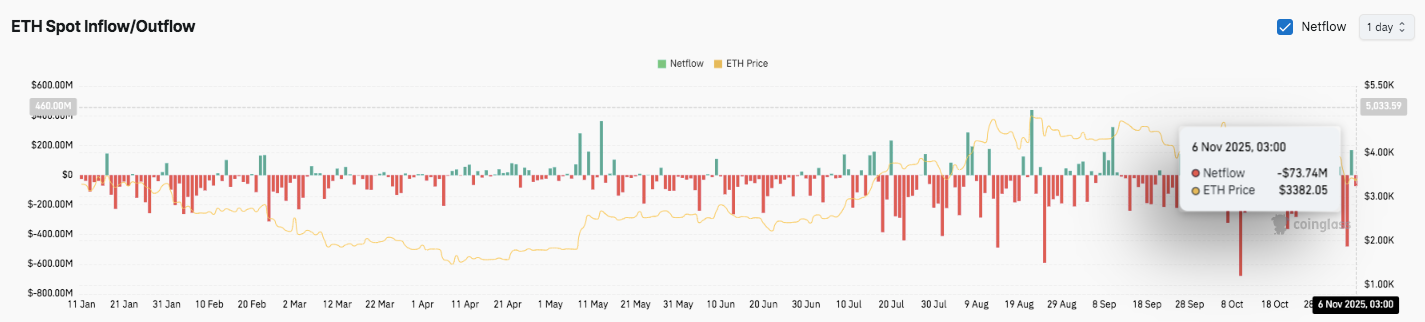

Ethereum on-chain information reveals constantly damaging internet flows, with an outflow of $73.74 million recorded on November sixth. This exhibits that withdrawals are bigger than deposits throughout main exchanges. Traditionally, such patterns typically coincide with accumulation traits as cash transfer from exchanges to chilly storage.

Moreover, the continued crimson internet circulation bar since mid-October highlights buyers’ warning. This development reduces change liquidity, however might finally restrict promoting stress if long-term holders dominate buying and selling. Due to this fact, for a stronger restoration, recent inflows are wanted to stabilize liquidity and ensure renewed bullish conviction throughout buying and selling platforms.

Technical outlook for Ethereum (ETH/USD) worth

Key ranges stay properly outlined heading into November. Upside hurdles seem at $3,558, $3,656, and $3,793, coinciding with short-term resistance clusters and EMA intersections. A decisive breakout above $3,937 (100-EMA) might propel Ethereum in the direction of $4,038 and $4,257, the place the 200-EMA and 0.618 Fibonacci retracement converge.

On the draw back, fast help lies close to $3,382, adopted by a stronger base at $3,320. If sellers regain management under this zone, Ethereum dangers a deeper retracement in the direction of the following structural help stage at $3,200. The 20-EMA and 50-EMA clusters round $3,650 stay key ranges for a transition to medium-term bullish momentum.

The present chart means that ETH is compressing between $3,320 and $3,650, forming a consolidation channel that would set off a volatility breakout in both route. Supertrend indicators proceed to concern promote indicators, however lowered draw back stress and improved futures participation counsel early accumulation.

Will Ethereum regain momentum?

Ethereum’s near-term route will rely on whether or not patrons can defend $3,320 and reclaim the $3,650-$3,790 resistance vary. Sustained power above this band might affirm a bullish reversal and pave the best way for $4,038 and $4,257.

Nevertheless, a rejection close to $3,650 with out important inflows might reintroduce promoting stress and expose ETH under $3,200. Historic actions round related retracement zones present that Ethereum typically consolidates earlier than main development extensions. The following few periods might due to this fact decide whether or not this stabilization indicators the start of a broader restoration or an extension of the sideways section.

For now, Ethereum stays in a pivotal vary. Whereas futures inflows and FX outflows each spotlight cautious optimism, merchants will want affirmation from elevated quantity and continued closes above $3,650 to validate continued bullishness.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be chargeable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.